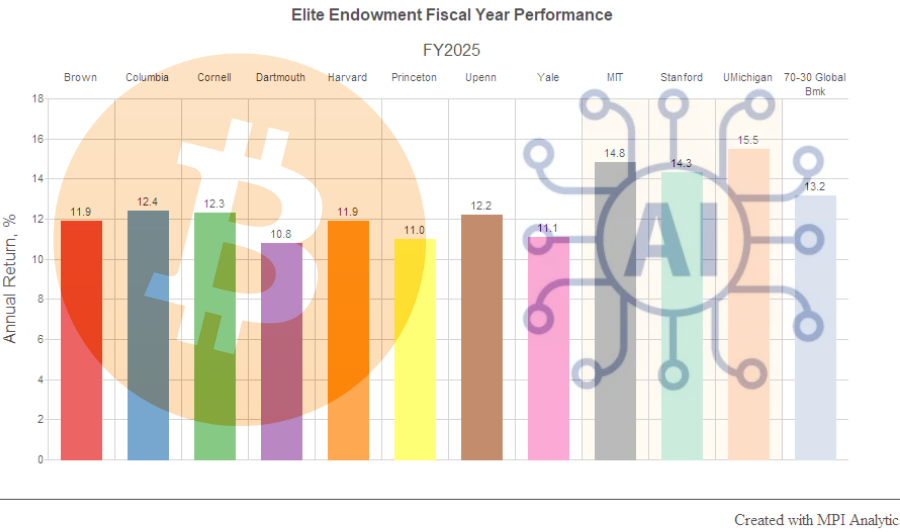

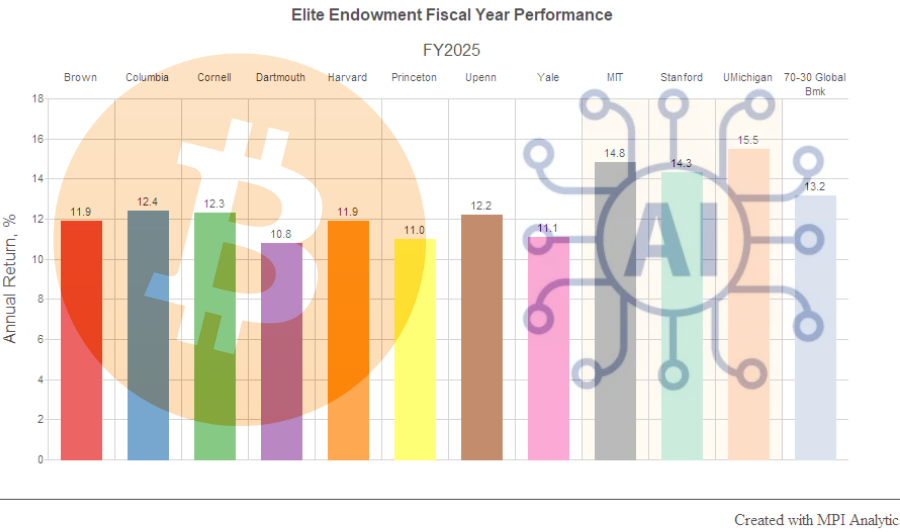

We analyze annual endowment returns to offer a plausible explanation for MIT, Stanford, and Michigan’s spectacular FY25 results. The evidence points to AI and digital-asset themes.

We analyze annual endowment returns to offer a plausible explanation for MIT, Stanford, and Michigan’s spectacular FY25 results. The evidence points to AI and digital-asset themes.

Our analysis shows how portfolio construction, pacing, and governance created a resilient “Switzerland” profile – and what others can emulate.

