Don’t Declare the Death of the Yale Model Just Yet

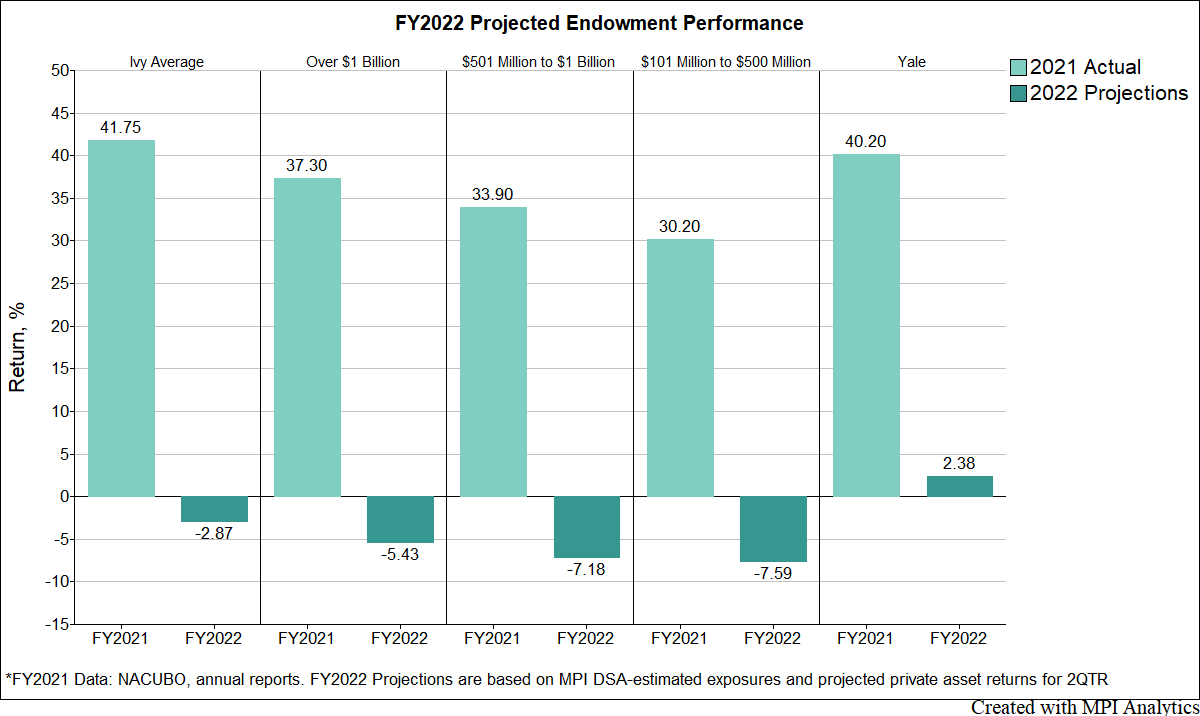

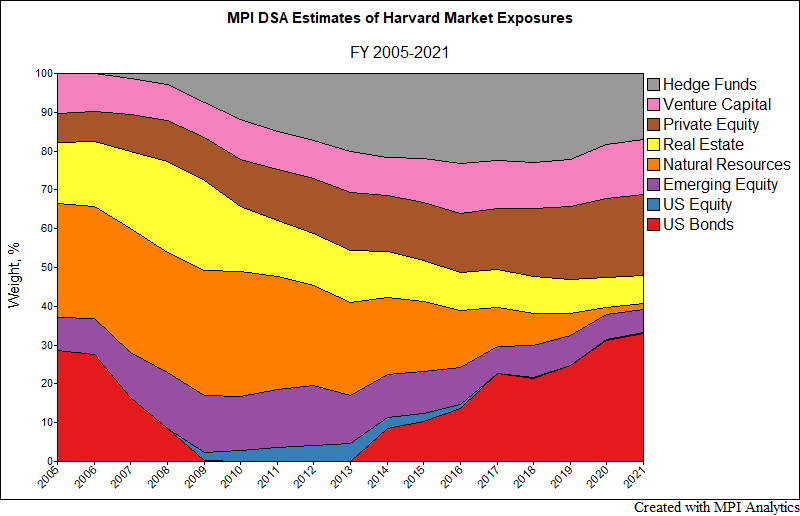

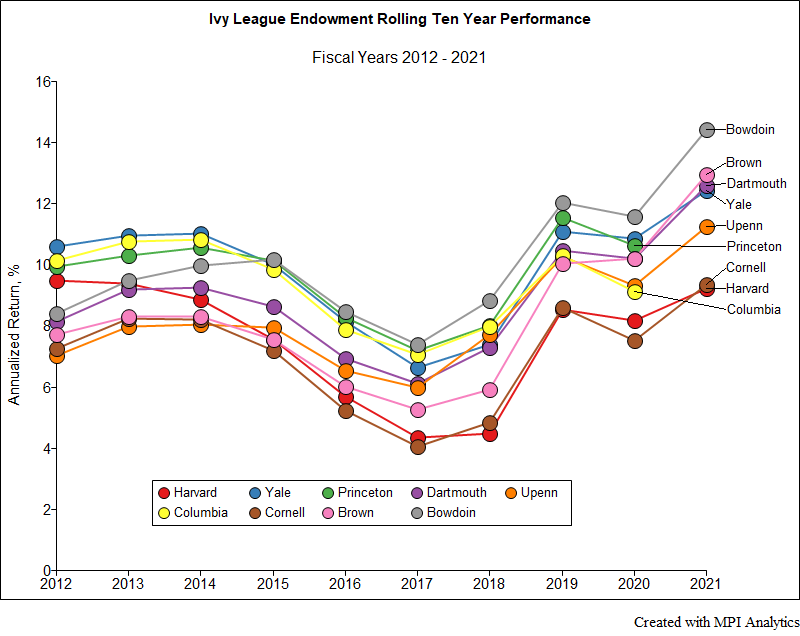

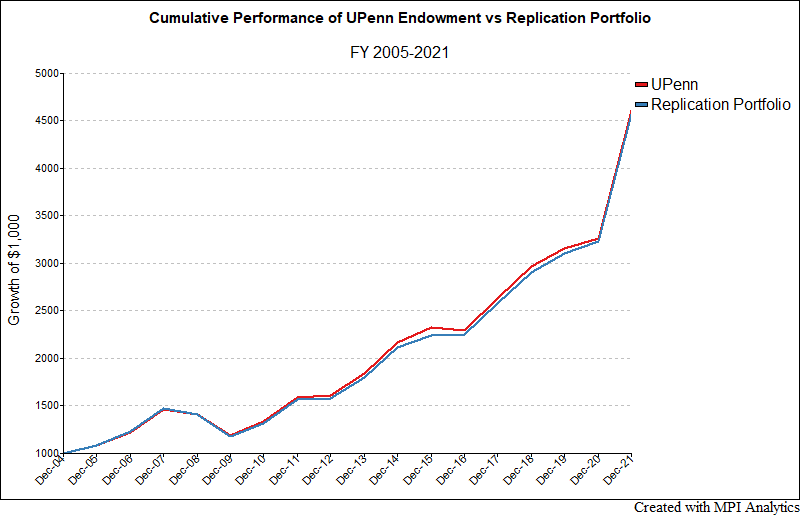

MPI’s CEO interviewed by John Authers‘ protege Richard Annerquaye Abbey on Ivy League endowments and how MPI Transparency Lab keeps tabs on risk, return and asset class attribution at the large, elite schools employing the Yale Model. See their Bloomberg Opinion “Points of Return” column “Don’t Declare the Death of the Yale Model Just Yet” covering MPI’s latest FY 2023 Ivy Report Card.