Infinity Q: Locating the Alpha

Following up on our most recent article, “Infinity Q: Too Much Alpha,” Infinity Q also managed a hedge fund product, Infinity Q Volatility Alpha, which exclusively employed volatility strategies. Using known sub-strategies as regression factors for a multi-strategy product can prove very useful in identifying the source of both skill and risk in a more complex product.

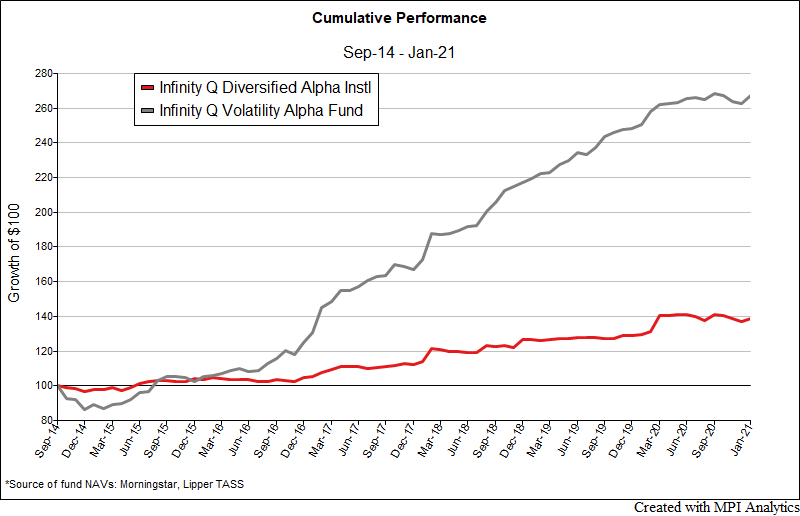

Following up on our most recent article, “Infinity Q: Too Much Alpha,” Infinity Q also managed a hedge fund product, Infinity Q Volatility Alpha, which exclusively employed volatility strategies. This fund, which held $760 million per its March 31st 2020 regulatory filings, is now being liquidated as well. We have compared the performance of these two funds, in the chart below, over the common time interval from September 2014 through January 2021. The Volatility Alpha hedge fund returned an annualized 16.8% which is more than three times the return of the Diversified Alpha mutual fund, at 5.3%, over the same period (albeit before the March 2021 adjustment).

Although the difference in returns is striking, it’s not uncommon for a hedge fund to perform better than its mutual fund version given all the investment, trading and leverage constraints that are imposed on a ‘40-act registered vehicle.

Sign in or register to get full access to all MPI research, comment on posts and read other community member commentary.