Quant Funds in the Coronavirus Market Rout: Risk Parity

How have risk parity funds actually acted (or reacted) during the current crisis? We use our Stylus Pro system to estimate changes in allocations and leverage levels.

It’s not as bad as you think (2020 Q1)

Over many of the drawdowns in the latter half of history’s longest ever bull market, risk parity strategies have been blamed time and again for exacerbating selling and volatility. The current bear market rout caused by real and expected economic impacts of the coronavirus pandemic has been no different. Others think the strategy is outdated. Due to the decades-long descent of interest rates to their historic lows some, including Morgan Stanley, have predicted that the strategy is no longer viable and will underperform during the next decade.

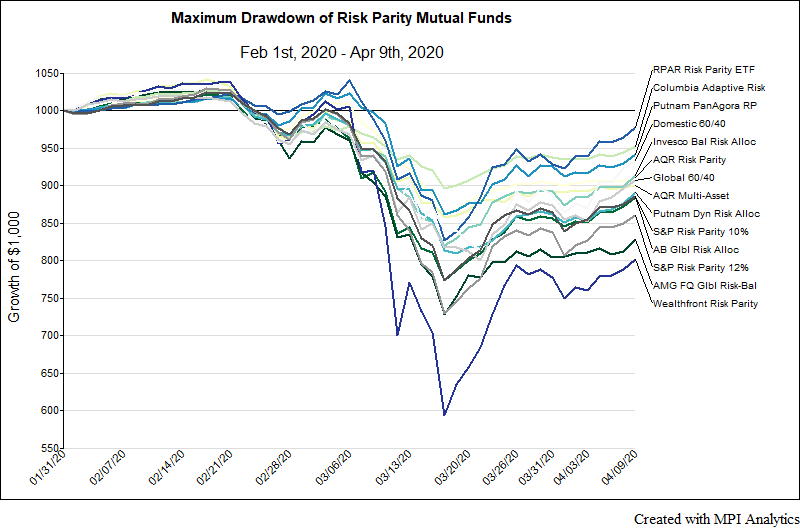

But, how have risk parity funds actually acted (or reacted) during the current crisis? Certain funds have done a lot better than naysayers thought – which may be a surprise to some allocators and asset management industry watchers – and a pleasant one to risk parity investors.

Risk parity is a multi-asset strategy designed to perform relatively well in all investing climates by balancing risk across its components. Generally, portfolio volatility is targeted at 10-15% and the bond allocation, due to the historically lower realized volatility in fixed income, is typically leveraged. Allocation shifts are subject to some blend of rules/models and discretionary management, and they are often made gradually. Yet, within those broad confines lies a lot of variance in implementation by managers, often leading to different results.

With an estimated total asset base across all risk parity investment vehicles between $175B-$400B, the bulk of assets are in hedge funds, not 40 Act mutual funds. With about $60B, the Bridgewater All Weather funds, from the pioneer of the strategy Ray Dalio and his team at Bridgewater Associates, LP, are the largest in the risk parity universe. The advantage of examining risk parity mutual funds is that they offer us frequent and timely performance data. Dynamic analysis of mutual funds’ daily NAVs using Dynamic Style Analysis (DSA) in MPI’s Stylus platform presents analysts a unique ability to estimate intra-month allocations, even though information on exposures might not ever be available since mutual funds are not required to disclose intra-month positions and only have to report quarterly, doing so with a lag.

Sign in or register to get full access to all MPI research, comment on posts and read other community member commentary.