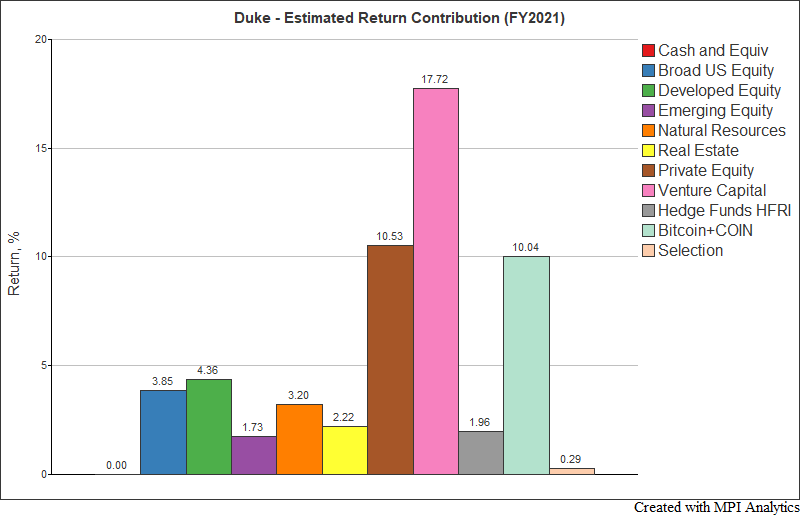

A smart Coinbase investment launched Duke into rare heights in FY 2021. We use MPI Stylus to estimate the size of Duke’s Coinbase position and its impact on this year’s results.

A smart Coinbase investment launched Duke into rare heights in FY 2021. We use MPI Stylus to estimate the size of Duke’s Coinbase position and its impact on this year’s results.

Using Norwegian pension as an example we provide a quick and easy path for US pensions to become more transparent and regain trust of their beneficiaries as well as general public

