Corporate News

The latest information on our product and service enhancements, client wins and company moves.

A new research from MPI that can serve as an early-warning indicator for potential greenwashing risk and help prioritize deeper ESG review of funds.

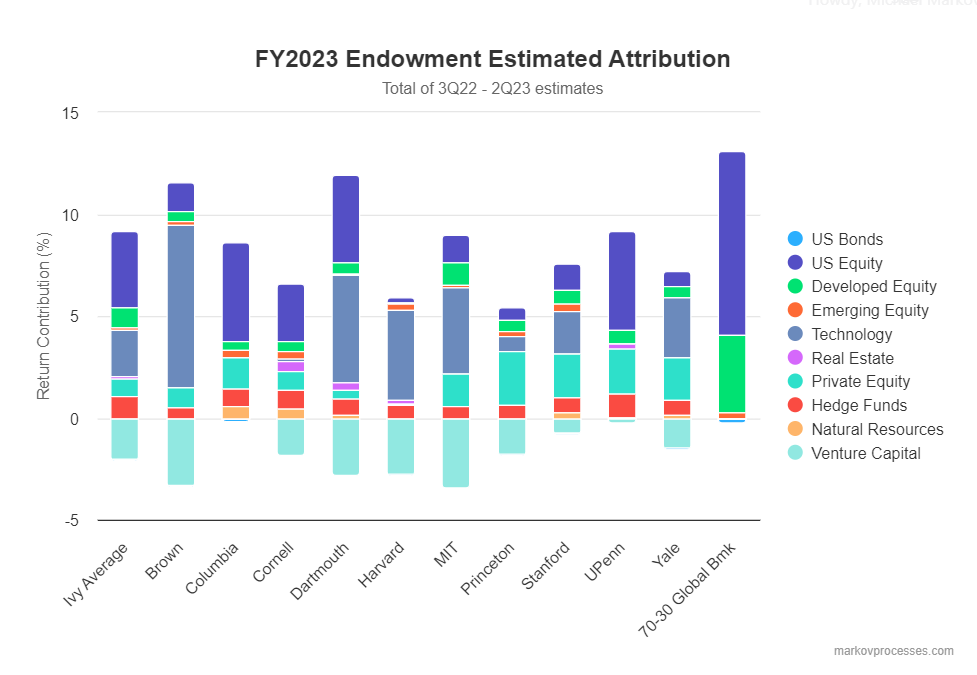

Using its proprietary Stylus Pro software, MPI shows that concentrated exposure to these areas is a plausible source of superior performance at Michigan, MIT and Stanford, among other schools.

MPI released an important institutional research of the $3.2 billion City of Tampa Fire and Police Pension Fund to show that the fund, long known for a remarkable stock-picking approach uncommon in pensions and endowments, actually is a validation of principles of broader diversification and index investing.

Michigan State Through the Roof – MPI Stylus Pro Was Instrumental in Solving the Biggest Puzzle of the 2024 Endowment Season

In October of 2024, Michigan State University’s (MSU) $4.4 billion endowment stunned the investment world by announcing a 15.1% return for the fiscal year ending June 2024, outperforming every Ivy League and other elite endowments tracked by the MPI Transparency Lab. By comparison, the top-performing Ivies, Columbia and Brown, reported returns of 11.5% and 11.3%, respectively, for the 2024 fiscal year, while the 70/30 Global Benchmark returned 14.2%.

In its published research, MPI research team uses MPI Stylus Pro analytics to uncover major sources of the MSU endowment’s exceptional performance and attributes the success of the top-performing team to its higher-than-average exposure to technology stocks and risk.

MPI announced the addition of tax-adjusted asset allocation simulations for financial advisors, wealth management firms and investment professionals working with taxable accounts. MPI also announced the addition of portfolio fee-adjustment capabilities so that wealth and investment management organizations can adhere to the new “Marketing Rule” directives. This enhancement will help MPI clients deliver compliant presentation of gross and net performance returns in published materials.

Exposure to stocks again seen driving public pension returns in FY2024. Georgia and Kentucky Teachers projected at top of league tables again. Public-private markets divergence continues—systems with higher equity exposure expected to fare better than those with elevated allocations to privates.

These widely cited projections come from MPI’s Transparency Lab, which provides unique insights into the styles, risks, and performance of traditionally opaque pensions and endowments.

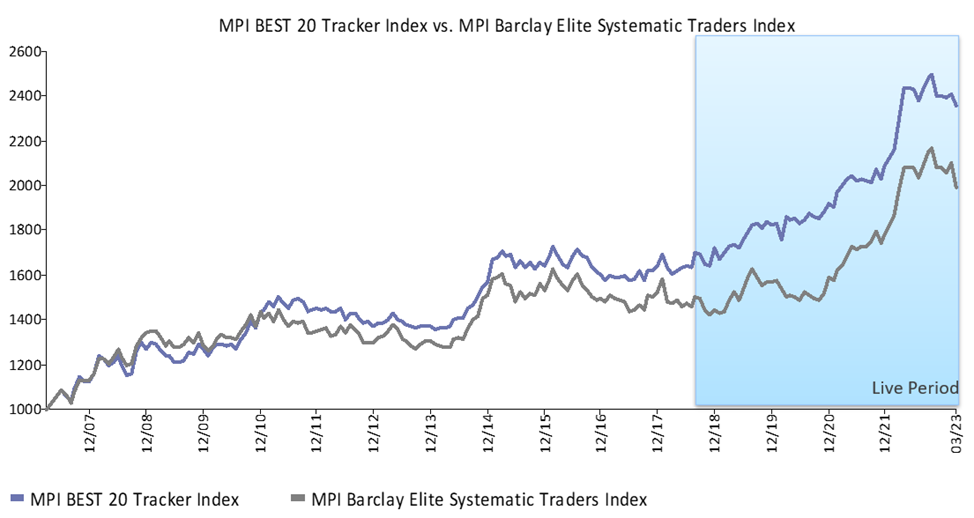

MPI released five-year performance data for the MPI BEST20 Tracker Index, an investible benchmark showing that it is possible to capture diversification and risk-mitigation benefits of some of the most sophisticated systematic trading strategies.

This new offering gives advisors who serve the 401(k) and defined contribution market flexible analytics and reporting that help differentiate their practices to win and retain plan sponsors.