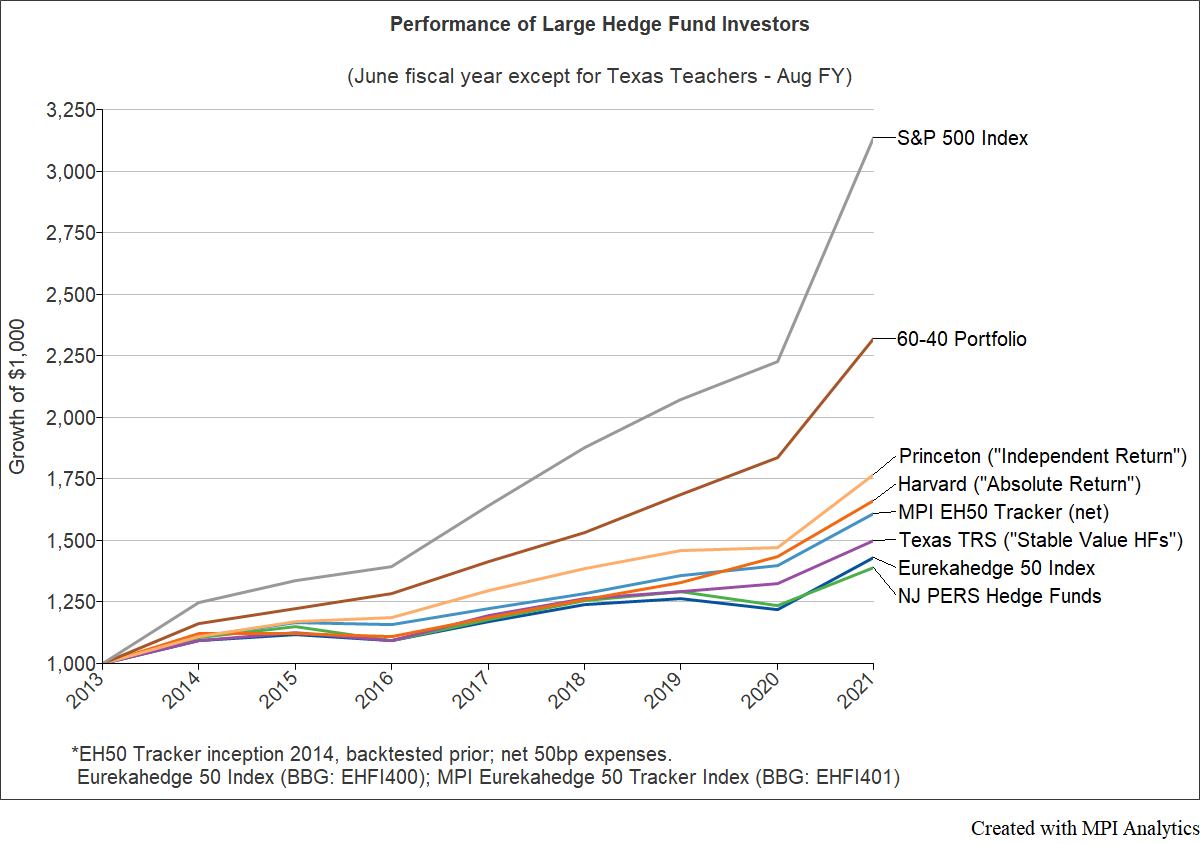

MPI today released eight-year performance data for its MPI Eurekahedge 50 Tracker Index that indicate its basket of liquid, retail exchange-traded funds can deliver the performance of a diversified portfolio of institutional-quality hedge funds.

hedge fund index

Eight years ago, we partnered with Eurekahedge to develop a unique hedge fund benchmark. We review live performance of the index and its liquid tracker – MPI Eurekahedge 50 Tracker Index.

Opalesque Exclusive: Investors Grow Wary as Market Risks Rise

“More than one third (38%) of respondents listed slower growth as the biggest risk in 2019, a significant jump from March, when 12 percent of respondents listed it as the top risk. Two other top investor concerns for 2019 are rising interest rates (29%) and a stock market reversal (21%). The results come on the heels of a separate report from the White House that the US government shutdown could eventually push the US economy into recession if it persists. “What we’re starting to see from investors is a growing interest in so-called uncorrelated strategies like global macro managed futures,” said Rohtas Handa, EVP, Head of Institutional Solutions at MPI in an interview with Opalesque. “There’s a desire to reposition portfolios so that they are insulated if the volatility we experienced in December is a more consistent theme in 2019.”” Read the full article here. (subscription required)

MPI Launches Target Volatility Indices for Hedge Fund Trackers

“I think it’s an extension of what we have done before. We launched our hedge fund benchmarks with daily tracker indices to provide a better measure of hedge fund performance while also providing insight on what the drivers of returns are,” said Rohtas Handa, EVP and Head of Institutional Solutions at MPI. “While traditional hedge fund indices give a measure of overall performance, there isn’t a focus on what is driving constituent returns. So, we are excited to deliver these new insights.” Read the full article here.

MPI Adds Volatility Versions to Hedge Fund Benchmarks

“Target volatility versions of the MPI Eurekahedge 50 Tracker Index are now available with 6% or 8% volatility, while the MPI Best 20 Tracker Index, which tracks the MPI Barclay Elite Systematic Traders Index, comes in 8% and 10% volatility versions. “You can scale up the volatility and scale up the risk level of the proxy index to get an ‘apples-to-apples’ comparison,” said Rohtas Handa, head of institutional solutions at MPI.” Read the full article here.

New Offering Leverages MPI’s Expertise, Patented Model to Create Better Benchmarks for Elite Hedge Fund Performance

MPI Ties up with Eurekahedge & BarclayHedge

“Selection/non-reporting bias, survivorship bias, and backfill or instant history bias can all serve to artificially inflate index returns, which are often higher for non-investable than for investable hedge fund indices,” explains Hamlin Lovell, in his feature article on the launch of MPI’s Hedge Fund Indices business. “According to MPI, these biases can be overcome by building a representative index comprised of a selective group of the largest funds.” Read the article here.

MPI Partners with Eurekahedge for New Hedge Fund Index, Eurekahedge 50

MPI partners with Eurekahedge to create and maintain the Eurekahedge 50 Index, a new benchmark index tracking the top 50 hedge funds. The Eurekahedge 50 Index was created to meet the demands of institutional hedge fund investors seeking a more selective benchmark reflective of diversified institutional quality hedge fund portfolios. The Eurekahedge 50 Index tracks the returns of the top hedge funds based on longevity, assets under management and quality of risk-adjusted returns, taking into account stability and consistency. See the press release here.