Endowments Face Liquidity Crunch Amid Market Pullback, Funding Cuts

“Universities with large allocations to private markets are borrowing in the bond market to address funding issues, as private equity capital calls can compete with research funding for liquidity,” says Matt Toledo of the CIO magazine in his story discussing challenges facing elite universities in light of potential and real cuts in federal research grants.

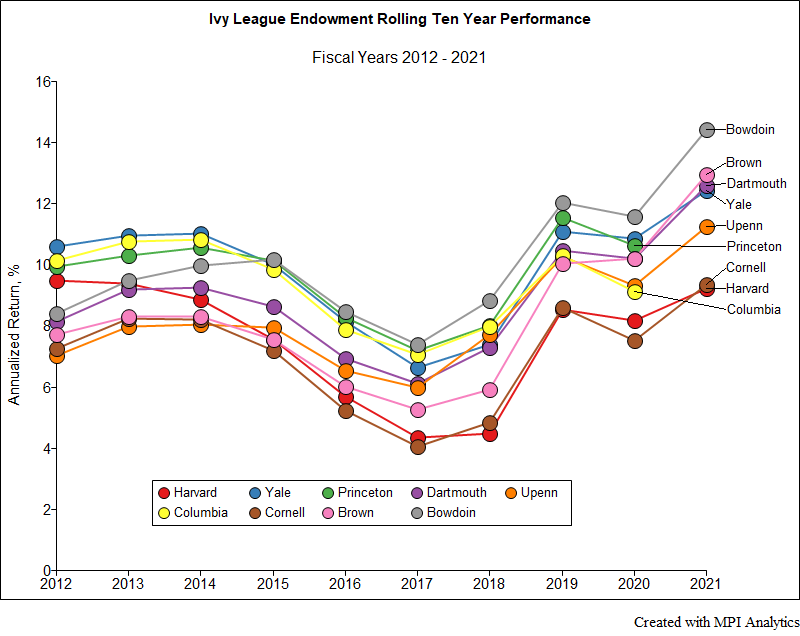

The article draws extensively on MPI’s research into endowment liquidity, including insights from the MPI Transparency Lab.