The November 21, 2011 WSJ article “Hedge Funds Kiss Their Alpha Goodbye” and a follow-up article look critically at the performance characteristics of hedge funds by presenting facts that, in authors own words, “aren’t exactly great PR for the hedge fund industry.” The article and its controversial conclusions got a lot of attention so we were compelled to write a brief response.

First, let’s turn our attention to the author’s use of two charts from a research report produced by a Morgan Stanley strategist. One of the charts is showing a rolling 60-month correlation of the HFRI Equity Hedge index with the S&P 500 Index over the past 20-years. The other one shows 60-month rolling residual “alpha” returns of the HFRI index net of market factors over the same period.

1. Correlation with the market

The author observes steadily increasing correlation of the index with the S&P 500 and makes the following conclusion:

“For one thing, the correlation between hedge fund returns and the S&P 500 has risen to nearly 100% in the past couple of years, meaning the gap between hedge fund returns and pure market returns is vanishing rapidly.”

2. Excess Market Performance

Next, the author observes a steady decline in residual return to being slightly negative in the last 60-month period:

“For another thing, whatever gap there is between hedge fund returns and market returns may not be positive – the annualized excess hedge-fund return for the past five years has turned negative this year, meaning you were actually better off just sitting in the market than putting money in a hedge fund.”

Although, we believe, charts reflect reality faithfully, both conclusions are incorrect. High correlation by itself is not a sign of an inability to generate superior returns. It is quite possible to have a product highly correlated with the market and still deliver great performance. The observed trend in correlation is directly related to textbook diversification argument: the more funds in the equal-weighted index, the lower is specific, diversifiable risk and the higher is the correlation/R-squared to systematic factors/market. In the chart below we show the historical number of funds in the HFR Equity Hedge category and note that the number of funds increased more than 10-fold over the 20-year period.1

The second observation about negative “gap… between hedge fund returns and market returns” is also incorrect. First, the chart in the article depicts residual return or alpha (after market factors are taken out) rather than excess market return as the author implies. The fact that alpha is steadily diminishing in the index is also a direct consequence of diversification: the more funds are in the index, the more the alpha is diversified away. However, it doesn’t go away but is transformed into dynamic factor bets, which are sometimes referred to as alternative beta, representing “common wisdom” of thousands of hedge fund managers.

Therefore, a slightly negative residual return over the past 60-month period means that the index is on par or underperforms a dynamic combination of market factors rather than the market itself. In fact, the HFRI Equity Hedge index outperformed S&P 500 index by a large margin over the trailing 5-, 10- and 20- years as shown in figure below.

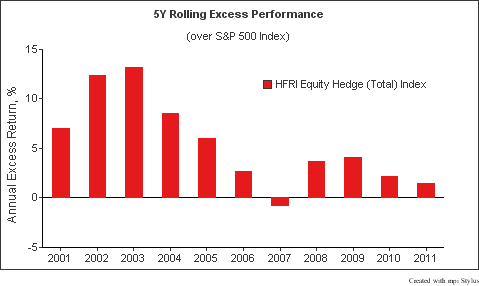

Moreover, the index–being the average of about a 1,000 equity hedge funds—has outperformed the market in practically every 5-year period over the past 15-years. In the figure below we show index excess S&P 500 performance over each 5-year interval. Even in the latest 5-year challenging period (through Oct) it still managed to outperform the market.

Therefore, hedge fund index seems to be a great investment – quite contrary to what the article implies. But wait, a fair performance comparison has to be based on comparing two fundamental sides of the equation: relative returns and risks. Therefore, the most important fact is that this index, representing dynamic bets of thousands of managers managed to deliver such superior performance with roughly half of the market risk. In the figure below we compare volatility of the index and the market over the same 5-, 10- and 20-year periods.

Now, this makes the HFRI Equity Hedge Index a phenomenal investment — both on absolute and risk adjusted basis! But, since it’s not investible2, here’s a natural question: are there any other investment products that have similar risk/return profile? We looked at all 6,000 mutual funds in the Morningstar database in all equity, income, balanced both global and domestic categories and couldn’t find a single mutual fund that had similar or better risk/return characteristics!3 Attractive properties of hedge fund indices were first studied in the 2010 paper “Hidden Benefits of Equal-Weighting: The Case for Hedge Fund Indices.”

So who would argue against hedge funds and their fees when even their simple average is better than each and every existing mutual fund?

Footnotes

- 1Only unique share classes counted

- 2The index can be replicated but low tracking error is the key, otherwise these attractive properties would be “lost in replication.” For more information see our Hedge Fund Index Solutions

- 3Specifically, the index has the lowest risk than any fund that outperformed S&P500 Index in at least 10 out of 11 5-year periods.