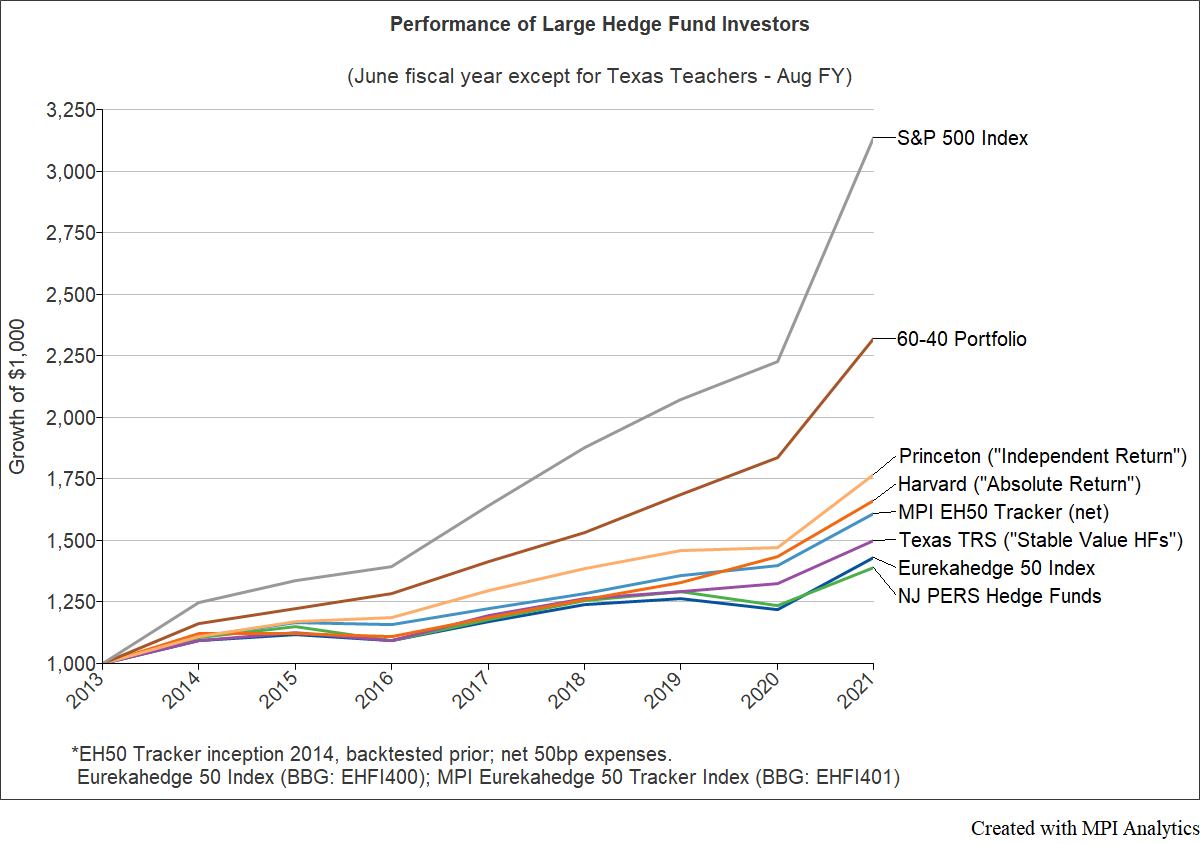

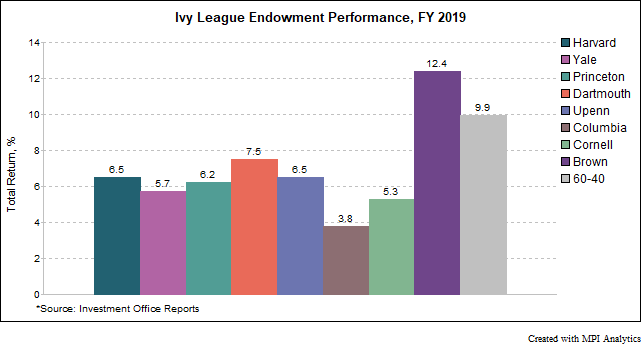

Eight years ago, we partnered with Eurekahedge to develop a unique hedge fund benchmark. We review live performance of the index and its liquid tracker – MPI Eurekahedge 50 Tracker Index.

