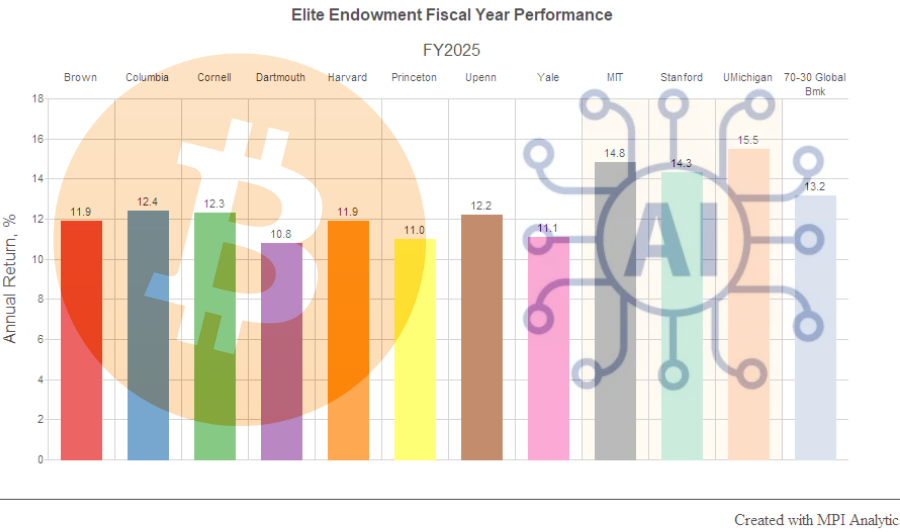

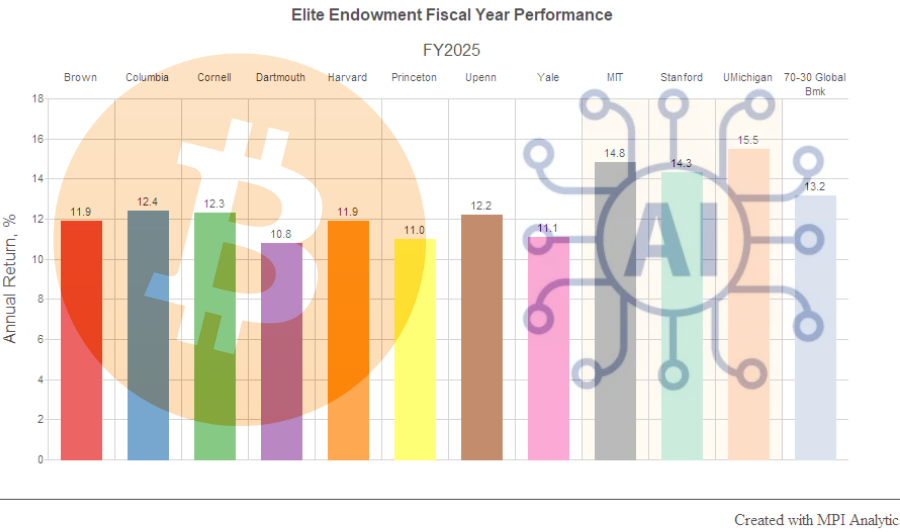

We analyze annual endowment returns to offer a plausible explanation for MIT, Stanford, and Michigan’s spectacular FY25 results. The evidence points to AI and digital-asset themes.

We analyze annual endowment returns to offer a plausible explanation for MIT, Stanford, and Michigan’s spectacular FY25 results. The evidence points to AI and digital-asset themes.

Reading the President’s warning through the lens of liquidity vs. market risk

Ivy endowment Fiscal 2024 in review: risks; VC; long-term vs recent years; prospects of Yale Model.

