Ivy endowment Fiscal 2024 in review: risks; VC; long-term vs recent years; prospects of Yale Model.

Ivy endowment Fiscal 2024 in review: risks; VC; long-term vs recent years; prospects of Yale Model.

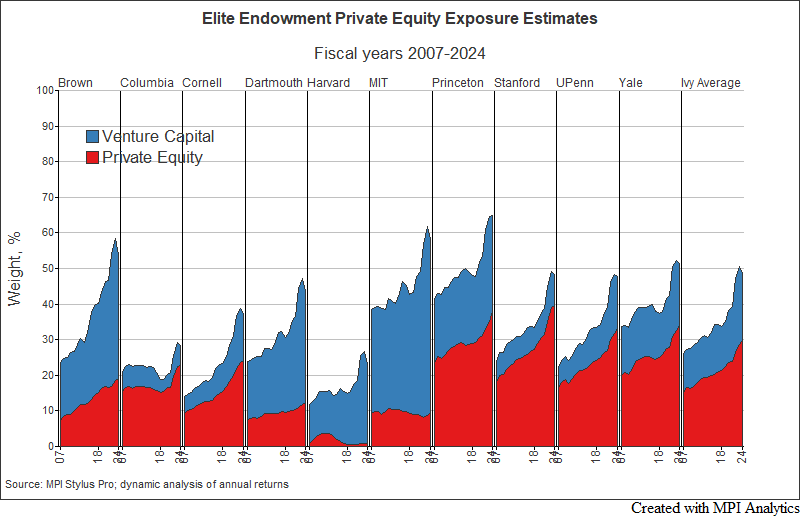

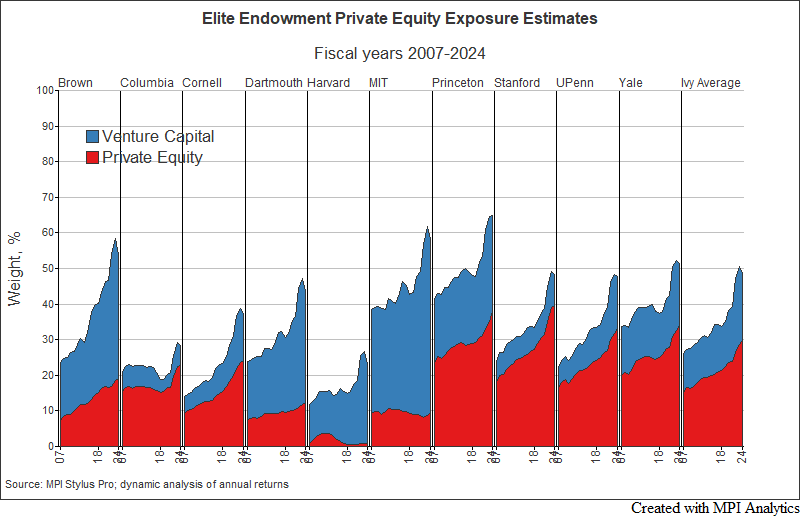

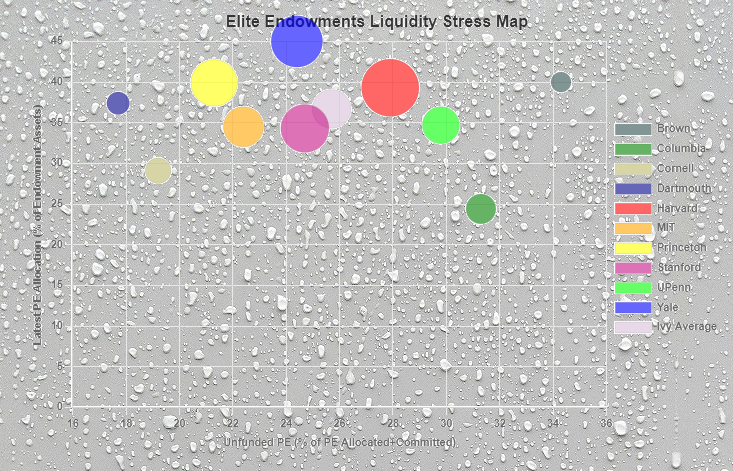

How the anemic deal climate, record low distributions and massive unfunded capital commitments are pushing endowments further into illiquid private equity & venture capital, increasing risk & leverage in portfolios (and markets broadly)

