endowments

Crypto Is the Secret Sauce University Endowments Don’t Want to Talk About

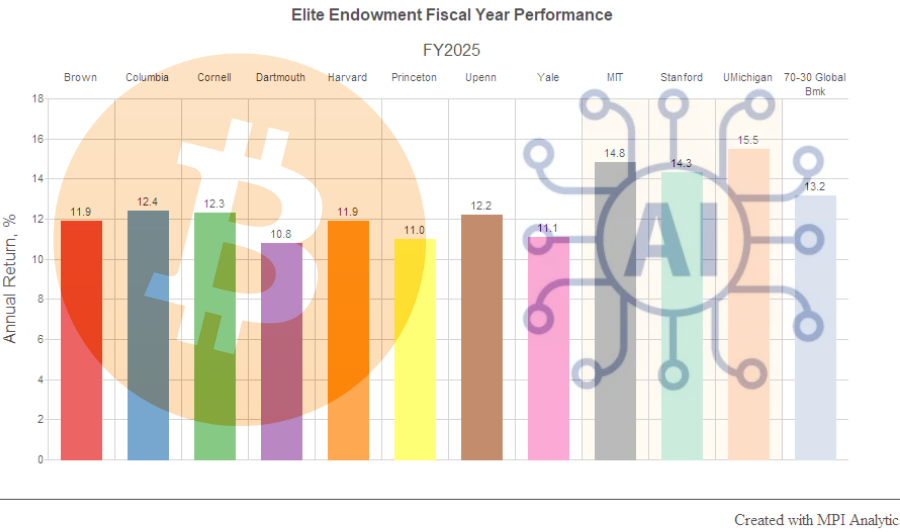

In a December 1, 2025 feature titled “Crypto Is the Secret Sauce University Endowments Don’t Want to Talk About,” Institutional Investor’s Leah McGrath Goodman highlights MPI’s latest returns-based analysis of elite university endowments. Drawing on MPI’s work, the article reports that digital asset and AI bets boosted fiscal 2025 results at leading institutions such as Michigan, MIT, and Stanford by an estimated 200–300 basis points, helping drive average returns of roughly 11–12 percent for large Ivy and peer endowments. It also underscores MPI CEO and co-founder Michael Markov’s view that, despite crypto’s growing contribution to performance, many endowments remain reluctant to speak publicly about these exposures due to political and governance sensitivities

University Endowments Returned to Growth in 2025

Matt Toledo of Chief Investment Officer (AI-CIO) cites new research from Markov Processes International (MPI) in his feature “University Endowments Returned to Growth in 2025.” Based on MPI’s returns-based analysis, the article shows that leading university endowments with meaningful allocations to AI-focused venture capital and digital assets, including crypto funds and direct holdings, saw these themes contribute significantly to strong FY25 results, while a substantial share of AI-driven gains remains unrealized and mark-to-model—raising important liquidity and risk-management questions.

Large Universities Like Michigan Benefited from Early Bets on AI, Crypto

Institutional Investor’s John Comtois highlights MPI’s new Transparency Lab research showing that elite endowments with early, targeted exposure to AI and digital assets—often via venture capital and hedge funds and some direct stakes—outperformed peers in FY25, adding as much as ~300 bps to returns when allocations were meaningful. The article quotes MPI co-founder & CEO Michael Markov: “It is plausible that AI and digital-asset exposure is now large enough to affect overall results,” noting implications for liquidity stress and governance as these positions scale.

We analyze annual endowment returns to offer a plausible explanation for MIT, Stanford, and Michigan’s spectacular FY25 results. The evidence points to AI and digital-asset themes.

Using its proprietary Stylus Pro software, MPI shows that concentrated exposure to these areas is a plausible source of superior performance at Michigan, MIT and Stanford, among other schools.

Institutional Investor Featured MPI CEO’s Opinion Piece on Endowment Liquidity

Institutional Investor ran Michael Markov’s op-ed, “How Dartmouth Actually Became the Ivy League’s Switzerland,” demonstrating—via quantitative analysis—that the endowment’s modest liquidity risk and limited reliance on government funding helped shield it from the political turbulence facing other universities.

‘A stress test’: Harvard has a $53 billion endowment. As Trump’s assault escalates, will it cash out?

The article highlights MPI’s endowment risk and liquidity research and quotes MPI CEO:

“This moment is a stress test on Harvard’s liquidity,” said chief executive Michael Markov.

