MSTR (Strategy) Beauty Pageant – Premium to Bitcoin

Our Stylus Pro system is normally used by large multi strat hedge funds to x-ray traders’ P&L. Here we decided to x-ray the daily stock price of the largest holder of Bitcoin.

Strategy (ticker MSTR) isn’t just another software stock anymore – it’s the largest publicly traded corporate holder of Bitcoin. With 600,000‑plus BTC on its balance‑sheet, the share price is effectively a leveraged bet on crypto. But one question sits at the heart of every trading strategy:

How much extra are you paying for Bitcoin exposure via MSTR?

That markup – the “premium to Bitcoin” – is the market’s pressure gauge for risk, financing capacity and sentiment.

A Beauty Contest, Keynes‑Style

Premium math is squishy. Some investors compare MSTR’s equity value to the raw coin hoard; others subtract the company’s $8 bn of zero‑coupon converts first. Jim Chanos – the short‑seller who called out Enron – recently said the stock trades at 1.9 × NAV (his NAV = BTC‑at‑spot minus debt).

Yet that “correct” premium also embeds liquidity value, leverage, optionality, and a dash of Michael Saylor’s showmanship. As Keynes might say, the winner isn’t the prettiest contestant but the one everyone else thinks will win.

Reverse‑Engineering the Crowd with MPI Stylus

We fed daily MSTR returns into MPI Stylus Pro, modelling them with three live factors:

| Factor | Why it matters |

| Bitcoin price | Core asset exposure |

| Nasdaq‑100 (QQQ) | Residual software‑business beta |

| 3‑month T‑Bill | Cash + implied leverage |

Stylus’s dynamic machine‑learning engine (normally used by multi‑strat hedge‑funds to x-ray traders’ P&L) adapts betas far faster than a rolling regression, letting us watch the market’s consensus move day by day. Here we’re applying the same math to the daily stock price.

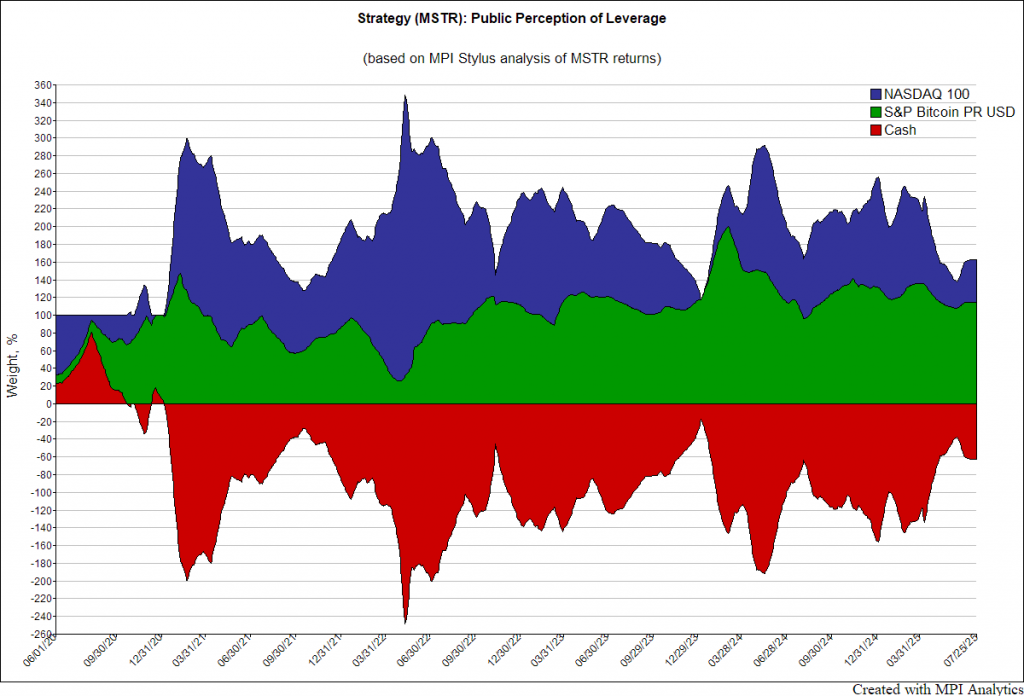

The chart below (produced in Stylus) shows the evolving market consensus on MSTR’s mix of leverage, software value, and Bitcoin exposure.

It’s also a great conversation piece: from a mostly software business (blue) in early 2020, to its first BTC purchase (green, Aug 2020), to the first leverage event ($650m convertible, Dec 2020), and today: a lightly levered BTC proxy with only a sliver of tech-beta. All that, extracted from price data—no 10-Qs required.

