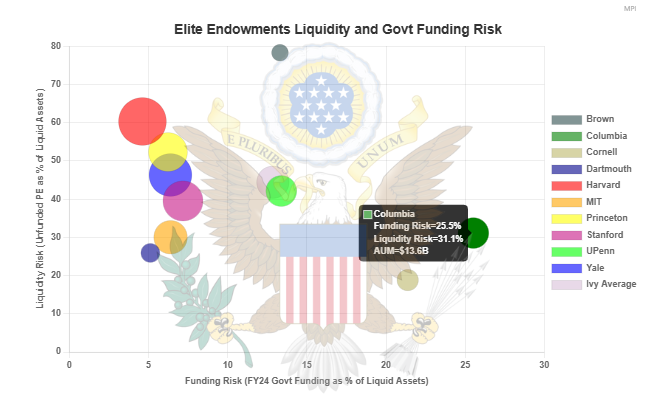

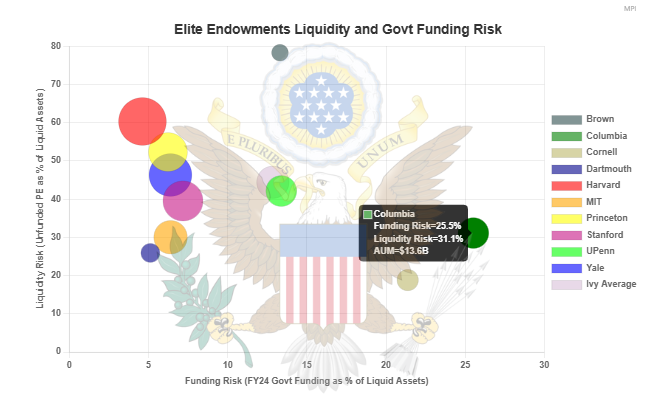

Federal funding cuts could impose significant financial strain on elite universities. One key factor in determining a university’s resilience to such funding disruptions is the liquidity of its endowment.

Federal funding cuts could impose significant financial strain on elite universities. One key factor in determining a university’s resilience to such funding disruptions is the liquidity of its endowment.