Eight years ago, we partnered with Eurekahedge to develop a unique hedge fund benchmark. We review live performance of the index and its liquid tracker – MPI Eurekahedge 50 Tracker Index.

MPI’s September 2021 analysis of the Structured Alpha fund has again been at the forefront of investment reporting this week after Allianz’s recent admission of fraud and the sale of its U.S. asset management business to Voya. Illuminated sources of risk and alpha for investors.

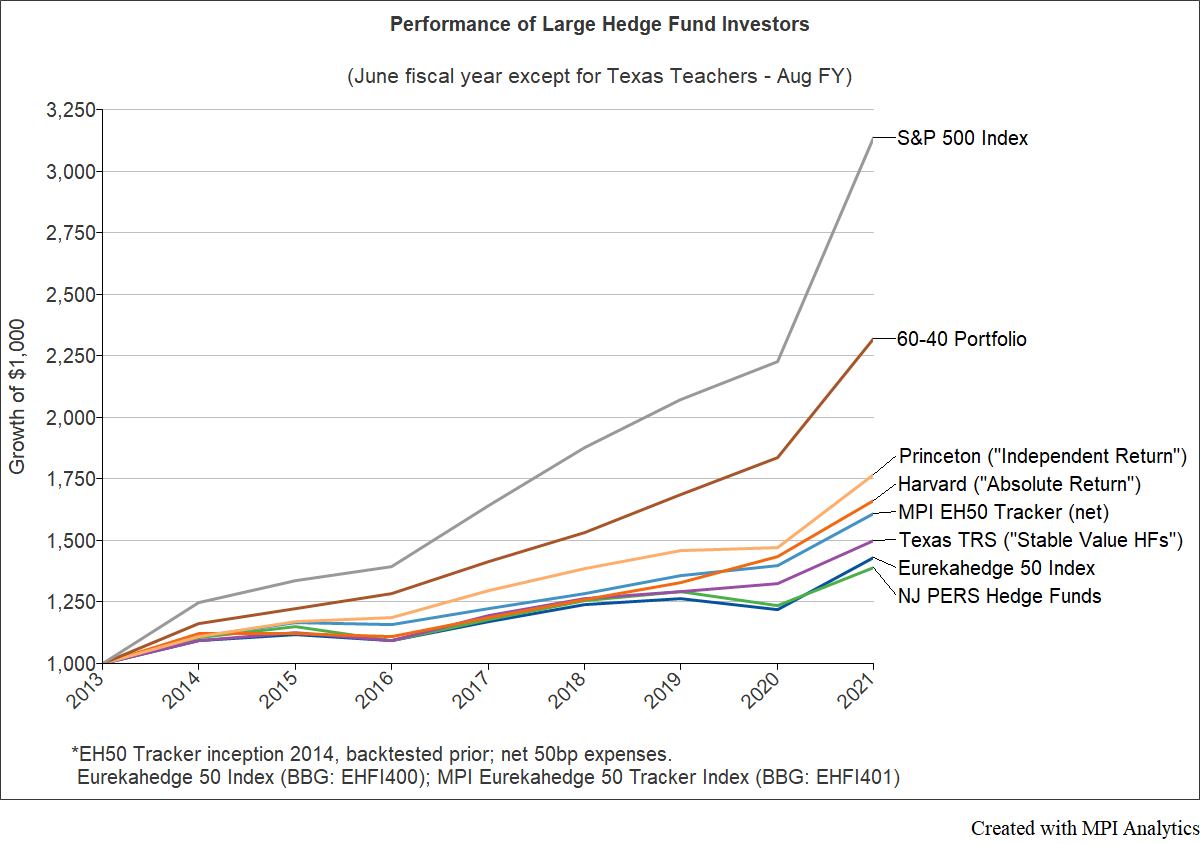

Using MPI’s Dynamic Style Analysis (DSA), we analyzed 600 equity hedge funds to assess their exposure to Russian equities

