Our analysis shows how portfolio construction, pacing, and governance created a resilient “Switzerland” profile – and what others can emulate.

Our analysis shows how portfolio construction, pacing, and governance created a resilient “Switzerland” profile – and what others can emulate.

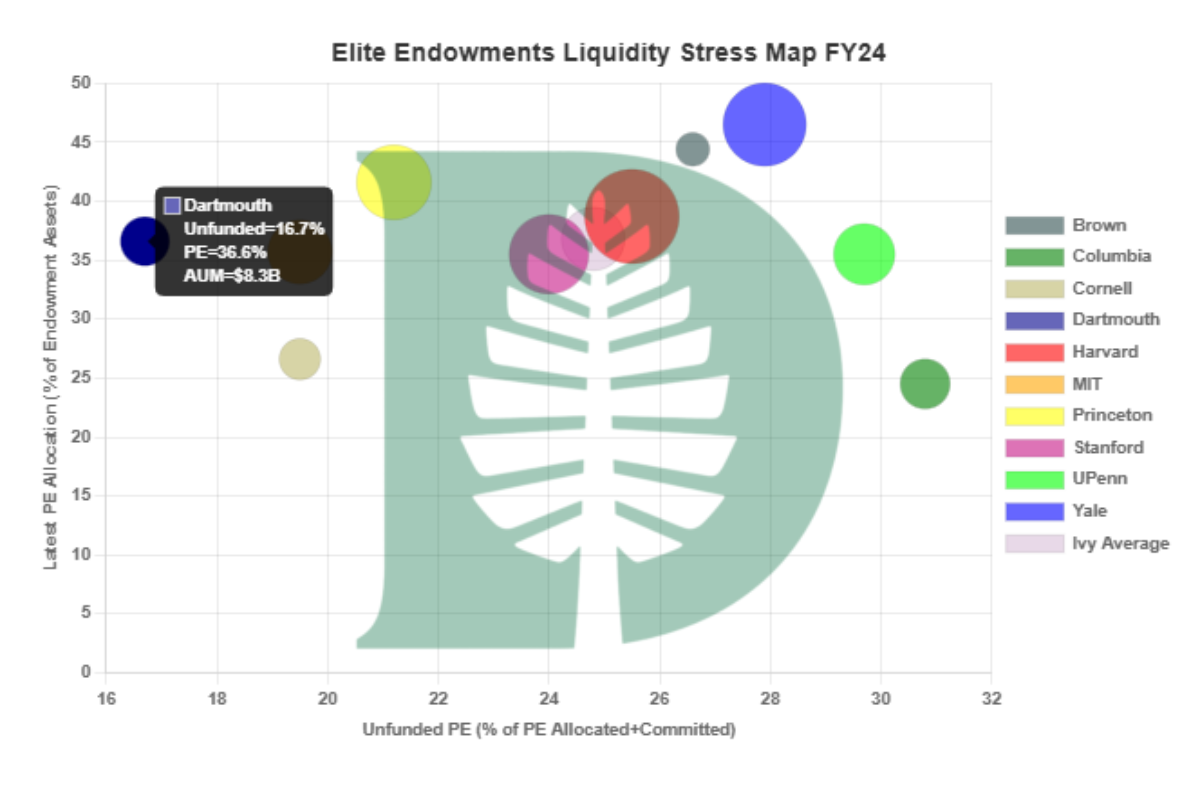

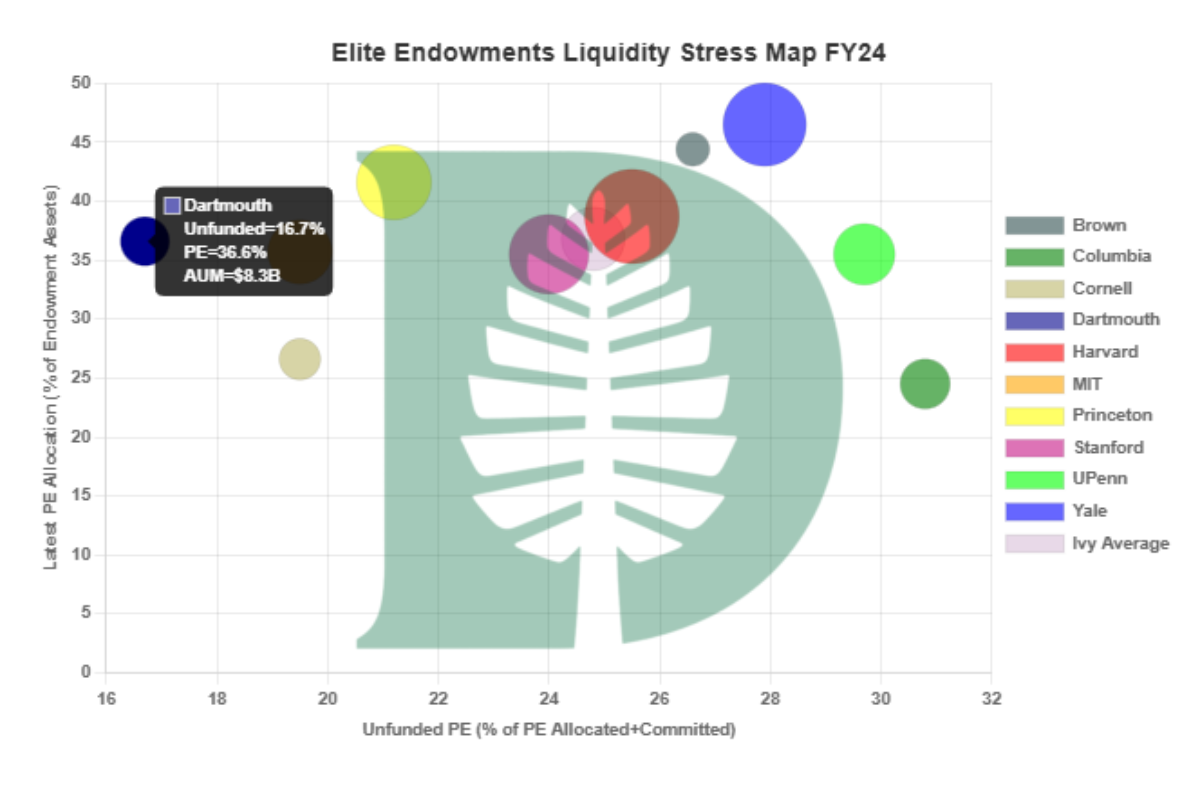

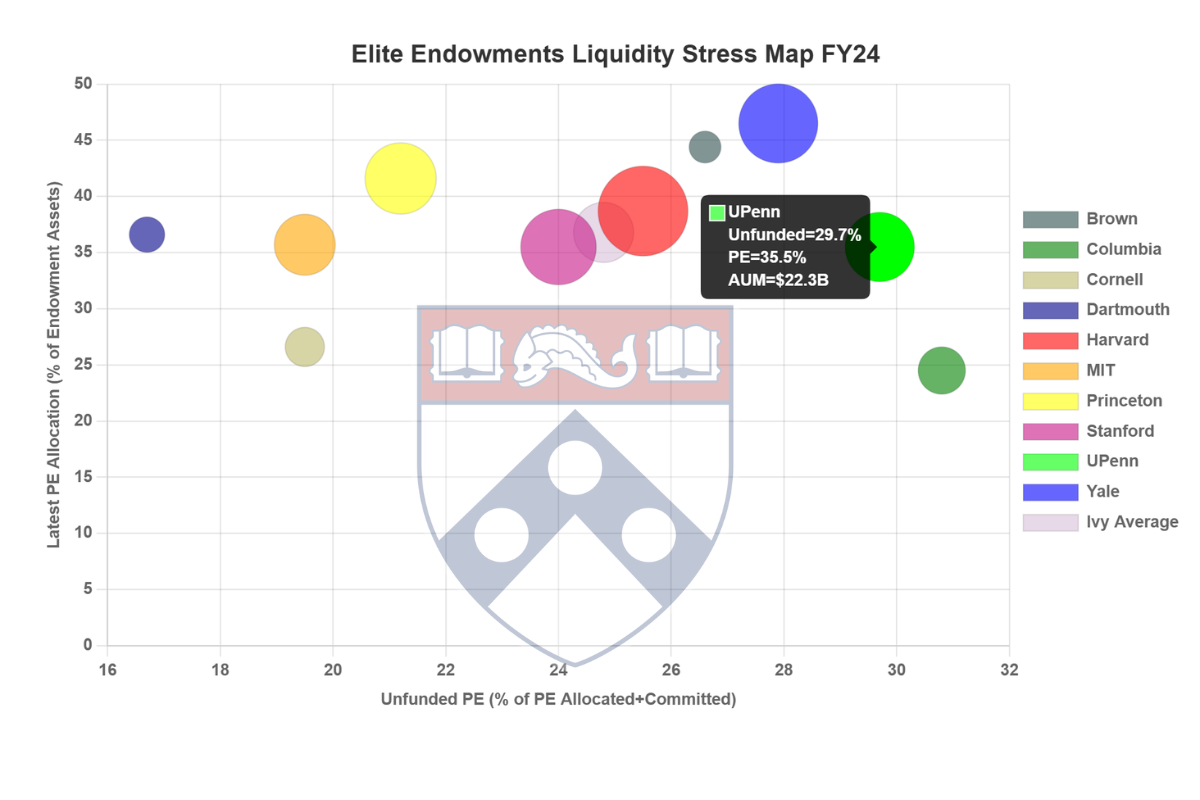

