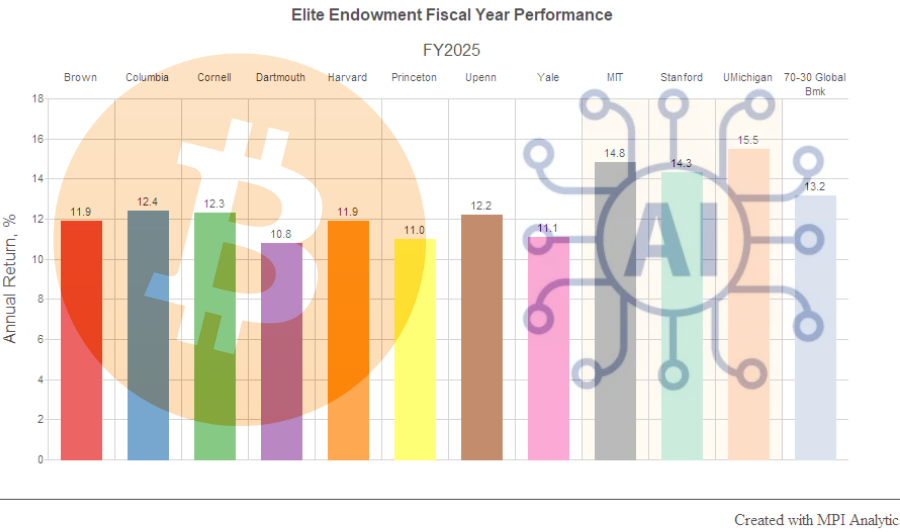

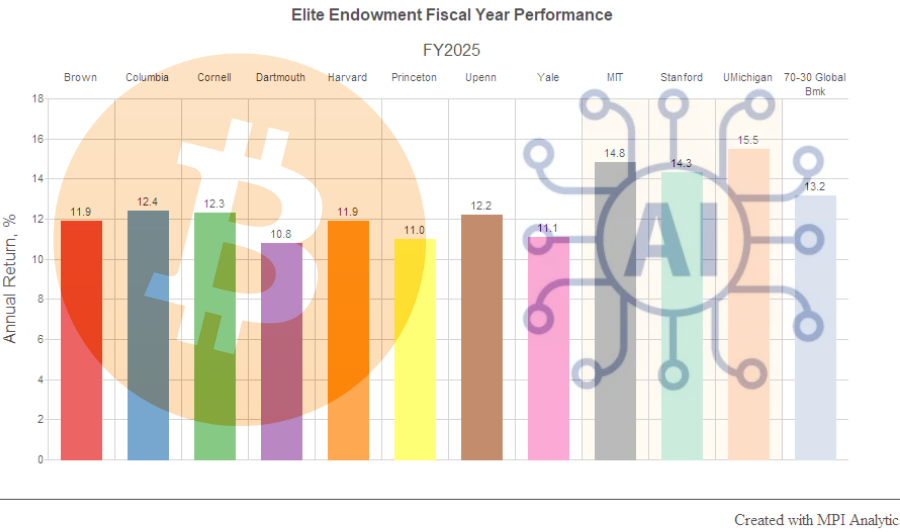

We analyze annual endowment returns to offer a plausible explanation for MIT, Stanford, and Michigan’s spectacular FY25 results. The evidence points to AI and digital-asset themes.

We analyze annual endowment returns to offer a plausible explanation for MIT, Stanford, and Michigan’s spectacular FY25 results. The evidence points to AI and digital-asset themes.

Using its proprietary Stylus Pro software, MPI shows that concentrated exposure to these areas is a plausible source of superior performance at Michigan, MIT and Stanford, among other schools.

Reading the President’s warning through the lens of liquidity vs. market risk

Ivy and elite endowments did poorly in fiscal year 2023, especially relative to a global 70/30 benchmark and smaller, less resourced endowments that invest in less private markets assets/funds than those employing the ‘Yale model’.