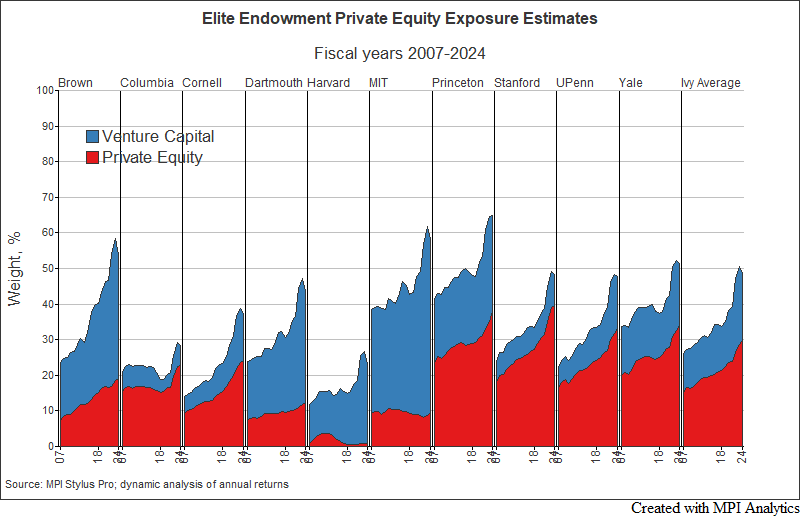

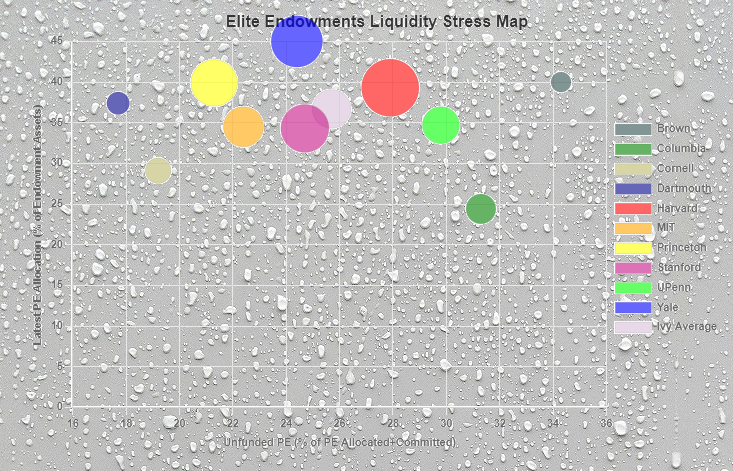

How the anemic deal climate, record low distributions and massive unfunded capital commitments are pushing endowments further into illiquid private equity & venture capital, increasing risk & leverage in portfolios (and markets broadly)

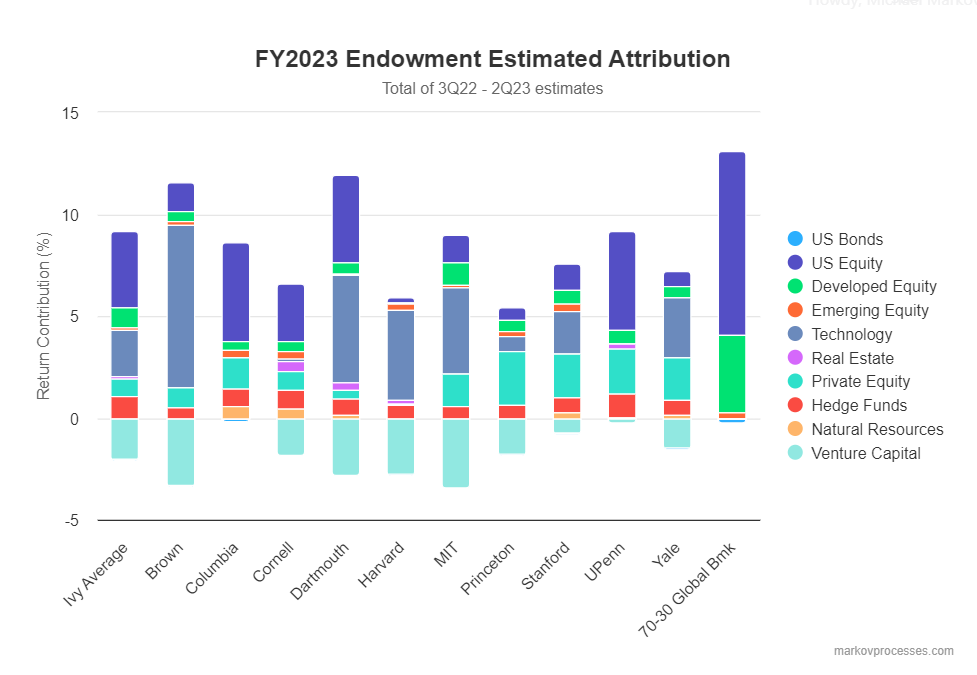

These widely cited projections come from MPI’s Transparency Lab, which provides unique insights into the styles, risks, and performance of traditionally opaque pensions and endowments.