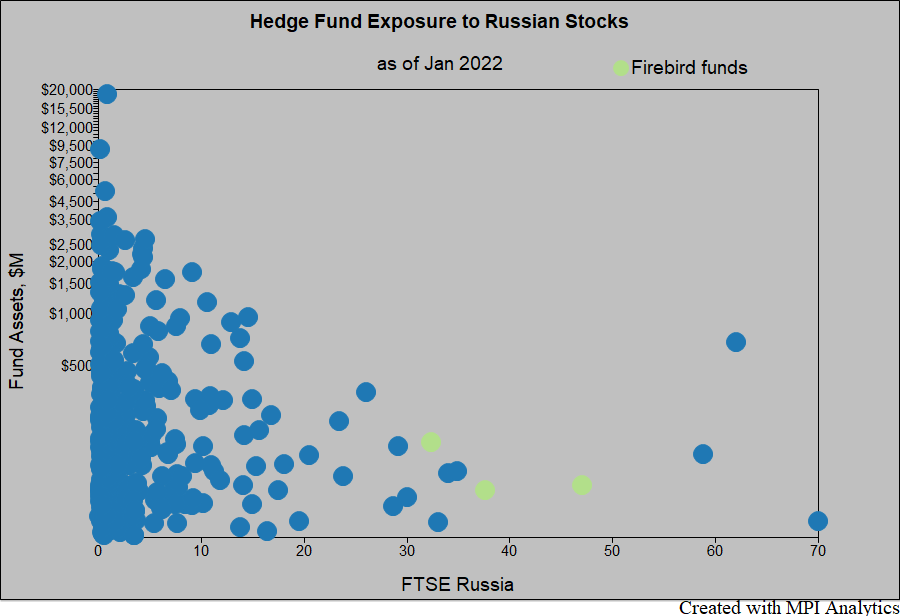

Fiscal year 2019 was a curious year for the Ivy League endowments. In a year with strong returns in key private market investment classes, the average Ivy underperformed a traditional domestic balanced 60-40 portfolio in FY 2019. Ivies also experienced a wider dispersion of returns and saw a shift in the historical positioning of performance leaders and laggards.

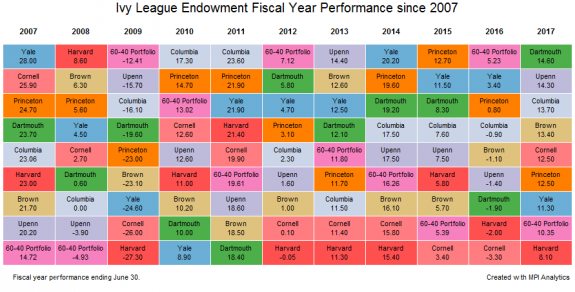

In stark contrast to FY 2016, this past year was a strong one for most endowments. In fact, nearly all the Ivy League endowments, Harvard being the only exception, beat the 60-40 portfolio, a commonly cited benchmark that endowments measure their performance against.

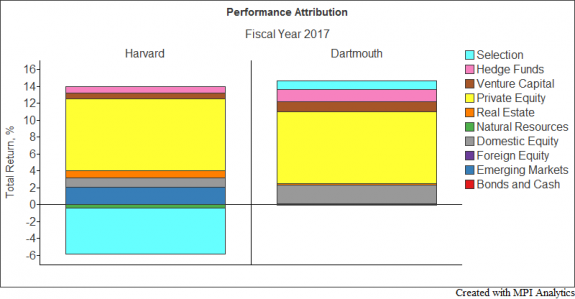

The returns of endowments can be attributed to two fundamental components: asset allocation and security selection. Asset allocation is what a factor model is generally able to explain, shown in terms of factor exposures.