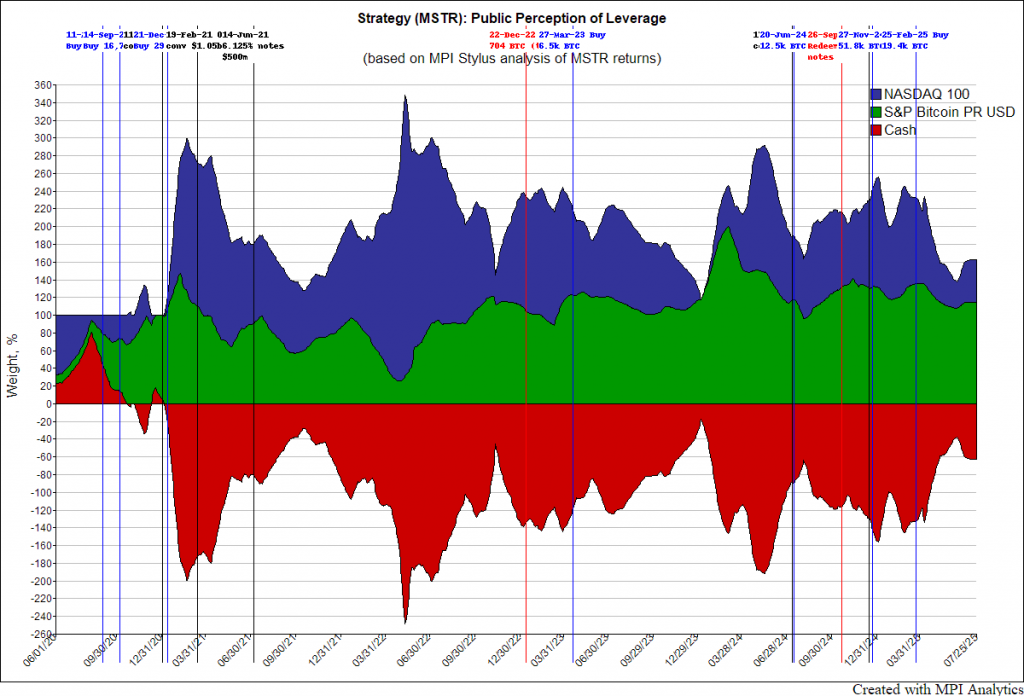

If someone actually wants to put this on a wall—or a T-shirt—we’ve also created a version with milestone labels: bitcoin buys (blue), debt issues (black), and secured note redemptions (red).