MPI Transparency Lab Analyst Commentary

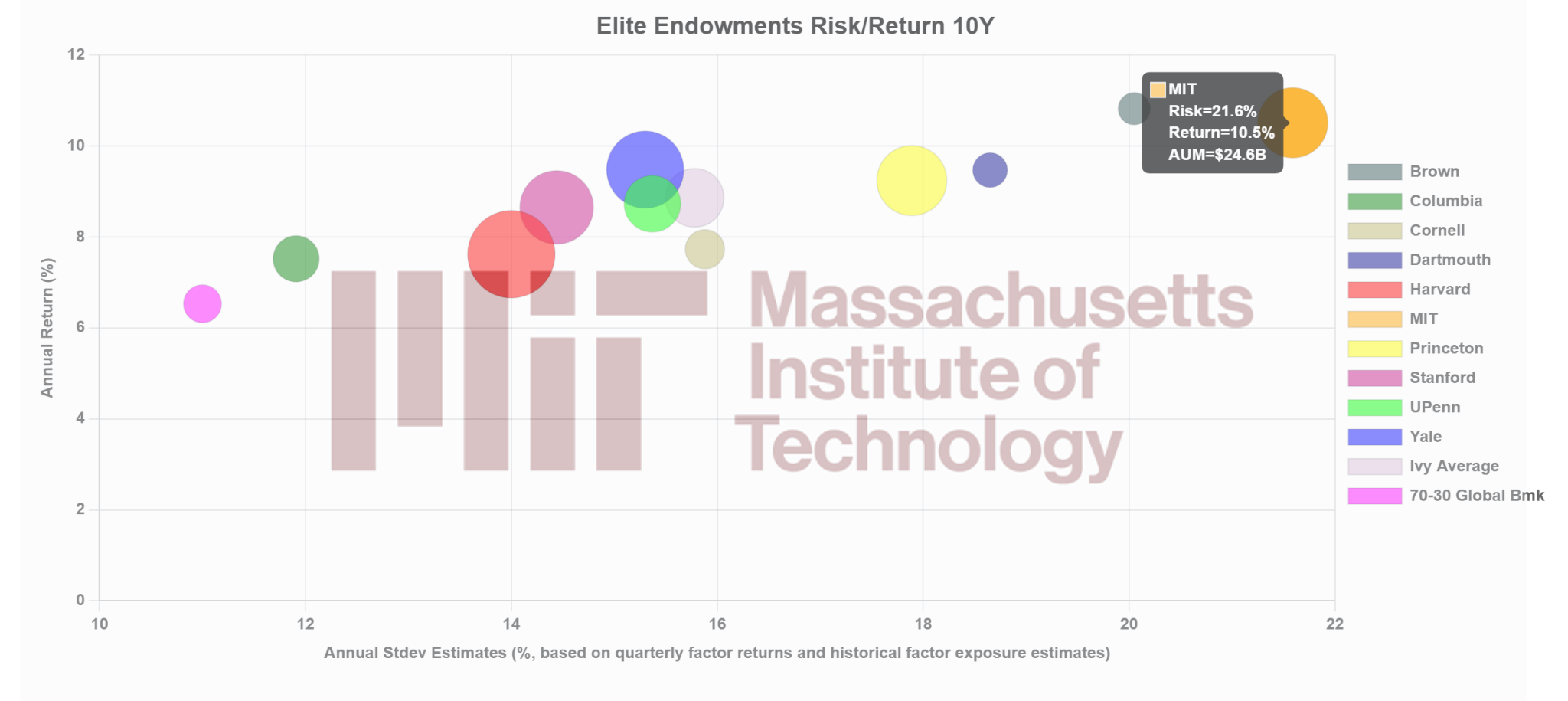

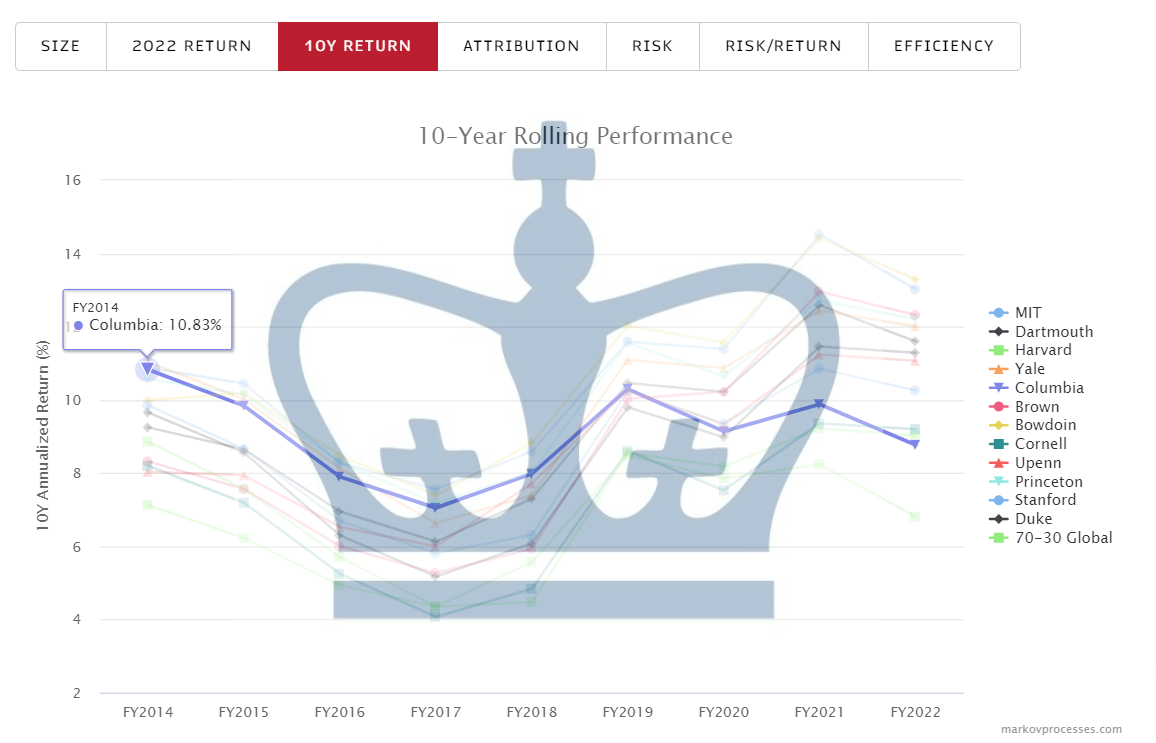

About eight years ago, Columbia University’s endowment had a 10-year return that was one of the best in class, together with MIT and Yale.

