MPI Hedge Fund Indices

Investible benchmarks representing the collective wisdom of top hedge fund managers

Well-documented biases of first-generation hedge fund indices prevent them from accurately representing hedge fund performance, while the inclusion of too many constituent funds often dilutes and negates information contained in hedge fund returns.

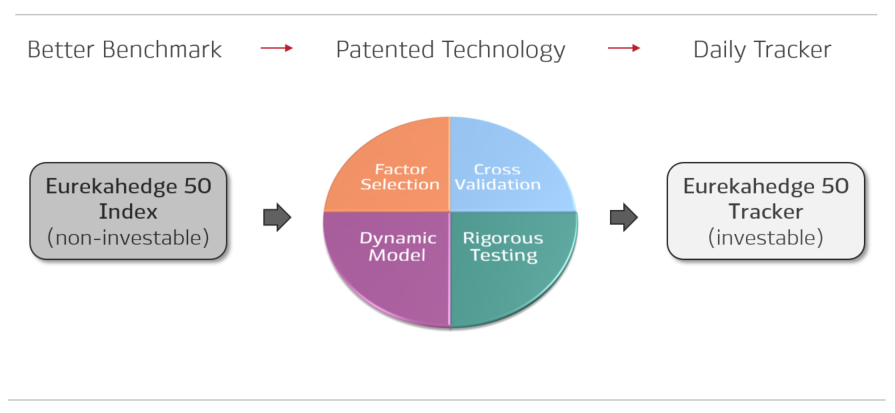

Our hedge fund indices reduce biases to provide more representative hedge fund benchmarks for institutional investors. Using our patented technology, we also develop an investible tracker index for each benchmark. Each tracker index is comprised of liquid securities to enable daily assessment of hedge fund performance and risk. Here is our approach:

- 1. A Better Benchmark

- 2. Patented Technology

- 3. Daily Tracker Index

1. A Better Benchmark

- Consists of a select group of large institutional-quality hedge funds.

- Improves index stability due to a low attrition rate.

- Avoids strategy bias and single fund risk through improved diversification.

- Employs a rigorous and transparent index methodology to minimize survivorship and backfill biases.

2. Patented Technology

- Identifies the factors that explain constituent hedge fund strategies.

- Captures changing fund exposures using our proprietary Dynamic Style Analysis model.

- Cross-validates selected factors through rigorous testing.

Benefits

Asset owners & consultants gain access to more representative hedge fund benchmarks with the added ability to monitor daily performance and risk.

Wealth managers gain access to a suite of liquid alternative benchmarks through daily tracker indices.

Asset managers can meet demand for innovative liquid alternative products by licensing MPI’s investable tracker indices.

Features

Benchmarks are constructed to more closely represent how investors typically allocate across hedge fund strategies.

Patented analytical model identifies systematic factors driving benchmark constituent returns.

Daily tracker indices comprised of liquid securities are paired with each hedge fund benchmark.

Why MPI

A 25-year legacy of working with large investors to help them better understand complex portfolio dynamics and the drivers of hedge fund returns.

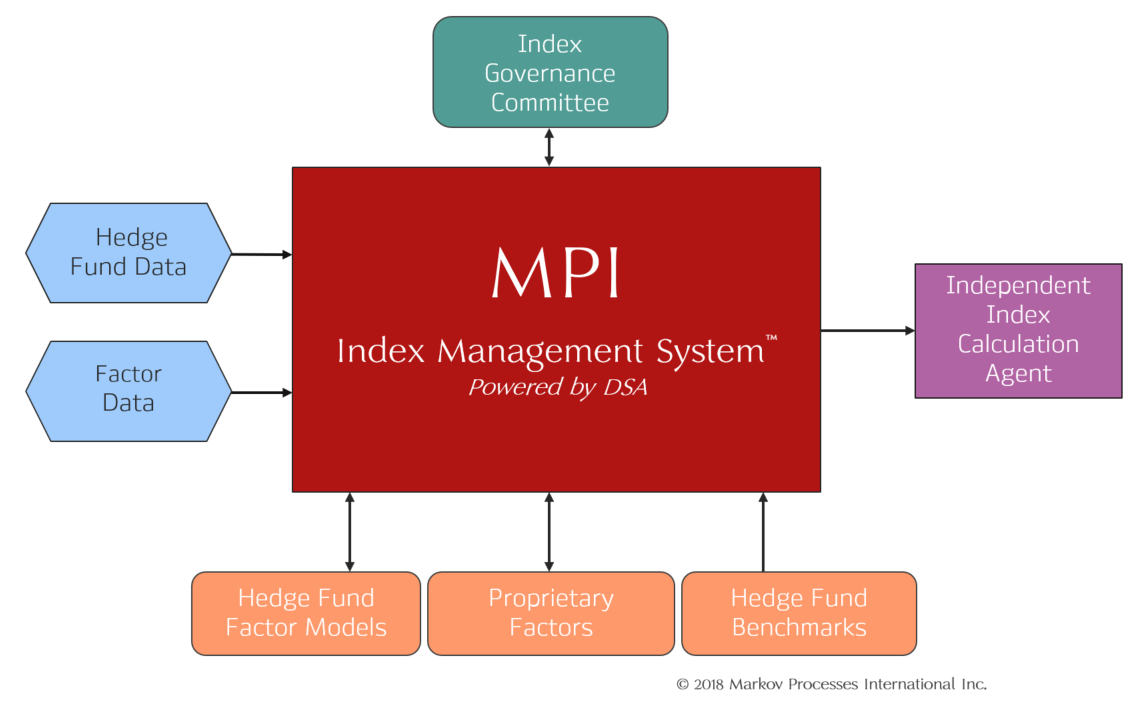

Dynamic Style Analysis (DSA) model provides exceptional ability to better capture the dynamic nature of hedge fund exposures.

DSA trusted by top institutional investors, investment management organizations and regulators as part of their fund due diligence and surveillance.

Methodology

- Factor Selection: ensures investable factors are closely aligned with selected funds.

- Cross Validation: tests factor selection against a broader group of similar strategies.

- Apply DSA model: captures the changing exposures of the hedge funds in the benchmark.

- Rigorous testing: improves predictive out-of-sample performance.

- Construct: select tracker index constituents.