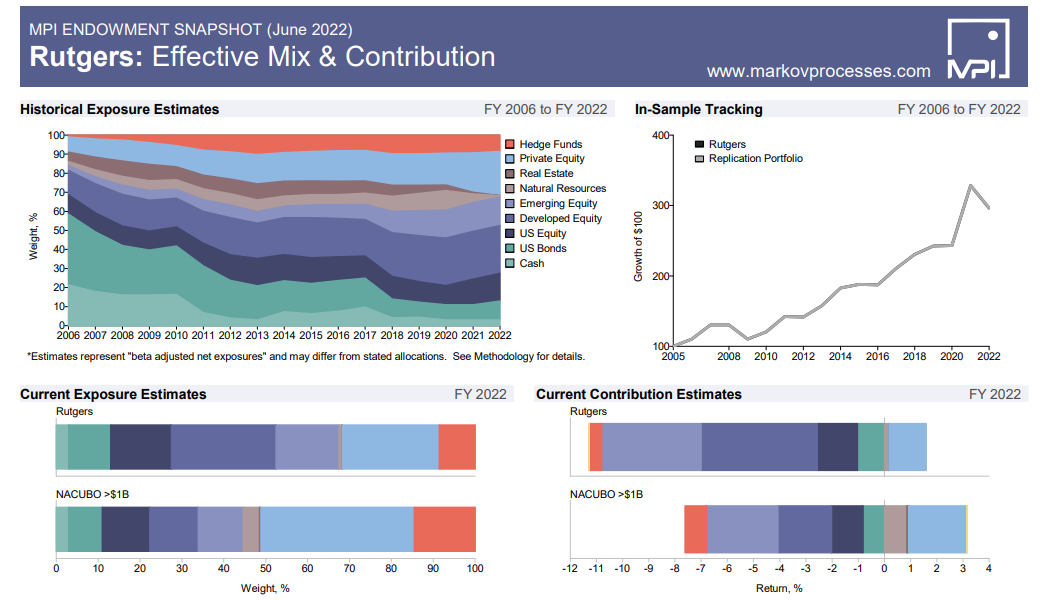

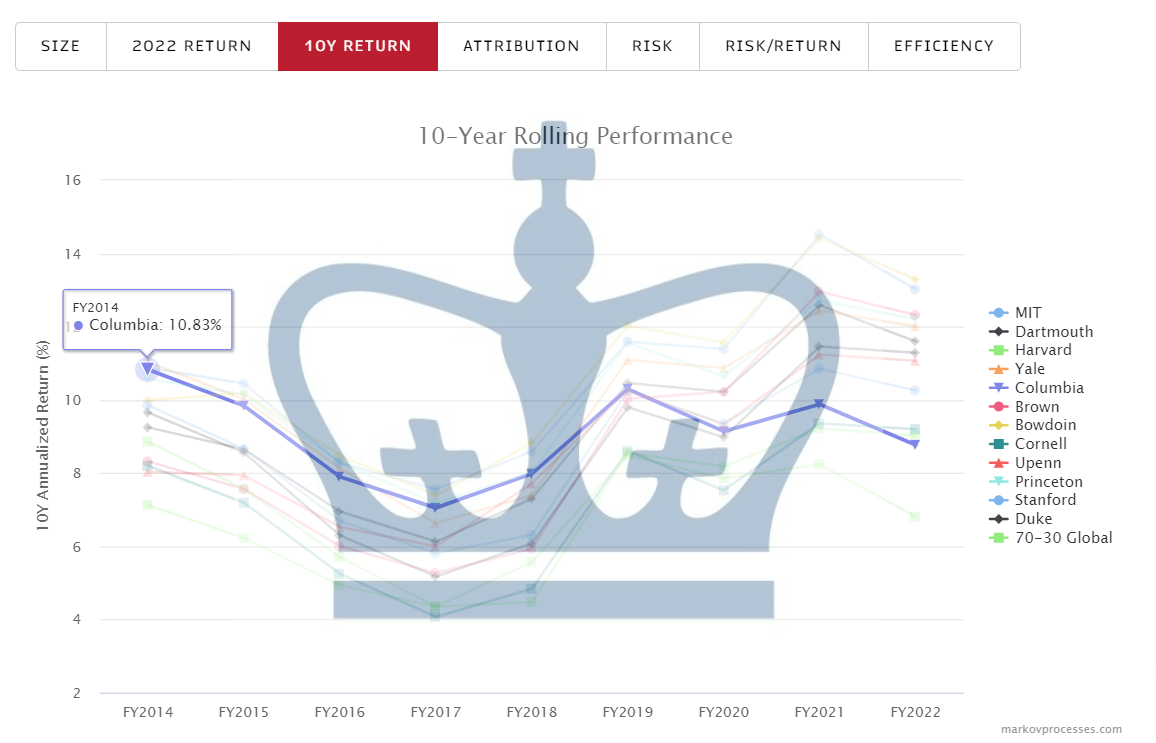

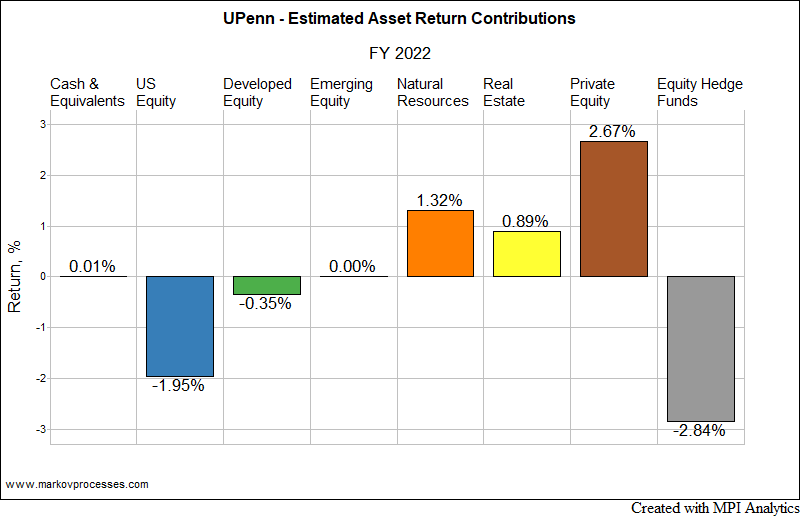

These widely cited projections come from MPI’s Transparency Lab, which provides unique insights into the styles, risks, and performance of traditionally opaque pensions and endowments.

MPI Transparency Lab Analyst Commentary

About eight years ago, Columbia University’s endowment had a 10-year return that was one of the best in class, together with MIT and Yale.

