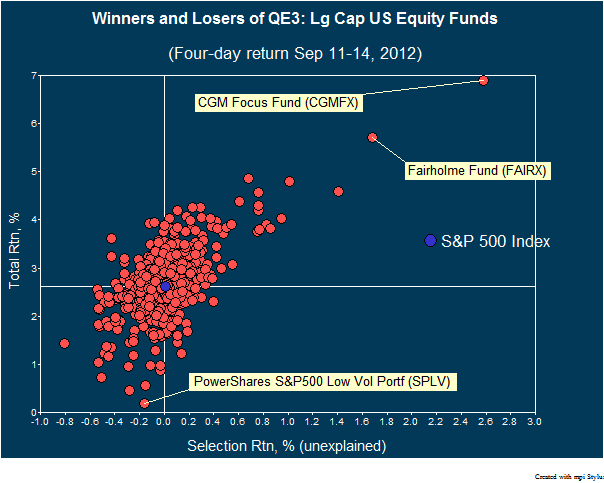

Chart of the Week: QE3’s Big Winners – Positioned for the Printing Press

While attention has focused on bond fund managers who benefited from the Fed’s much anticipated announcement of the next phase of Quantitative Easing (QE3) on Thursday September 13th, what happened with equity fund managers? Hindsight may be 20/20, but it is no secret that equity markets have responded ebulliently to past announcements; after all, money […]

While attention has focused on bond fund managers who benefited from the Fed’s much anticipated announcement of the next phase of Quantitative Easing (QE3) on Thursday September 13th, what happened with equity fund managers?

Sign in or register to get full access to all MPI research, comment on posts and read other community member commentary.