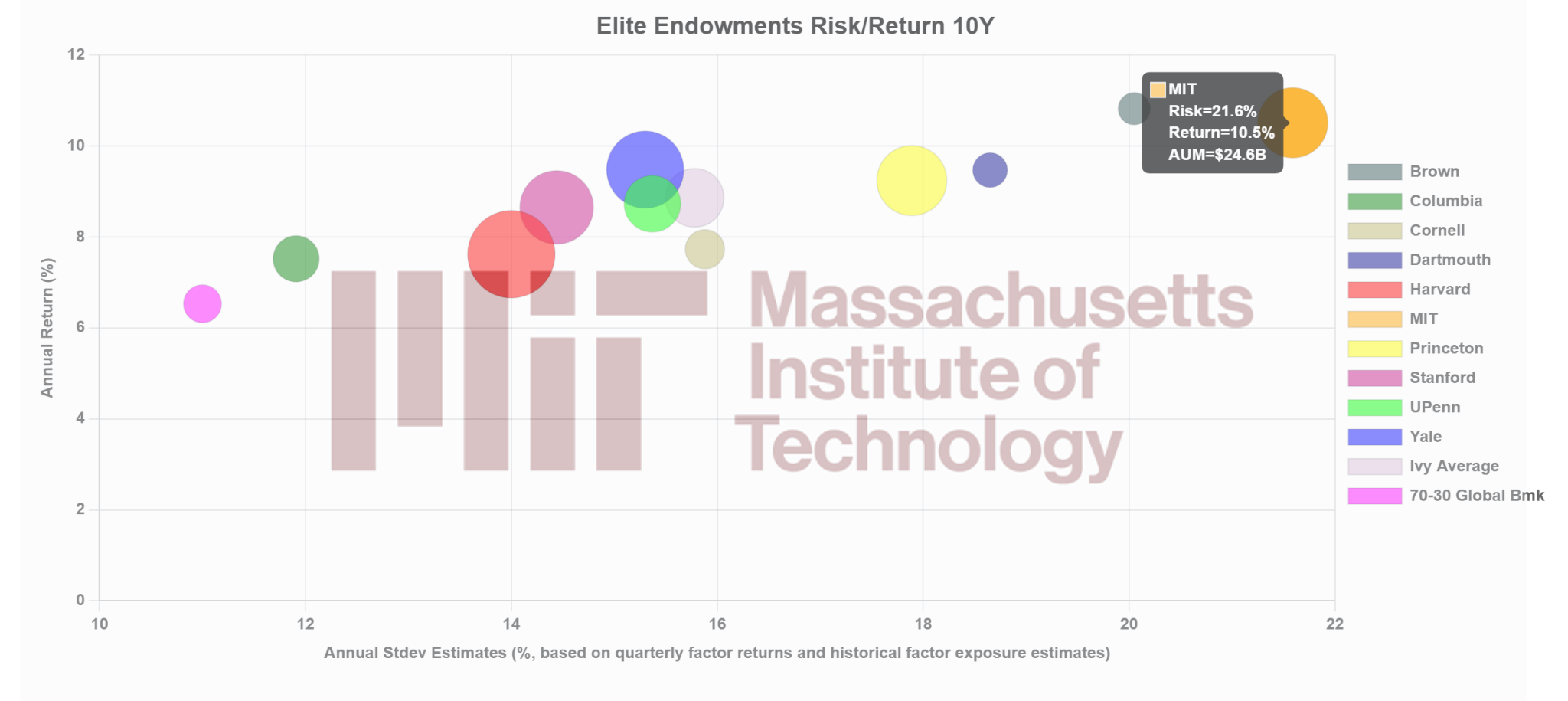

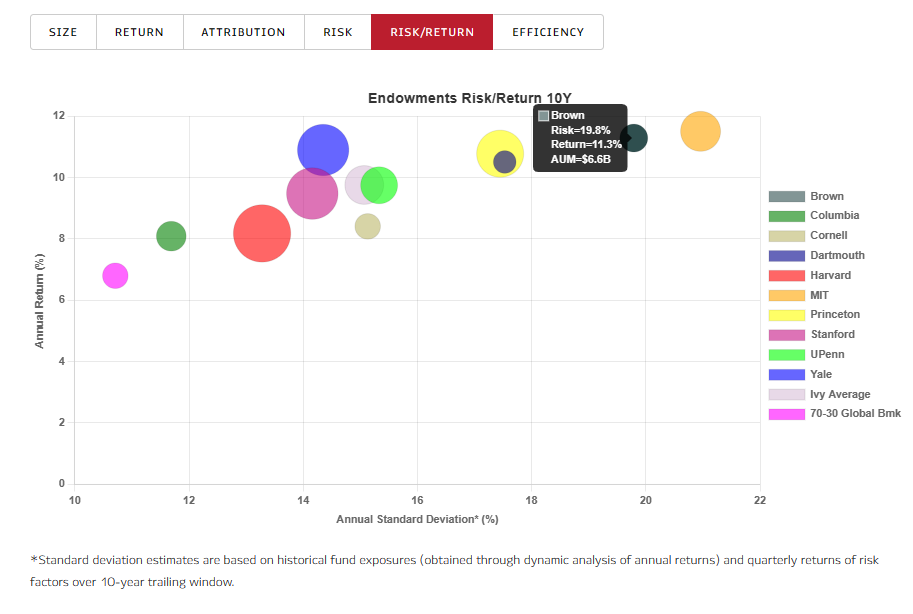

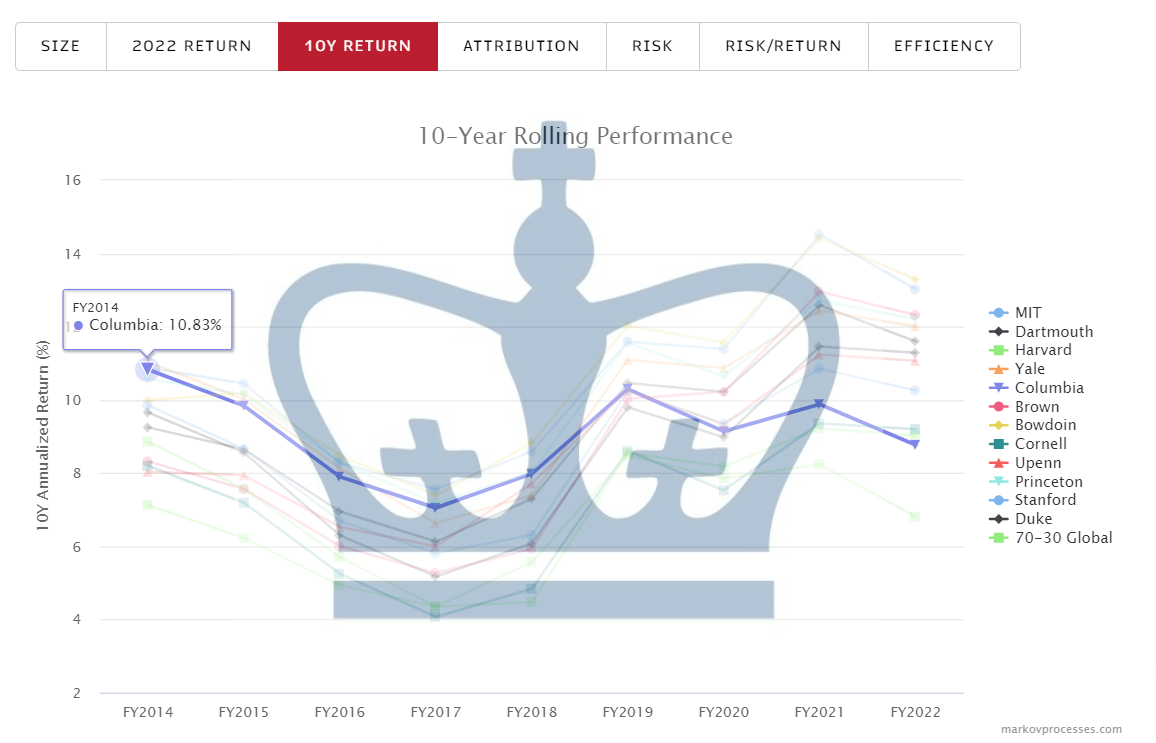

About eight years ago, Columbia University’s endowment had a 10-year return that was one of the best in class, together with MIT and Yale.

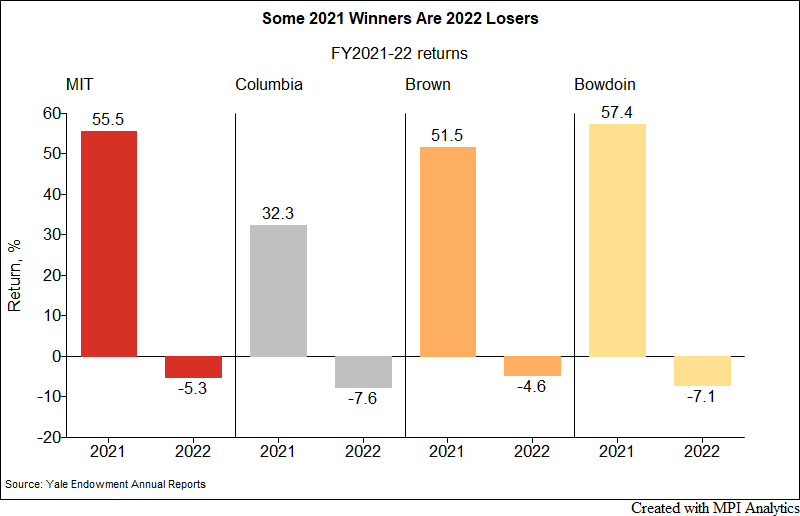

Most endowments have been propped up by a similar concentration in