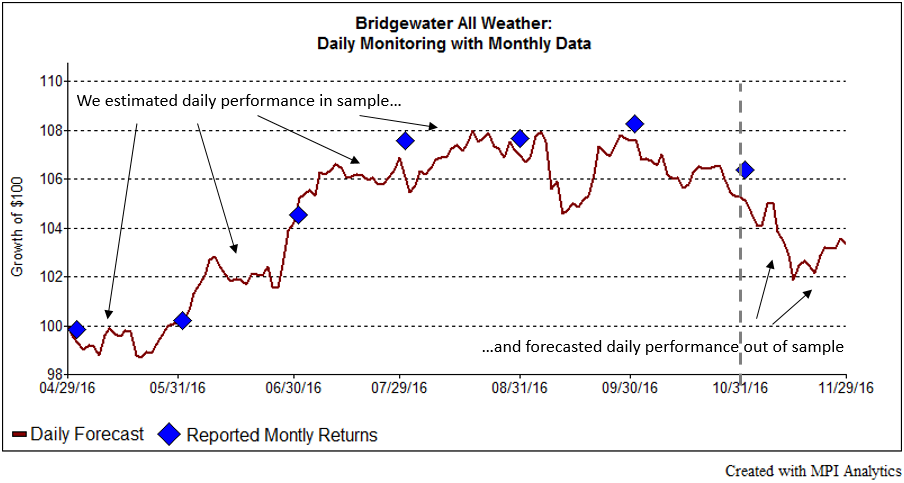

We use Bridgewater All Weather, one of the largest hedge funds, to illustrate how to quantitative techniques could provide investors with a more dynamic understanding of the potential fund behavior intra-month using only monthly fund data.

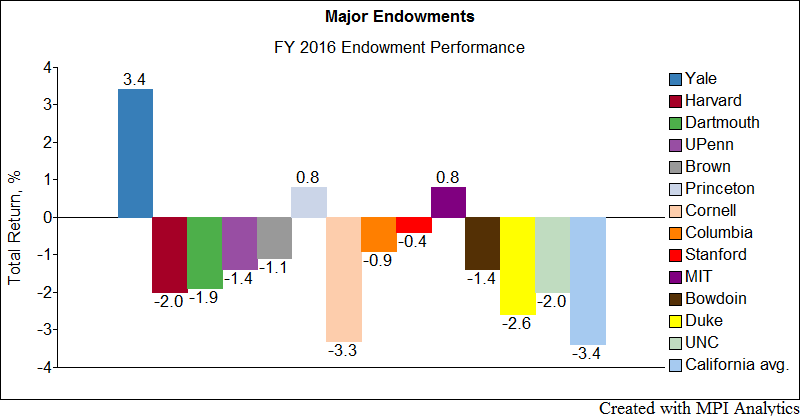

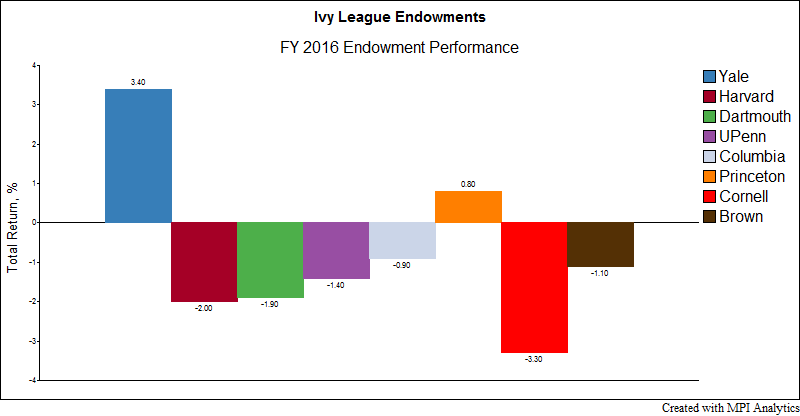

We look at the largest endowments and find striking similarities in their asset class exposures. At the same time, some endowments stand out both in terms of allocations and FY2016 performance.

An 1873 meeting that brought Harvard, Yale and Princeton together to codify the rules of American football also debuted a sports conference later known as the “Ivy League — eight elite institutions whose heritage, dating from pre-Revolutionary times, became formative influences shaping American character and culture. These schools also pioneered endowment investment management, thus helping to secure the nation’s educational legacy for posterity.

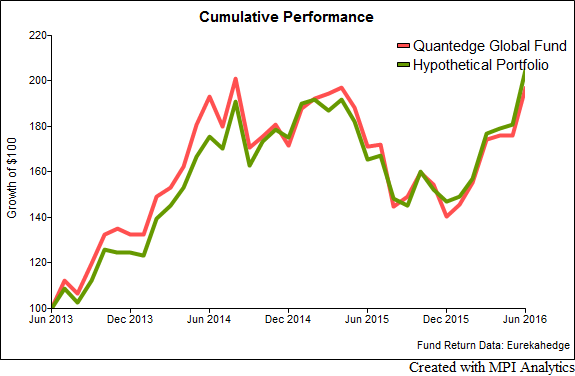

A July 20th WSJ article featured Quantedge Capital, a quantitative global macro hedge fund manager that gained 40% after fees year-to-date through June. We provide a quantitative insight into potential sources of such performance.