In recent weeks risk parity1 funds have been the focus of particularly unfavorable reports on their performance. Bridgewater’s All Weather Portfolio, the original and most famous risk parity fund, is often held up as an example.

The risk parity approach has performed particularly well over the past decade, minimizing losses during both the tech bubble and the financial crisis, as observed in our earlier post on Bridgewater All Weather. As with any (relatively) new strategy it has yet to prove itself outside of simulation in a broad spectrum of economic environments2. This combination of popularity and novelty can increase the desire for close monitoring of performance in situations like the one we now observe.

With the majority of risk parity assets invested in hedge funds, the need for close observation poses a problem in terms of data frequency and timeliness. A solution can be found by forecasting daily performance based on exposure estimates from the previous month, following the unique approach developed by MPI in collaboration with Prof. Russ Wermers.

For this, we performed a quantitative analysis of All Weather returns3 using MPI’s proprietary Dynamic Style Analysis (DSA) technique, similar to that performed on the Pure Alpha fund, the flagship fund of Bridgewater Associates, last year4. Although the fund return data is monthly, the underlying factor data is daily which allows us to create the intra-month hypothetical track record of the fund even though the current month’s return is not yet available.

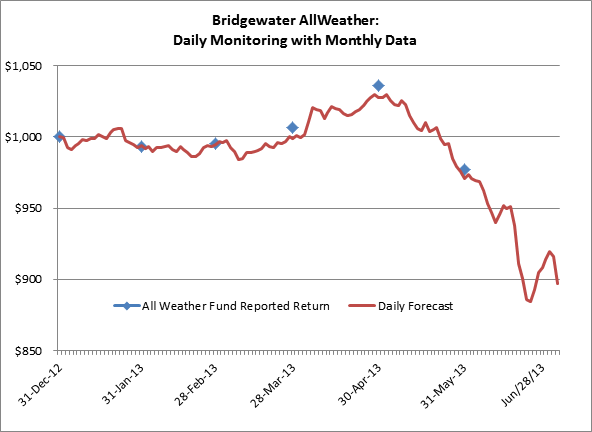

The chart above shows the cumulative performance of the All Weather Fund YTD as well as daily estimates using a synthetic portfolio consisting of daily frequency market factors5 for the intra-month periods. Estimates up to May 31st are in-sample, while all subsequent estimates are out of sample.

The daily forecast implies a June return of approximately -6.4% and a YTD loss for the fund of approximately -8.6%. Also indicated is a drawdown of approximately 14% between May 3rd and June 25th.

As always, please feel free to share this post, leave a comment, or reach out to us directly with any questions you may have.

Footnotes

- 1Risk parity is based on the observation that traditional balanced portfolios are in fact highly concentrated in terms of risk. To address this, the risks of different asset classes can adjusted to be comparable by leveraging or deleveraging and a more diversified portfolio can be produced. Rather than using correlation to achieve diversification, most risk parity funds allocate risk to the asset classes that are expected to outperform in four equally probably economic regimes.

- 2Please note that the strategy has been simulated historically by Bridgewater Associates, and current performance is within expectations. Where risk is matched to a traditional 60/40 portfolio the All Weather strategy exhibits several drawdowns greater than those of the traditional portfolio while outperforming significantly in terms of total performance over the full period.

- 3Data source: HFR

- 4MPI conducts performance-based analyses and, beyond any public information, does not claim to know or insinuate what the actual strategy, positions or holdings of the funds discussed are, nor are we commenting on the quality or merits of the strategies. This analysis is purely returns-based and does not reflect actual holdings. Deviations between our analysis and the actual holdings and/or management decisions made by funds are expected and inherent in any quantitative analysis. MPI makes no warranties or guarantees as to the accuracy of this statistical analysis, nor does it take any responsibility for investment decisions made by any parties based on this analysis.

- 5 Factors include TIPS, Government Debt, Commodities and Equities. Please contact us to obtain a detailed factor breakdown.