Liquid Alternatives are rapidly gaining a foothold in investors’ portfolios. A recent survey of Defined Contribution (DC) consultants by Pimco showed bullish predictions on the growth prospects for liquid alternatives and enthusiasm for the inclusion of these offerings in DC retirement plan lineups and products, including custom target date and target risk funds.

40 Act hedge fund products represent an avenue for investors of all stripes to gain access (in theory) to less correlated strategies that have the potential to reduce risk and enhance returns, particularly in volatile environments – all within a liquid and more transparent package. They are also an exciting area of growth for both private hedge fund managers and long-only asset managers specializing in mutual funds. The complexity, lesser understood risks and high fees that many critics thought would threaten acceptance haven’t inhibited growth of the burgeoning category. In fact, year on year growth in alternative mutual fund AUM was at 40% as of February, with a product universe expanding to 429 different products, according to Morningstar.

Reporting on the growth prospects, nature of strategies and industry implications of such new offerings, Risk Magazine asked MPI to analyze the performance of a liquid fund of hedge funds, the Blackstone Alternative Multi-Manager Fund (BXMMX), using our proprietary quantitative DSA model. According to the fund’s prospectus, “the investment seeks capital appreciation…. by allocating its assets among a variety of non-traditional or ‘alternative’ investment strategies.” The results of the analysis, appearing in the May editions of Hedge Funds Review and Risk magazine, follow:

Figure 1 (above), shows a dynamic combination of factor exposures that mimics the return movements of BXMMX since inception[1]. Each vertical slice represents factor allocations (betas) of a hypothetical tracking portfolio. Negative exposures may indicate actual shorting or a spread (e.g., Growth Equity vs. Value Equity), whereas values over 100% may indicate leverage.

The analysis indicates that Blackstone Alternative Multi-Manager Fund behaves as if it has been broadly diversified across equity, fixed income and cash equivalents. Other than actual short-term instruments or notes, the large cash exposure in the model may indicate a potential net market exposure of less than 100% (i.e. hedging) or use of derivatives. Also of note are the considerable changes in exposure and investment style that the model identifies.

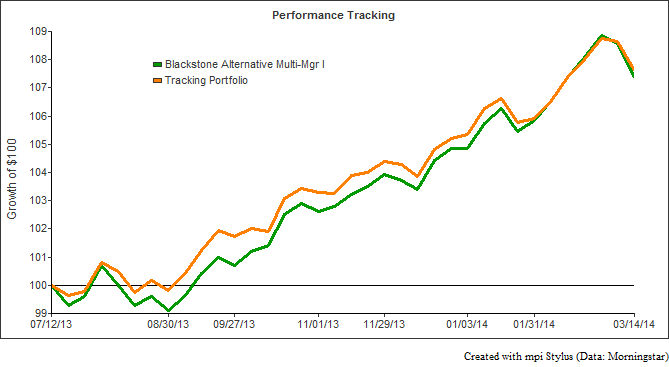

Figure 2, above, shows the tracking portfolio’s performance (red) vs. BXMMX’s actual performance (green). This chart displays how well the portfolio of the dynamically changing exposures in Figure 1 captures the performance of the fund.

With only six market factors, the tracking portfolio shows an impressive degree of precision over the short life of a complex fund that appears to shift investment style considerably. This ability to capture broad exposures from a group of different underlying strategies is something that could bring comfort to investors attempting to gain real-time understanding of such new offerings. Alternatively, others may feel that such mundane return behavior goes against the intention of “liquid alts” investments.

This tight tracking also demonstrates the power of hedge fund diversification – what happens when brilliance is bundled.

While excitement abounds, the number of liquid alt products with limited histories on the market has rapidly blossomed. Advisors, consultants and investors are now coming up against challenges and questions as the products step further into the spotlight. How do product providers explain their offerings to new audiences? How do advisors translate this to their clients? How can risks be appropriately shown? Are the tools of traditional mutual fund analysis, benchmarking and categorization able to capture and communicate the dynamic strategies and exotic asset classes, not to mention short histories of newly launched products?

Many are discovering that holdings-based transparency has its limits. While position disclosures are useful for traditional long-only mutual funds, liquid alternatives – with their high turnover, freedom to invest in derivatives and use of leverage – often evade the capabilities of traditional analysis. Unable to grasp net exposure and other crucial details, investors and mutual fund boards are turning to quantitative analysis to better understand these products and their potential risks. With the sophisticated strategies, complex securities and limited track records of newly launched products, quantitative modeling holds an important role in the diligence process and monitoring of these fledgling offerings.