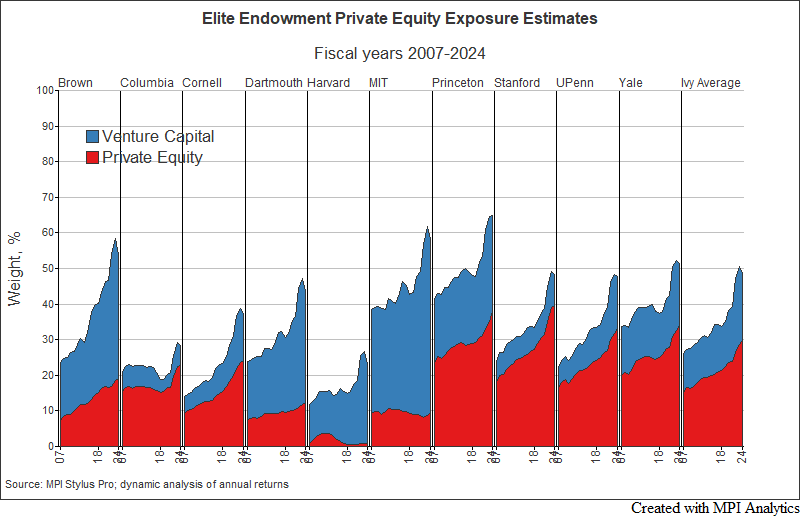

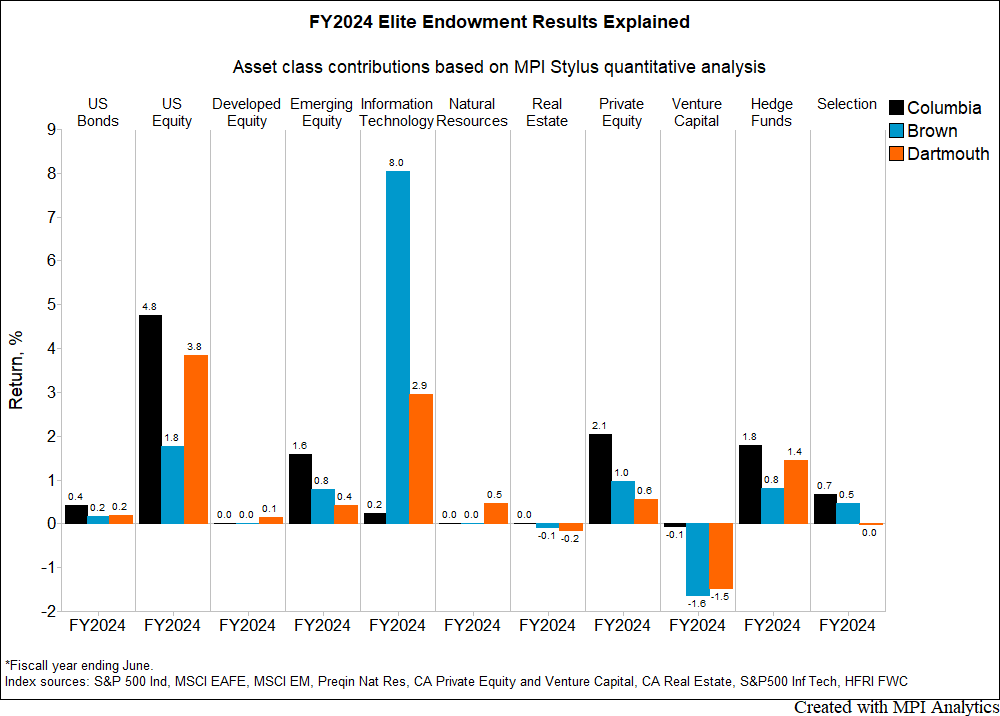

Ivy endowment Fiscal 2024 in review: risks; VC; long-term vs recent years; prospects of Yale Model.

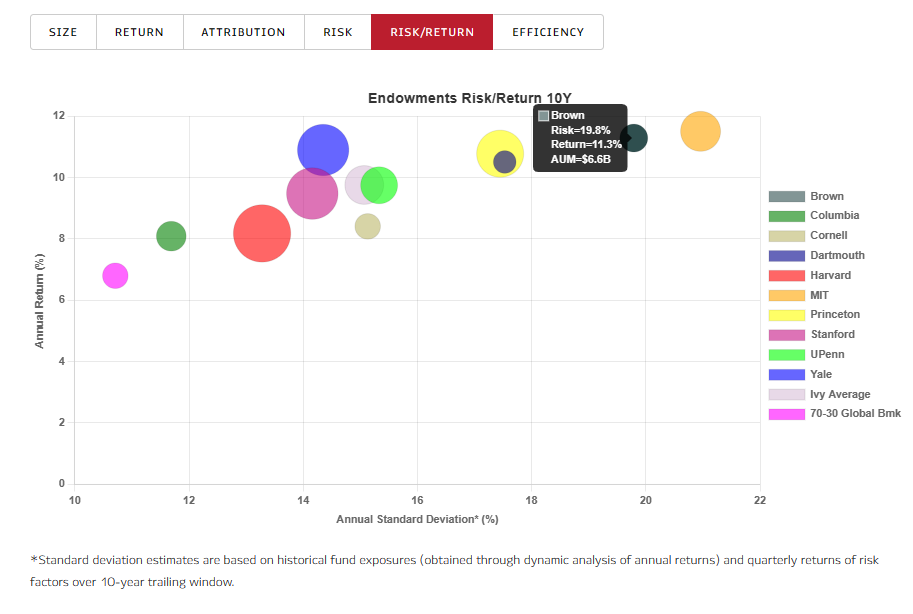

With Mag 7 stocks trouncing VC and Private Markets trailing in FY2024, Columbia and Brown lead Ivy endowments but with vastly different risk and exposures

Ivy and elite endowments did poorly in fiscal year 2023, especially relative to a global 70/30 benchmark and smaller, less resourced endowments that invest in less private markets assets/funds than those employing the ‘Yale model’.