private assets. The ones that suffered the worst, however, couldn’t have been more different in their approach.

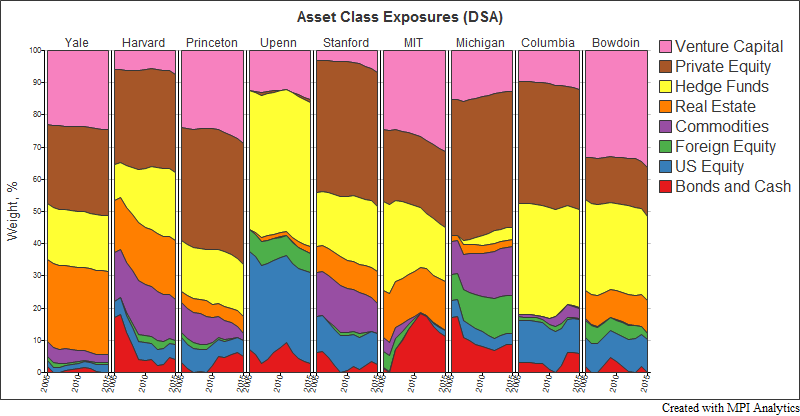

Using MPI’s Dynamic Style Analysis and public annual return disclosures we attempt to provide transparency on allocation decisions and performance results of some of the largest and most successful investors in the world.