Japan’s Government Pension Investment Fund (GPIF), the world’s largest public pension fund with AUM of $1.5 trillion, has extended its relationship with MPI to utilize MPI’s Stylus Pro suite for a multi-year contract.

Portfolio optimization

Creating a Deeper Connection with The Advisor Through Portfolio Consulting

A leading asset management firm realized that it had become increasingly difficult to maintain AUM when it is tied to performance alone. Some of their largest competitors are increasingly providing in-depth portfolio analysis to advisors as a complimentary service to help market their product. Many of the RIAs and advisors to whom they market need support to conduct in-depth portfolio analysis and reporting. Our client wanted to make sure they too offered a sophisticated solution, while providing a more consultative, technology-driven relationship with their advisor clients – one that offered a deeper level of engagement and a solution that could mitigate unintended risks while adding consistency to portfolio performance.

Key Challenges

- How can I show the value of my firm’s products within a client’s portfolio?

- How can I differentiate my firm from other firms that offer similar products?

- How do I get advisors to rely on my asset management firm for content and reporting?

- How can I do this cost-effectively and efficiently to serve a large number of advisors with each having their own unique model portfolio(s)?

MPI Solution

MPI helped the asset manager address these challenges by delivering an end-to-end portfolio analysis solution while reducing the pain of creating complex and dynamic reports. By working with MPI, the asset manager enjoyed the following benefits which helped strengthen its relationship with its own clients:

- Efficient production of reports highlighting the competitive advantages of its solutions

- Visually striking, differentiated reports that are easy to understand and draw advisor interest

- Sophisticated and flexible cloud-based reporting platform which promotes more interactive engagement with clients

- Integration of data and content from other sources and systems

- Insightful portfolio stress-tests, regime analysis and hypothetical shocks powered by proprietary MPI quant models

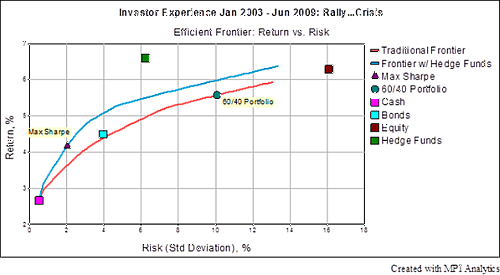

As the trickle of announcements about institutional investors exiting hedge funds became a steady stream, MPI decided to explore whether performance really justified an apparent growing disillusionment. Whereas much analysis and commentary to date had focused on the recent failure of hedge funds to beat the S&P 500 and other equity benchmarks, in our research we wanted to find out whether hedge funds had failed on their own terms.