University of Chicago’s Endowment FY2022 Risk Premia Story

MPI Transparency Lab Analyst Commentary

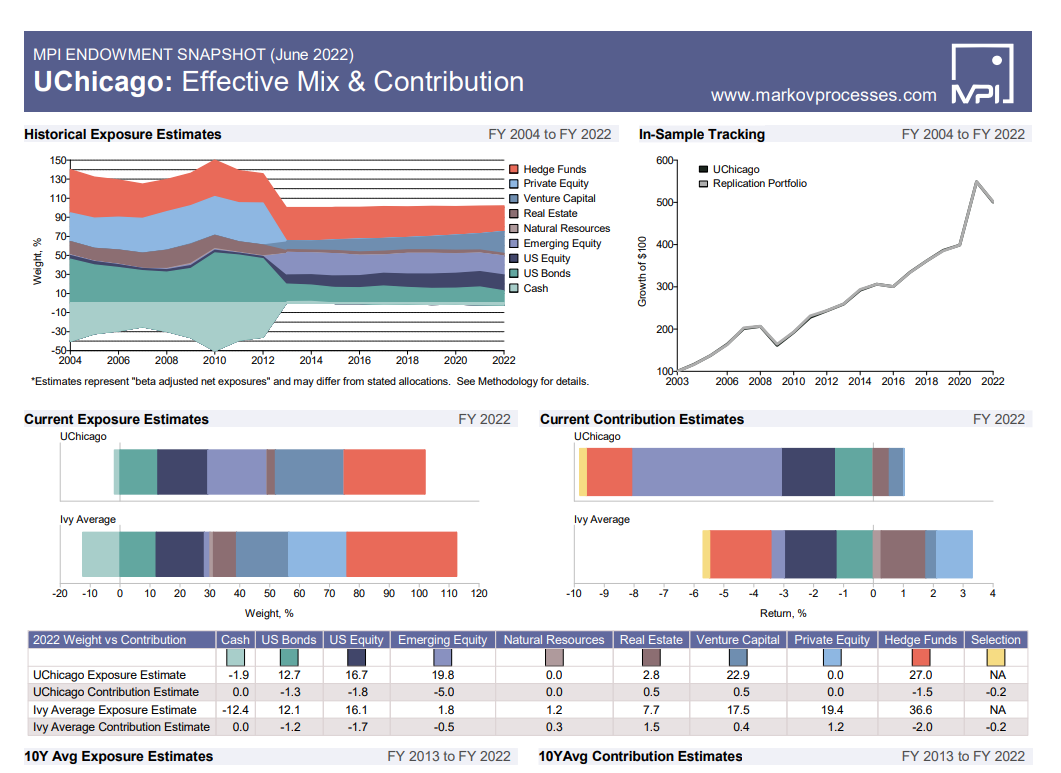

The $10.3B University of Chicago’s endowment beat the Ivies on a 10-year basis in 2013 (10% vs. 9.4%, respectively) but has since seen a steady relative decline. It posted a FY2022 loss of -8.8%, double that of the NACUBO $1B+ category (-4.46%), and it now underperforms the Ivies at 7.48% over the trailing 10 years (versus 10.8% for the Ivies.)

Our analysis shows that endowment exposures appear to have changed dramatically (beginning circa FY2012):

Sign in or register to get full access to all MPI research, comment on posts and read other community member commentary.