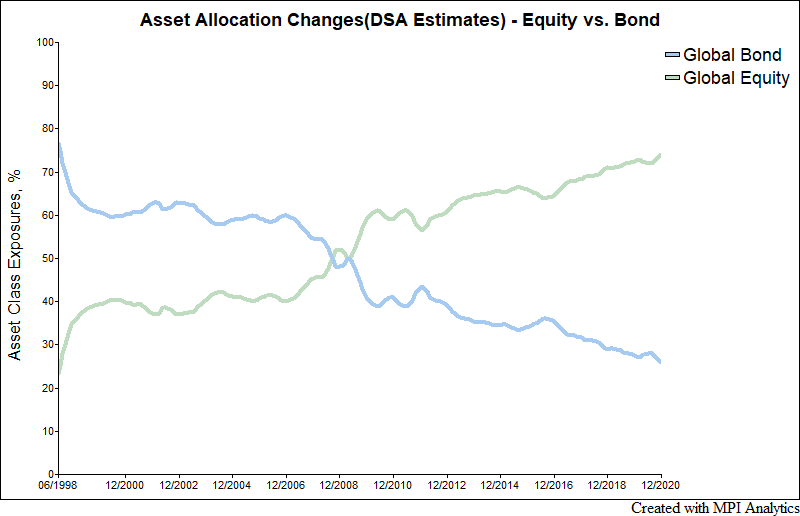

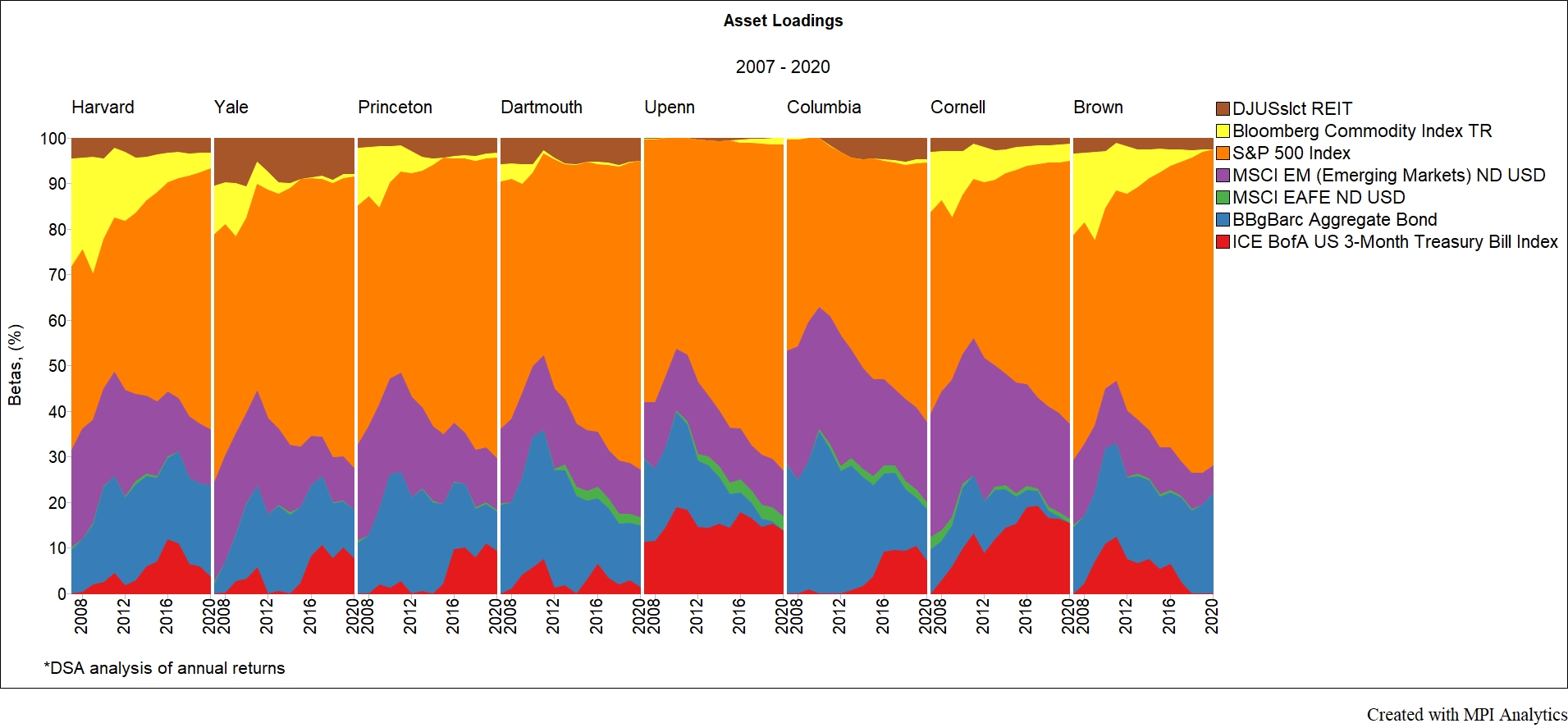

Lessons (not) learned: our analysis shows Ivies are at pre-GFC levels of risk

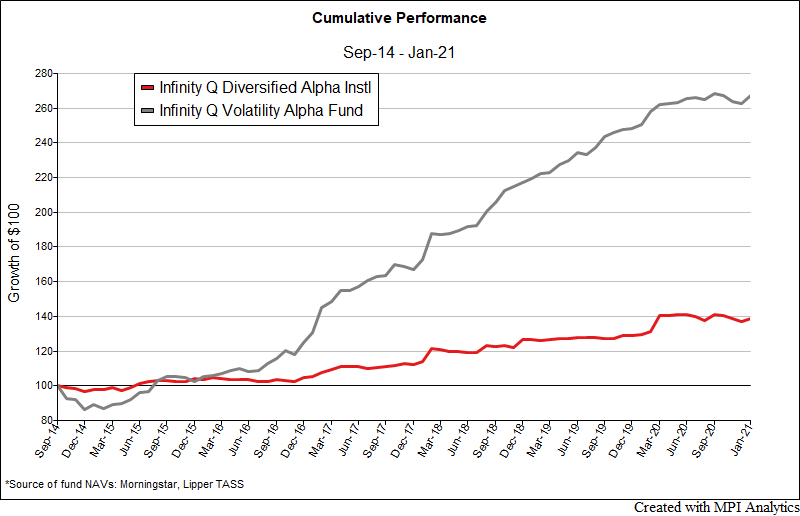

Following up on our most recent article, “Infinity Q: Too Much Alpha,” Infinity Q also managed a hedge fund product, Infinity Q Volatility Alpha, which exclusively employed volatility strategies. Using known sub-strategies as regression factors for a multi-strategy product can prove very useful in identifying the source of both skill and risk in a more complex product.