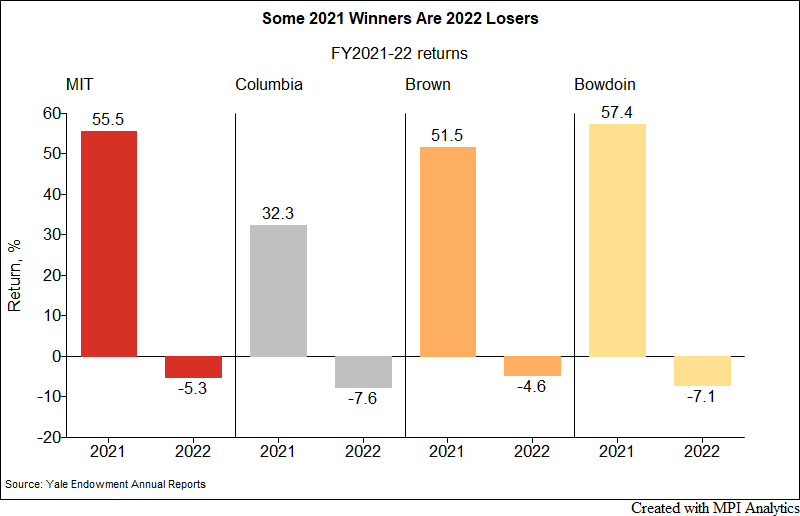

Most endowments have been propped up by a similar concentration in private assets. The ones that suffered the worst, however, couldn’t have been more different in their approach.

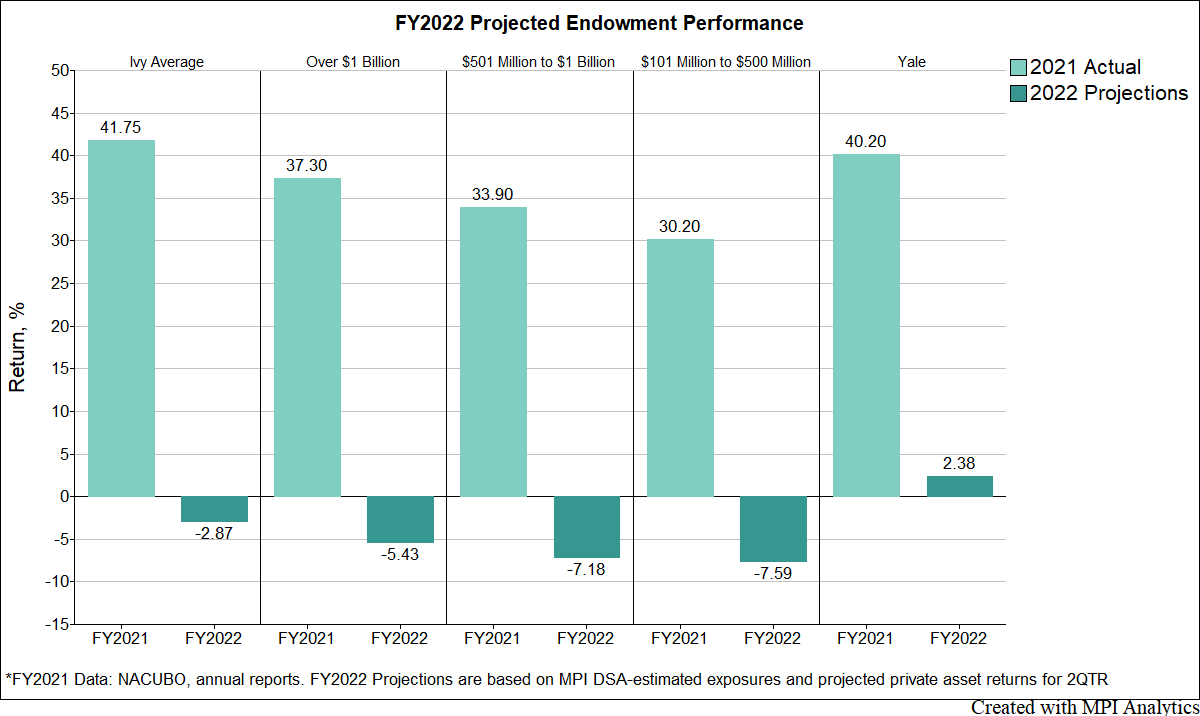

MPI is continuing its long tradition of bringing you special insights into the true drivers of endowment performance and risk. Stay tuned for the launch of our new Endowments research hub, and exciting daily updates throughout the FY2022 reporting season.

We embarked on a project to estimate 2022 FY performance for Ivies and major US university endowments… weeks before official reports become available.

