A Private Equity Liquidity Squeeze By Any Other Name

How the anemic deal climate, record low distributions and massive unfunded capital commitments are pushing endowments further into illiquid private equity & venture capital, increasing risk & leverage in portfolios (and markets broadly)

Related research: The Great Private Equity Squeeze of 2023 • Top Hedge Fund Managers Agree on Something • FY2023 Ivy Report Card: Volatility Laundering and the Hangover from Private Markets Investing

Yesterday’s Liquidity Lesson: Credit Crunch and the Escape Valve

The depths of the global financial crisis (GFC) were a nauseating time. Stocks plunged, valuations crumbled, liquidity froze as the market for both deals and basic financing seized up, and counterparty risk surged. Distributions from general partners “slowed to a trickle” while capital calls on limited partners, like Harvard Management Company and other endowments following the “Yale Model”, continued. LPs had to pay up. Between the collapse of Bear Stearns and the failure of Lehman Brothers, with an endowment then valued at $36.9B, Harvard had $18B in non-marketable assets (PE + VC + real assets) and over $11B in unfunded commitments, along with $8.3B in hedge funds[1]. Taken together, Harvard’s illiquid exposures and unfunded commitments (expected capital calls) were 79% of the endowment’s total value (AUM and unfunded commitments). In this acute liquidity crisis, Harvard leaned on its sterling Aaa credit rating and borrowed $2.5 billion in late 2008 to plug a funding gap.

The situation was worse at other Ivy league schools; allocations to private funds and illiquid investments coupled with unfunded commitments exceeded 100% of total endowment value at Yale, Princeton and Columbia.

Historic monetary and fiscal easing measures, coupled with low inflation, sparked a V-shaped rebound. Financial conditions loosened, valuations rose and the deal tap got flowing again, helping to rescue many endowments employing the Yale Model. It had been a harrowing time of budget cuts and haircuts. Many university leaders and endowment chiefs promised alums they’d learned a lifelong lesson in risk and liquidity management.

Today: “Worst Ever” PE Liquidity Environment

Though stocks have rebounded smartly off their 2022 bear market lows (SPY is >50% above its October ’22 nadir), things haven’t been going so well in private equity and venture capital. Reiterating this point, in April, Princeton’s Andrew “Sparky” Golden, the legendary outgoing CIO at PRINCO, told Financial Times this has been the “‘worst ever environment’ for liquidity” in private equity.

The breathtaking pace of the Fed’s rate rise cycle to combat the worst inflation since the 1980s impaired the deal climate for financing rounds, M&A and IPOs. Transactions stalled with GPs, portfolio companies and founders wary of undercutting heady valuations from frothier times. Many have held out, hoping for rate cuts that that keep getting pushed back. After fundraising surged in the easy money years of the pandemic (2021 and 2022 saw record fundraising), a slowdown in deals[2] has led to record amounts of dry powder ($2.6T in December, per S&P GMI).

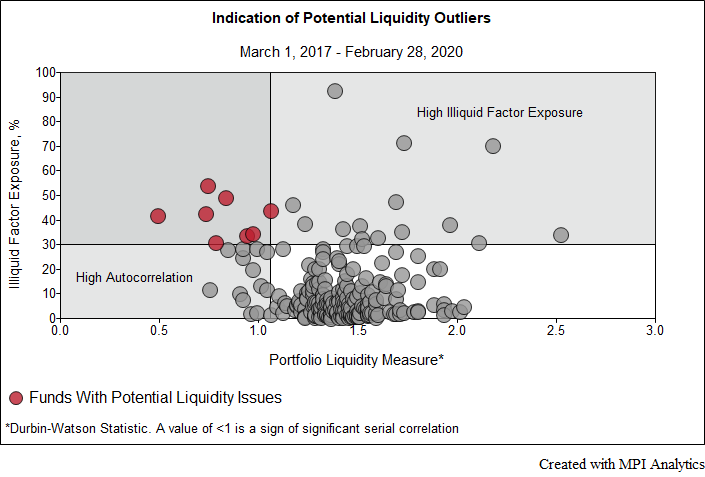

Offering a practical framework for investment practitioners to screen and monitor liquidity risks in fixed-income products

“DPI is the new IRR”

Cumulatively, this has limited the amount of money that is being returned to LPs—like endowments—in the form of distributions. Those distributions have become a highly depended on source of funding for not only university budgets, but further allocations to private equity managers themselves.

Sign in or register to get full access to all MPI research, comment on posts and read other community member commentary.