Read: Elite U.S. Endowments: Government Funding and Liquidity Pressure

Visit: MPI Transparency Lab

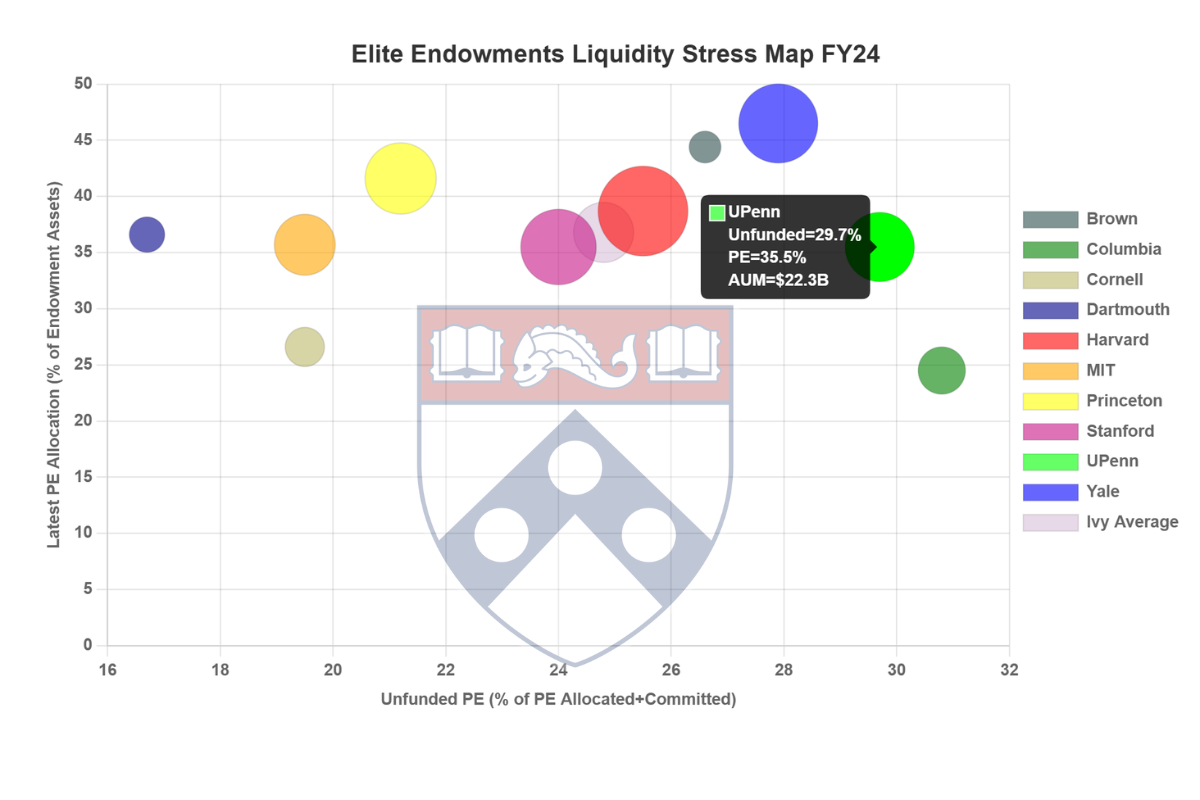

According to our analysis, UPenn’s liquidity problem is real—but somewhat different from those faced by other elite schools. Dartmouth emerges as the most resilient to cash flow pressures.

Yale seeks to sell billions in private equity investments as political pressures from Trump mount

Liese Klein, a reporter for CTInsider, interviews MPI CEO Michael Markov and Tim Yates, President and CEO of Commonfund Asset Management, to gain insight into the implications of Yale’s potential sale of “a major chunk of its private equity holdings.” While some may view the move as a routine rebalancing, the article highlights liquidity issues within the endowment portfolio, as revealed by MPI research.

“Political pressure is only part of a “perfect storm” currently impacting major private equity investors like Ivy League universities, said Michael Markov, CEO of quantitative analysis firm Markov Processes International. The company researches financial data on major university endowments to identify trends as part of its analysis of institutional investor strategy. Private equity returns have been down since 2022 as deals have lagged, with profits down to one-third of their former levels in some cases. Trump’s actions are adding to a liquidity squeeze as universities seek to continue operating… They needed a push from the White House to realize that they’re sitting on a time bomb,” Markov said. ” Click here to read full article.