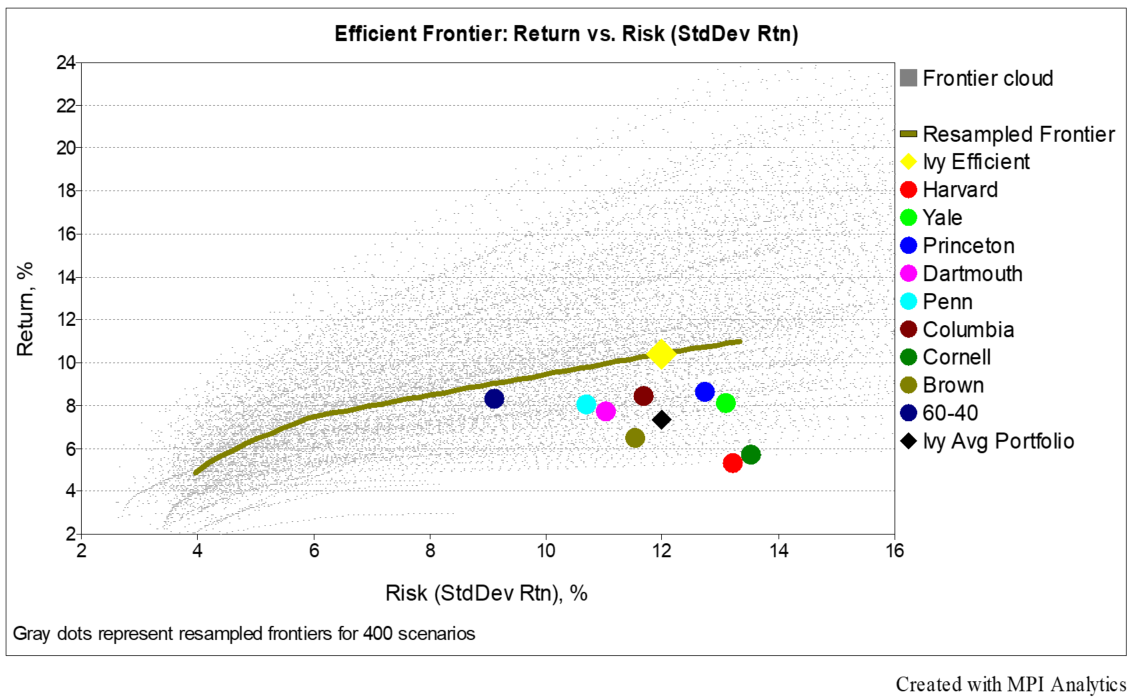

The endowment model, and active management in general, has come under increased scrutiny, while indexed, or passive, products have grown in popularity and number. Regardless of where you stand on that debate, it’s hard to deny that the Ivies approach to asset allocation has been very good.