According to our analysis, UPenn’s liquidity problem is real—but somewhat different from those faced by other elite schools. Dartmouth emerges as the most resilient to cash flow pressures.

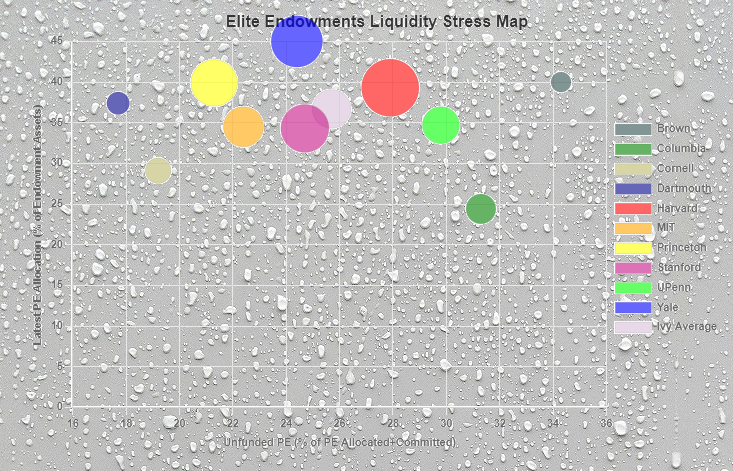

How the anemic deal climate, record low distributions and massive unfunded capital commitments are pushing endowments further into illiquid private equity & venture capital, increasing risk & leverage in portfolios (and markets broadly)