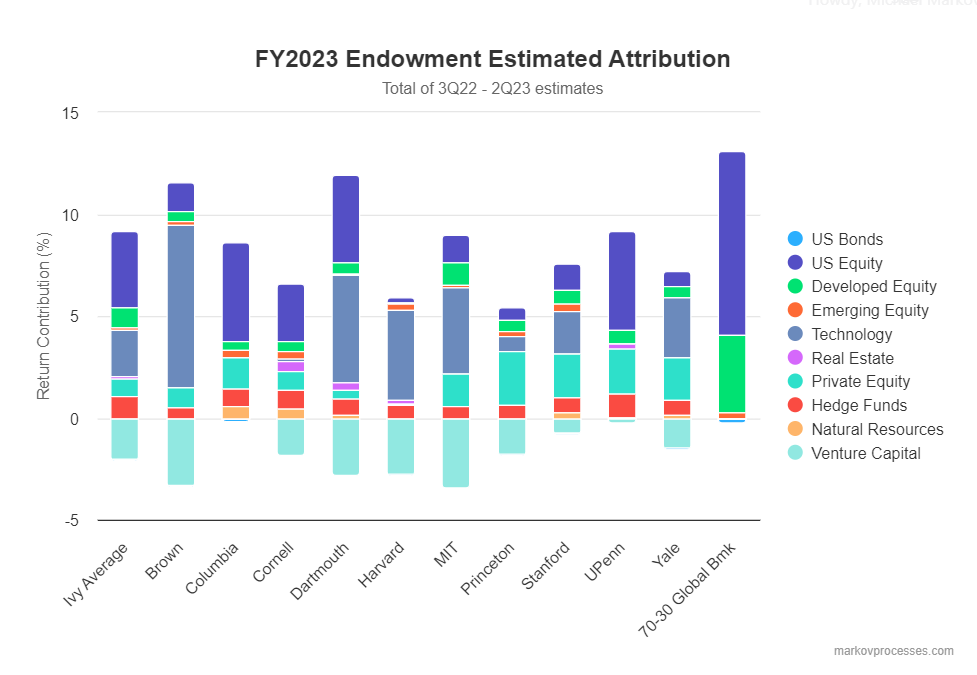

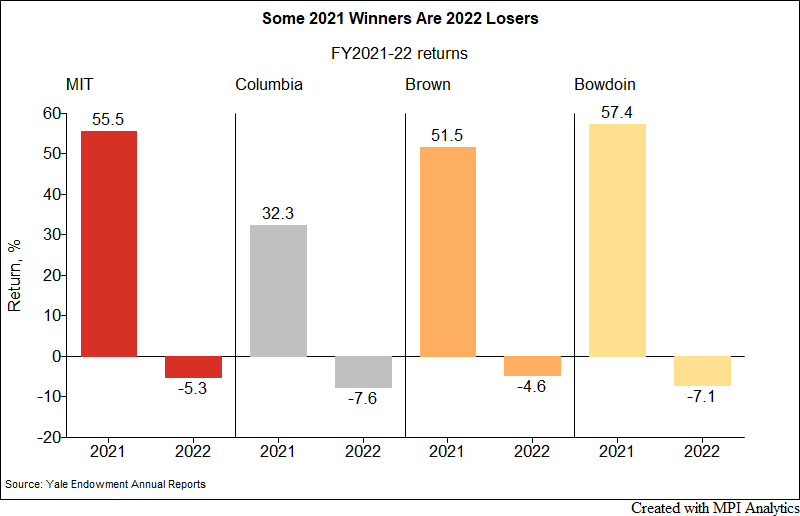

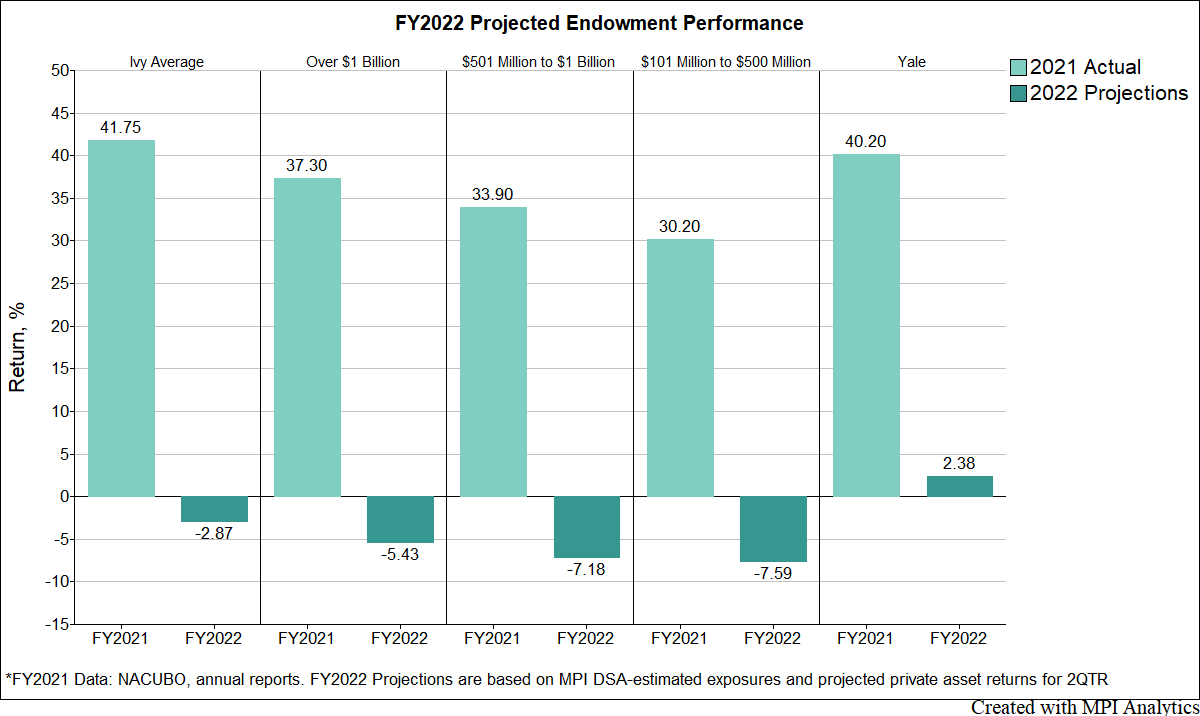

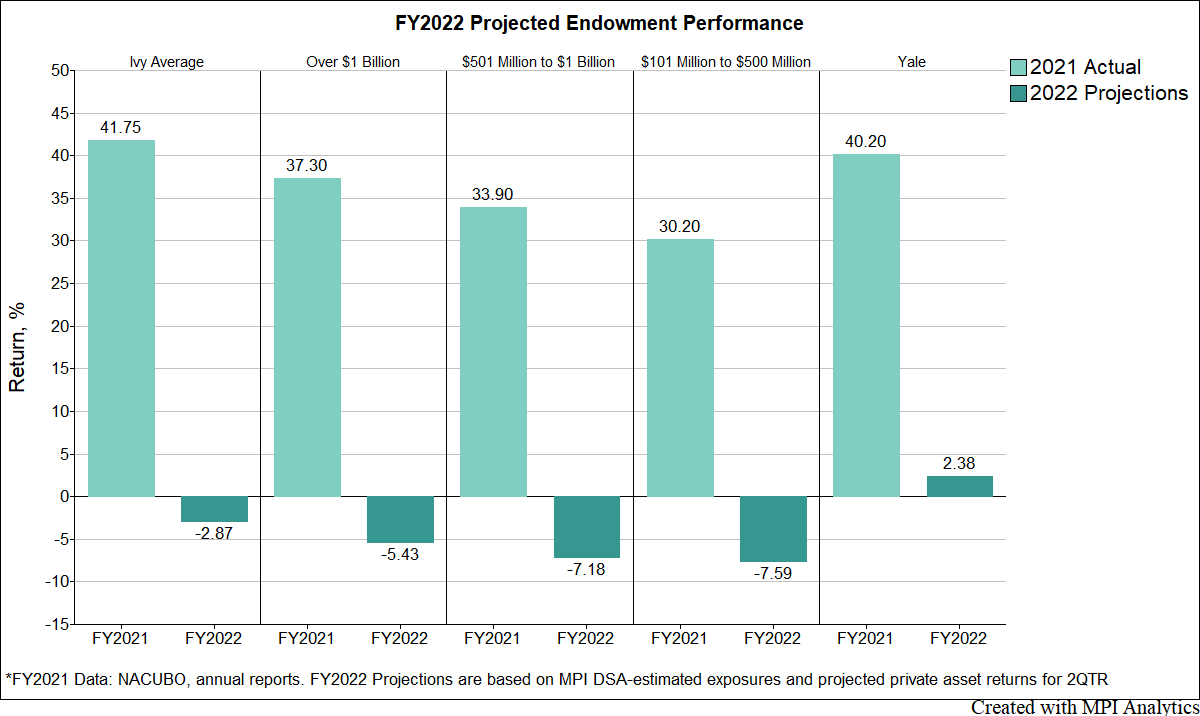

“Thanks to their high exposure to private markets, endowments have been sheltered from the worst effects of the market sell-off,” writes Pitchbook’s James Thorne, using MPI’s research. ”It will take several months, or even longer in the case of venture capital funds, for public and private asset prices to reach an equilibrium, assuming stocks and bonds remain depressed.” Please read full article here.

Most endowments have been propped up by a similar concentration in private assets. The ones that suffered the worst, however, couldn’t have been more different in their approach.

MPI is continuing its long tradition of bringing you special insights into the true drivers of endowment performance and risk. Stay tuned for the launch of our new Endowments research hub, and exciting daily updates throughout the FY2022 reporting season.

MPI Research team projected Ivies to have an average loss of -2.9%, with Yale potentially gaining 2.4%. Larger endowments ($1B or more) expected to lose 5.4%, while smaller endowments’ ($500M-$1B and $100M-$500M) losses will be higher at -7.2% and -7.4% respectively. These projections represent a valuable data point for CIOs looking for peer comparisons while valuing their portfolios. Read the entire report below:

We embarked on a project to estimate 2022 FY performance for Ivies and major US university endowments… weeks before official reports become available.