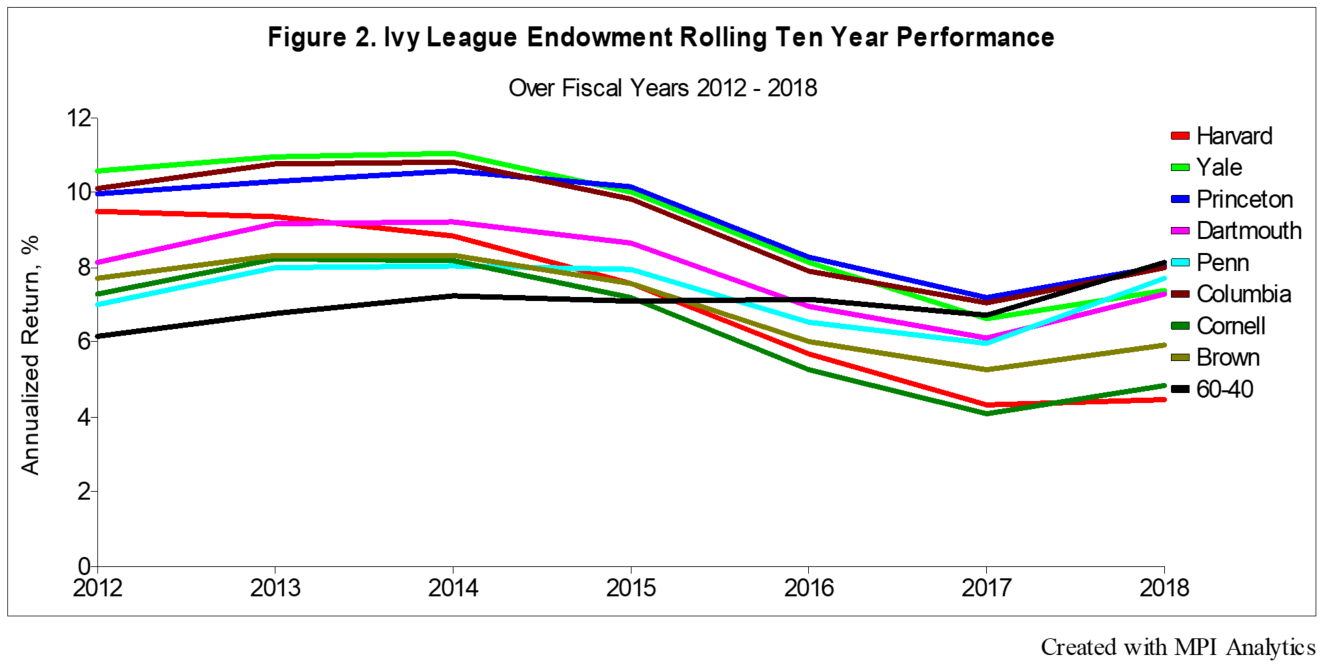

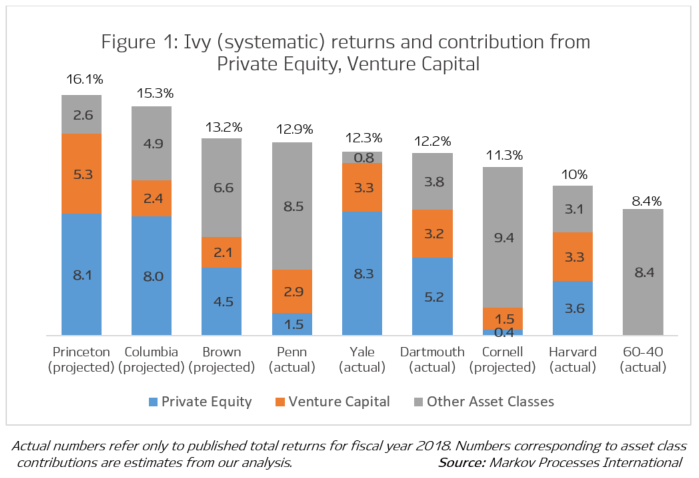

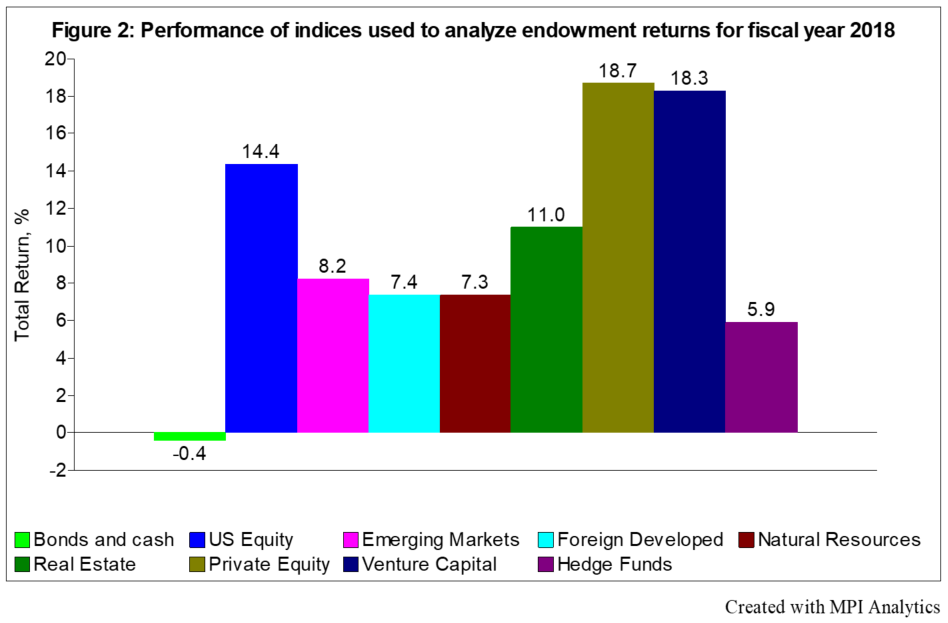

Similar to 2017 performance, this past fiscal year was a strong one for most Ivy League endowments. Fiscal year 2018 is noteworthy, however, for being the first year that long horizon (10-year) returns from all Ivy endowments lagged behind the 60-40 portfolio.

Returns across the Ivy League are largely seen as being driven by exposure to private equity and venture capital.

At the midway point of fiscal year reporting for the Ivy League endowments, our research team analyzes what we know so far to identify the key drivers of returns.