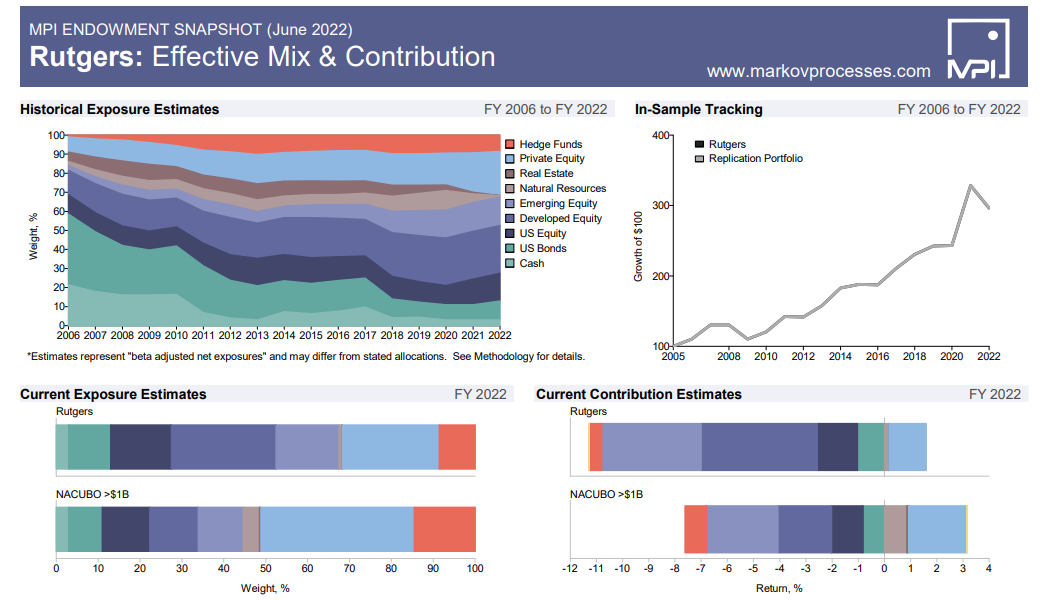

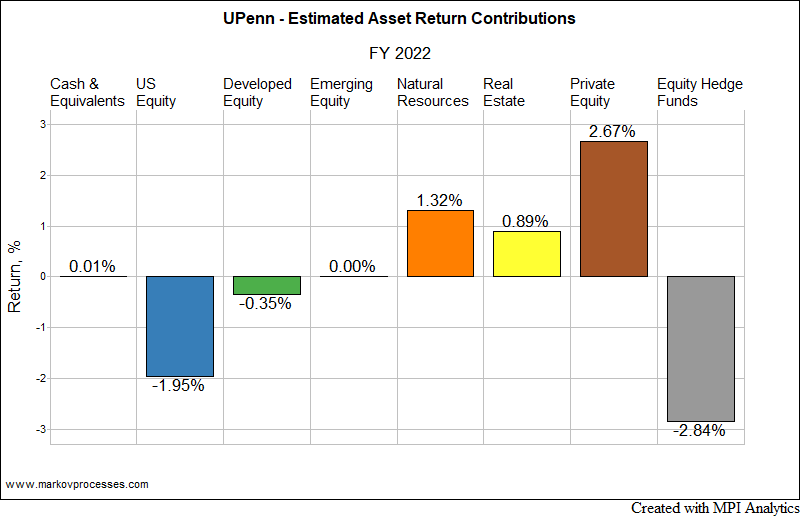

“Thanks to their high exposure to private markets, endowments have been sheltered from the worst effects of the market sell-off,” writes Pitchbook’s James Thorne, using MPI’s research. ”It will take several months, or even longer in the case of venture capital funds, for public and private asset prices to reach an equilibrium, assuming stocks and bonds remain depressed.” Please read full article here.

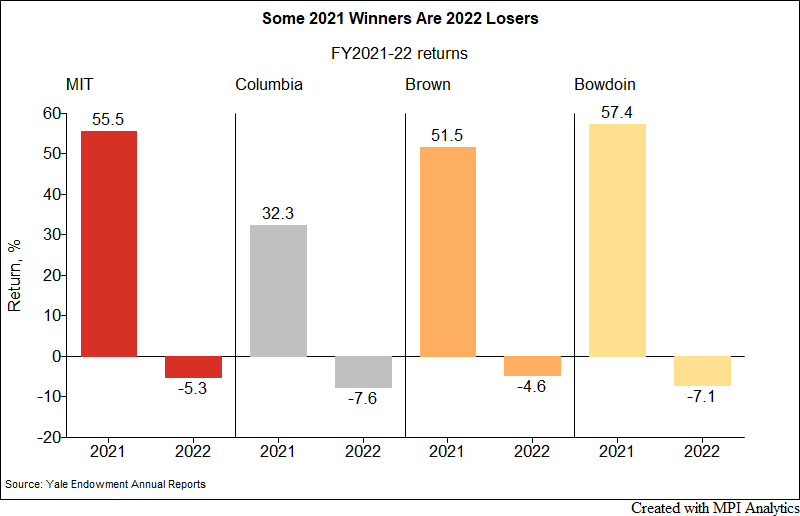

Most endowments have been propped up by a similar concentration in private assets. The ones that suffered the worst, however, couldn’t have been more different in their approach.

MPI is continuing its long tradition of bringing you special insights into the true drivers of endowment performance and risk. Stay tuned for the launch of our new Endowments research hub, and exciting daily updates throughout the FY2022 reporting season.