Back-of-the-Envelope Premium Calculations

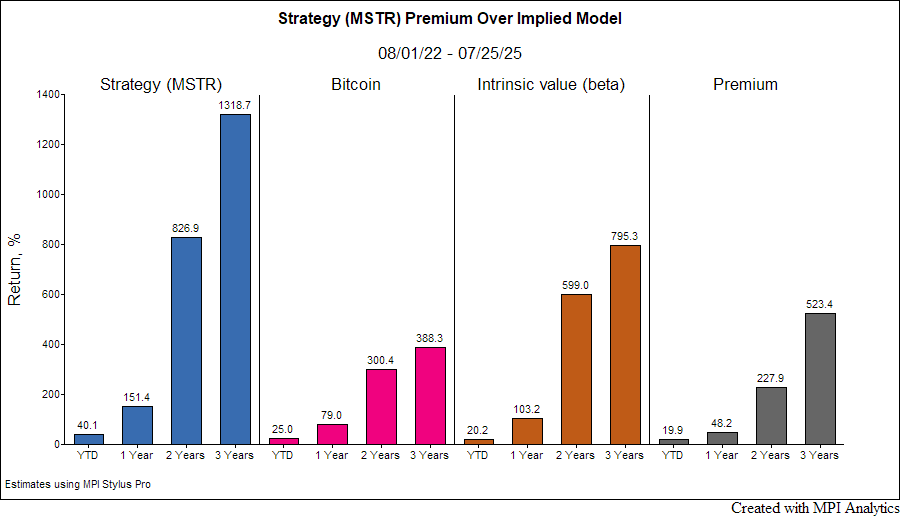

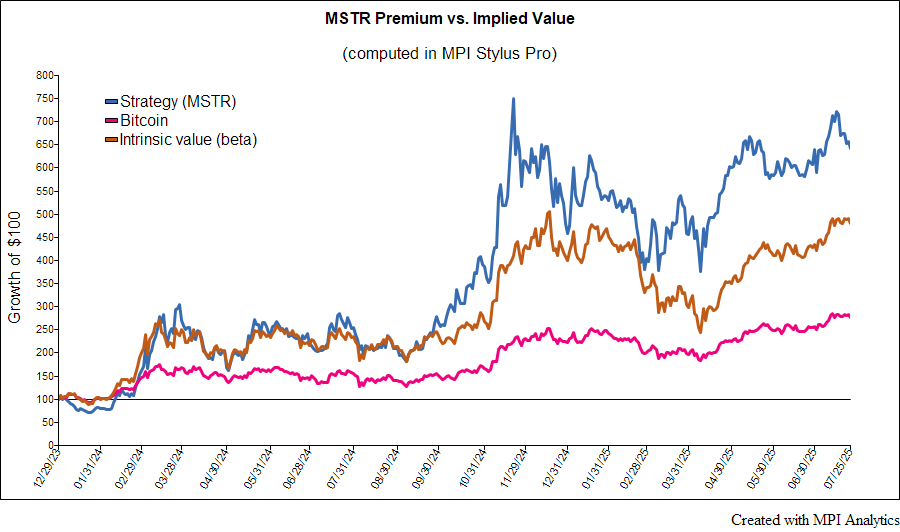

Here’s a snapshot of how MSTR’s stock has outpaced a simple “intrinsic” mix of Bitcoin and software beta in 2024–2025. The premium over this model-implied intrinsic value fluctuates, but it’s consistently smaller than the premium over Bitcoin alone—roughly half, based on cumulative returns.

Over a 36-month holding period (last column in the chart below):

- MSTR returned 1,319%

- BTC returned 388%

- A levered BTC portfolio (Stylus-implied, no trading/friction costs) would return 795%

- The premium over BTC: +931 percentage points

- The premium over Stylus intrinsic return: +523 percentage points

Intrinsic return = Bitcoin β + Nasdaq β (Stylus betas).

Premium = MSTR return – intrinsic return.

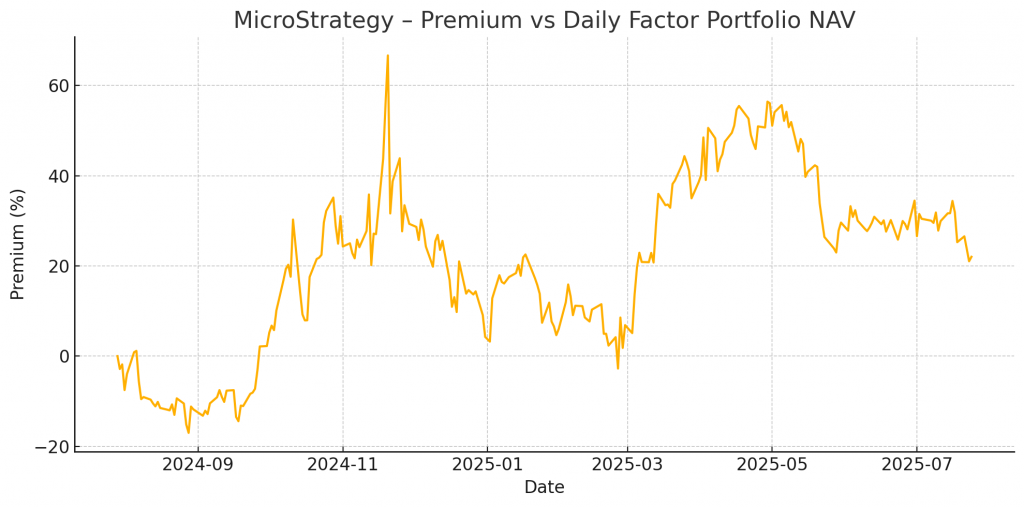

The premium could be calculated on daily basis by maintaining a hedge with an intrinsic beta portfolio. The chart below shows such daily premium over the past 12 months.

Key observations:

- Early‑August 2024: stock actually traded below the factor NAV (premium negative).

- Nov 2024 spike: premium briefly exceeded +65 % around the $3 bn zero‑coupon convert issue.

- Q2 2025: premium hovered in the 40‑55% zone but has slid back toward the high‑20s by late July.

At no point did our model‑implied premium exceed 90%, contra Chanos’ headline number.

Takeaways

- The BTC premium isn’t optional; it’s the vital sign traders watch for funding risk.

- Premiums are plural – each desk has its own recipe.

- Stylus offers a consensus‑implied premium you can track daily – essential if you trade, hedge or just marvel at the biggest corporate Bitcoin bet ever.