Following the financial media’s reporting on hedge funds over the past few years, one could be mistaken for thinking that frustrating industry-wide returns – along with some high profile winning bets, frauds and serial insider trading – have dominated the industry. And yet money, particularly of the institutional variety, continues to flow towards these expensive dynamic investment vehicles. Indeed, a record amount of money ($2.317 trillion) is currently invested in hedge funds. Why? Well, it’s not just about returns.

Let’s consider the name: hedge fund. The goal of a hedge fund – as Alfred Winslow Jones intended – is to hedge, keeping a ceiling on volatility and managing downside risks through market cycles. A hedge fund’s worth – nor that of the industry at large – should not be solely measured in returns against the broader market in which it invests (or doesn’t). With this in mind, why are risk measures not being mentioned alongside returns in the headlines?

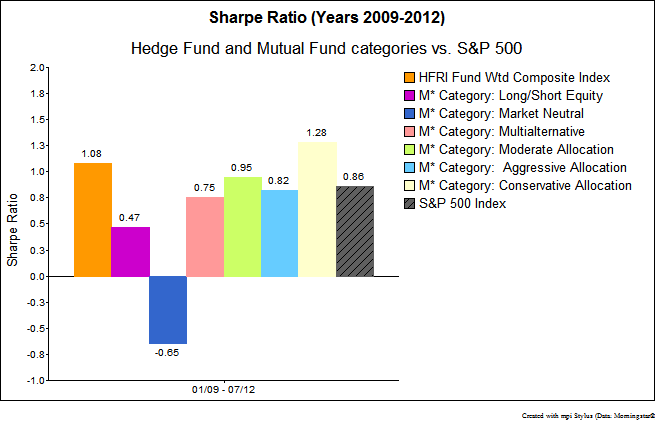

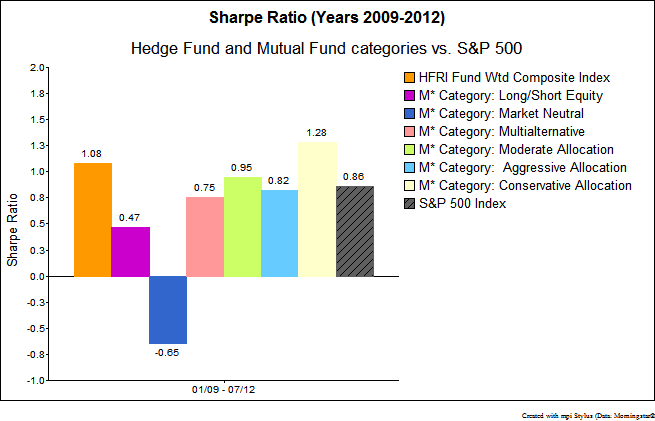

Finding it unfortunate that performance statistics (often measured against the S&P 500) too often dictate the narrative in the media, we decided to add risk to the equation. According to the above chart, on a risk-adjusted basis over the last 43-month period (since January 2009), an average hedge fund1 outperformed both the market (S&P 500) and many of the “alternative” mutual fund categories, including Long/Short Equity, Market Neutral and Multialternative, and Allocation Categories (Moderate and Aggressive). The sole exception was Conservative Allocation funds.

Further, for the previous 8-year period, hedge funds dominated the market and the mutual fund categories in returns, while capping volatility at less than half of the S&P 5002:

Clearly, it is too early to write off hedge funds as a group just based on recent underperformance.

Frauds are an unfortunate circumstance and require better monitoring and diligence on the part of investors and smarter regulation on the part of market police. But, as the MFA and any other lobbyist worth their fees is quick to point out, we must not forget that hedge funds did not require any government assistance in the depths of the Financial Crisis. And with institutional money comes institutional demands; industry-wide leverage, one measure of risk, has remained rather constant at 3.5 times net assets in recent years. The industry will lose its luster if it forgets these crucial facts and cedes control of the narrative around risk.

And while a recent Wall Street Journal article provided the catalyst for this post and quick quantitative review, the media are not the only ones concentrating on returns. There is a worrying trend amongst institutional investors of becoming overly focused on hedge funds’ returns. As U.S markets have been trending directionally upward since 2009, it can be easy to dismiss the volatility that has plagued the markets. While fees, plan liabilities and expected rates of return apply enormous pressure, institutional investors mustn’t forget about risk and, in the process, negate the value of hedge funds.

Yes, in hindsight, over certain periods there is an opportunity cost in not putting more of a portfolio in low cost passive index-tracking products. But investors cannot remove timing and risk from that equation. Therein lies the job of a hedge fund manager, to navigate markets with an eye on capital preservation and (if they’re good) achieving consistent absolute returns. The Journal article specifically counsels investors not to chase returns when selecting individual funds. Indeed, we side with the reporters in that this message is as applicable to hedge funds as it is to investing as a whole.

Footnotes

- 1Represented by the HFRI Fund Weighted Composite index.

- 2We highlight returns and volatility in the 2001-2008 period rather than Sharpe Ratio because Sharpe Ratio is confusing in periods of negative performance.