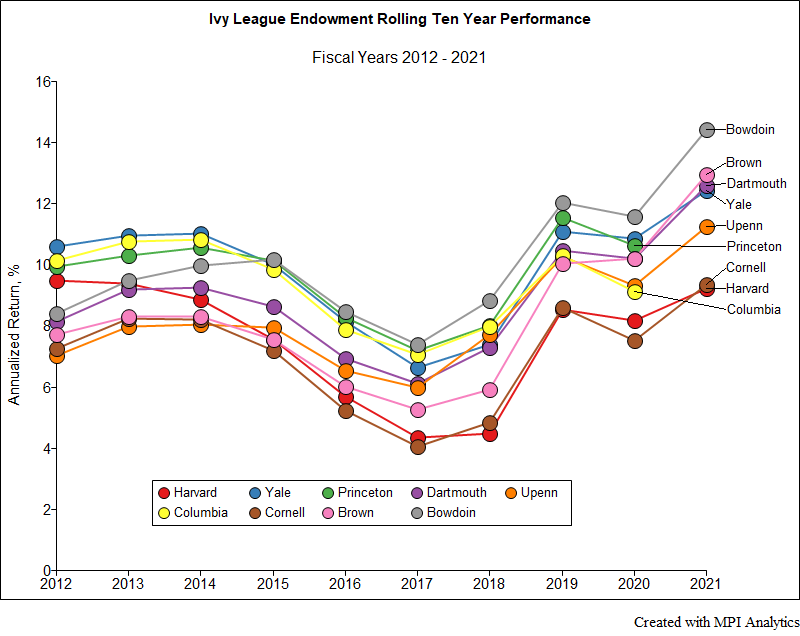

Bowdoin College Endowment has been outperforming all Ivies on a 10-year basis since 2015 with its latest FY2021 result bringing it to 14.4%, an almost impossible number to beat.

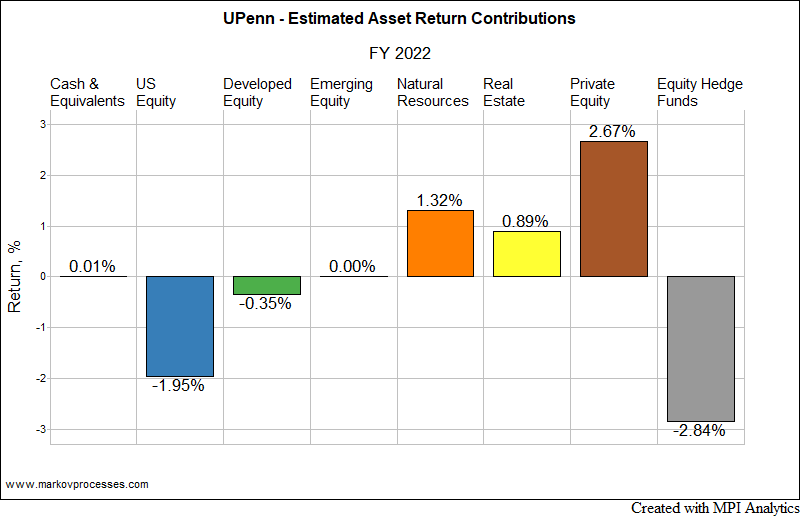

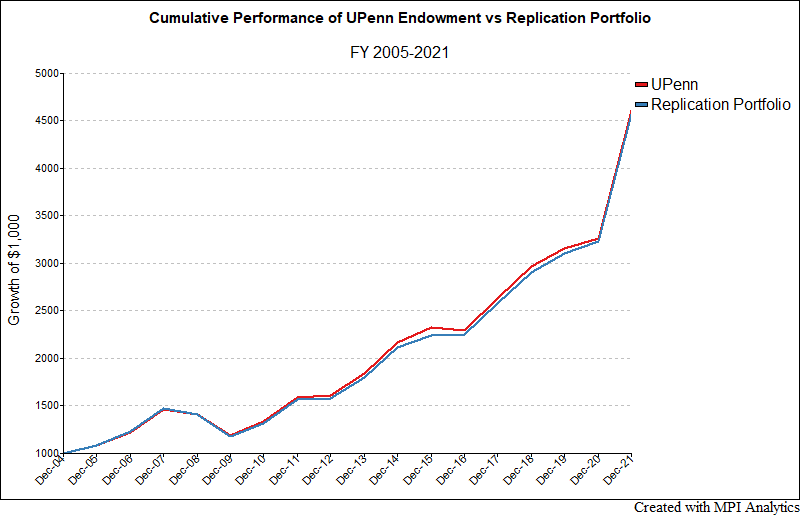

UPenn’s $20.5 Billion endowment posted a return of 41.1% for FY 2021, driven by strong returns in private equity and venture capital.

AlternativesWatch’s Susan Baretto explores how MPI’s patented analysis technique — Dynamic Style Analysis, was used to dissect Brown University’s endowment annual returns, providing a plausible explanation of the outlier’s spectacular FY20 results.