Bounce in crisis-hit funds prompts health warning

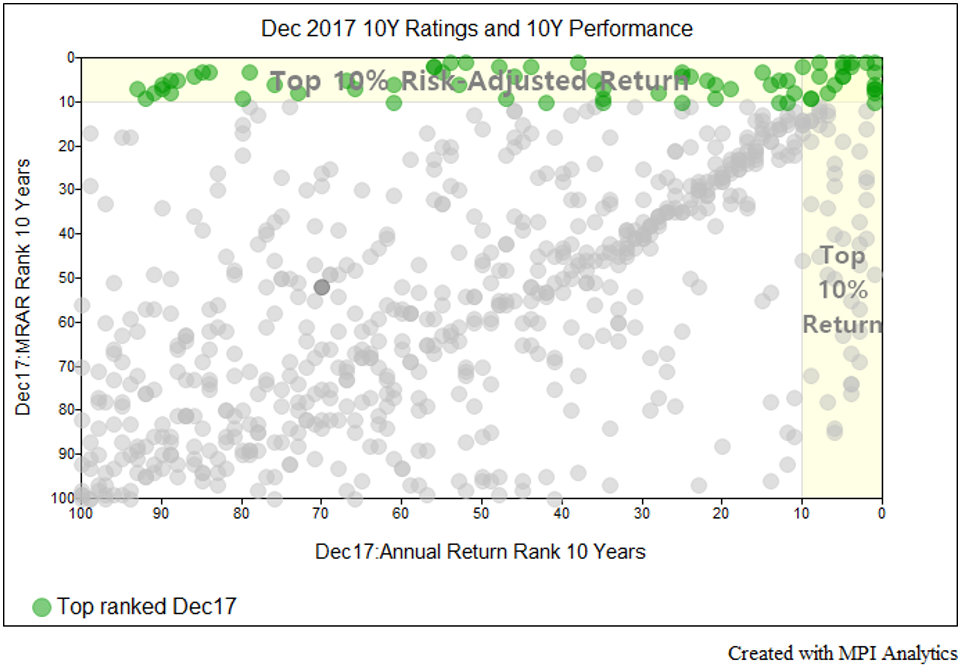

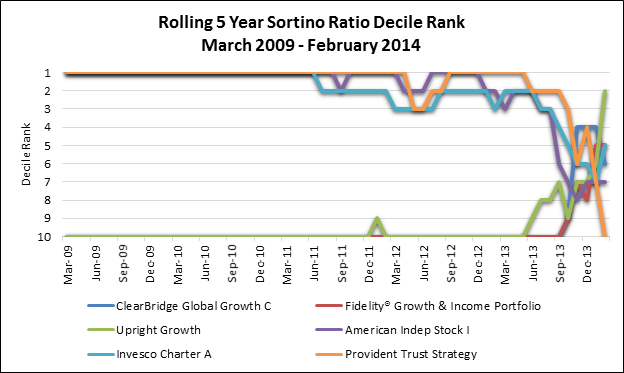

“Markov Processes also examined the relationship between volatility and performance of all 700 funds over both periods. It found that conservatively constructed funds that exhibited lower volatility (beta) than the market were more consistently top-ranked in the first period, which included the financial crisis. But higher beta (more volatile) funds tended to be more prominent among the better performers in the later 10-year period when the crisis had faded. Markov found a “near linear relationship” between funds’ risk-adjusted returns rankings and performance since the crisis.” Read the full article here (subscription required).