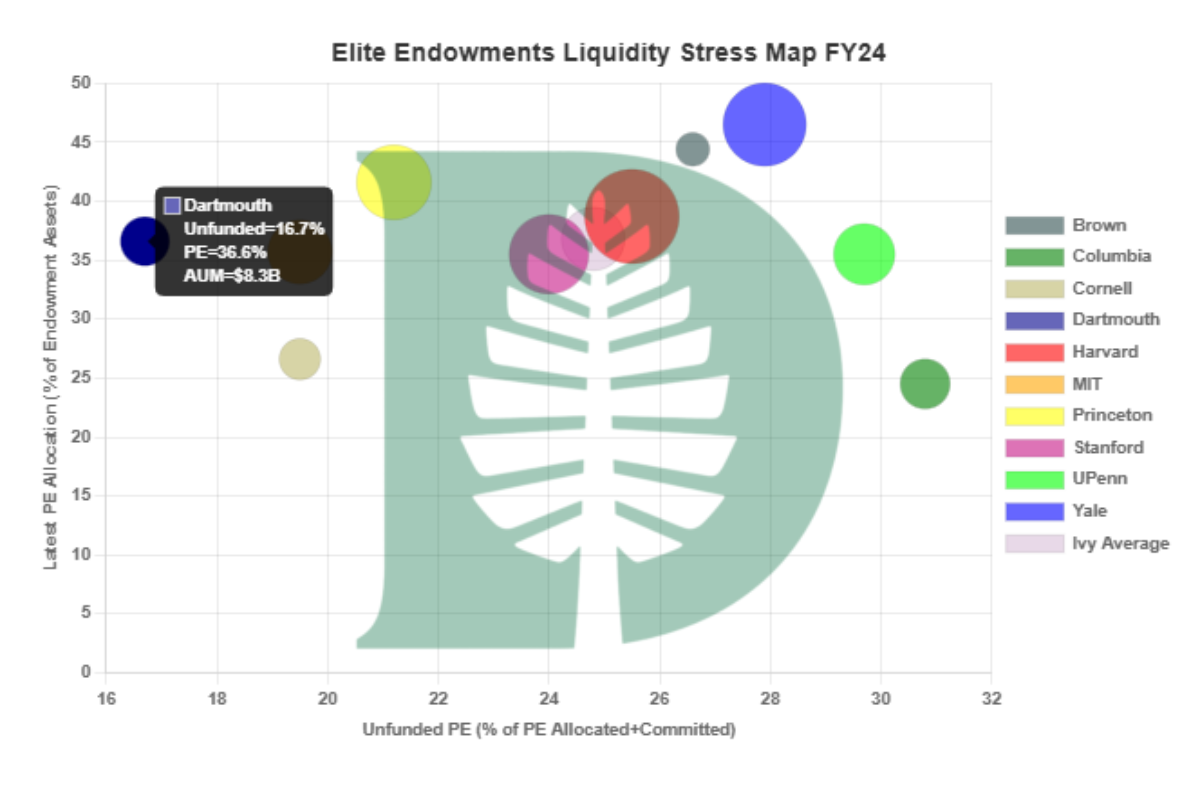

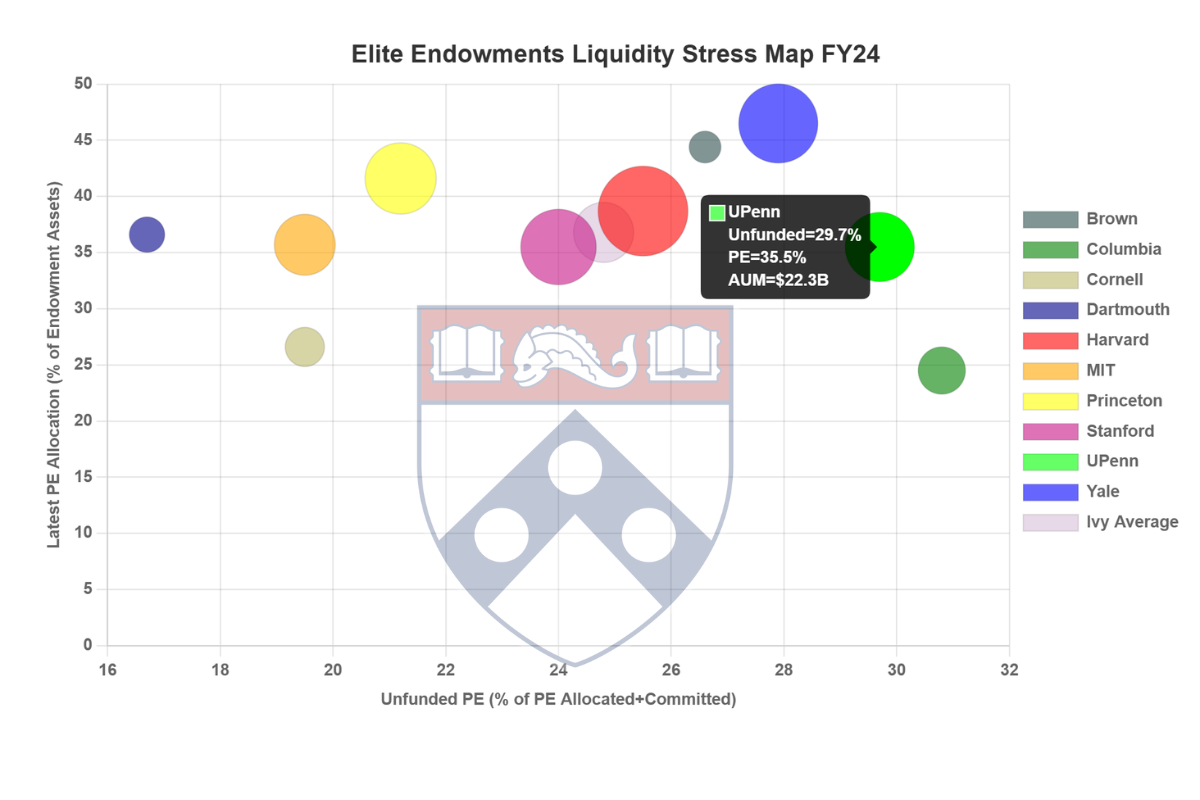

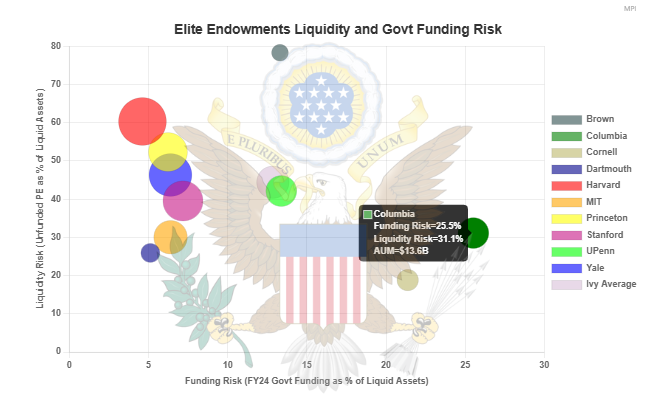

According to our analysis, UPenn’s liquidity problem is real—but somewhat different from those faced by other elite schools. Dartmouth emerges as the most resilient to cash flow pressures.

Liese Klein, a reporter for CTInsider, interviews MPI CEO Michael Markov and Tim Yates, President and CEO of Commonfund Asset Management, to gain insight into the implications of Yale’s potential sale of “a major chunk of its private equity holdings.” While some may view the move as a routine rebalancing, the article highlights liquidity issues within the endowment portfolio, as revealed by MPI research.

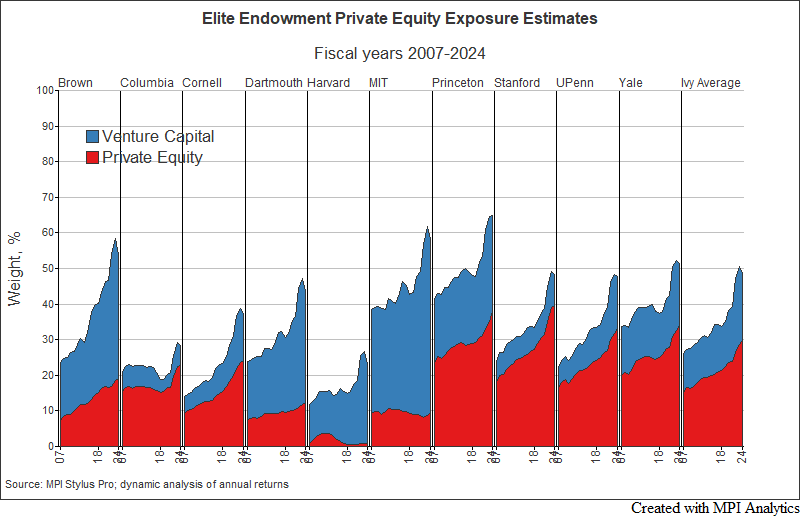

“Political pressure is only part of a “perfect storm” currently impacting major private equity investors like Ivy League universities, said Michael Markov, CEO of quantitative analysis firm Markov Processes International. The company researches financial data on major university endowments to identify trends as part of its analysis of institutional investor strategy. Private equity returns have been down since 2022 as deals have lagged, with profits down to one-third of their former levels in some cases. Trump’s actions are adding to a liquidity squeeze as universities seek to continue operating… They needed a push from the White House to realize that they’re sitting on a time bomb,” Markov said. ” Click here to read full article.

The cover article of Institutional Investor, “Yale’s Potential PE Sale Won’t Solve Liquidity Challenges,” provides an analysis of the school’s rationale behind its $6 billion sale in the secondaries market. James Comtois offers a detailed account of financial challenges facing the endowment, using MPI endowment liquidity analysis framework and quoting MPI CEO.

Federal funding cuts could impose significant financial strain on elite universities. One key factor in determining a university’s resilience to such funding disruptions is the liquidity of its endowment.

Ivy endowment Fiscal 2024 in review: risks; VC; long-term vs recent years; prospects of Yale Model.

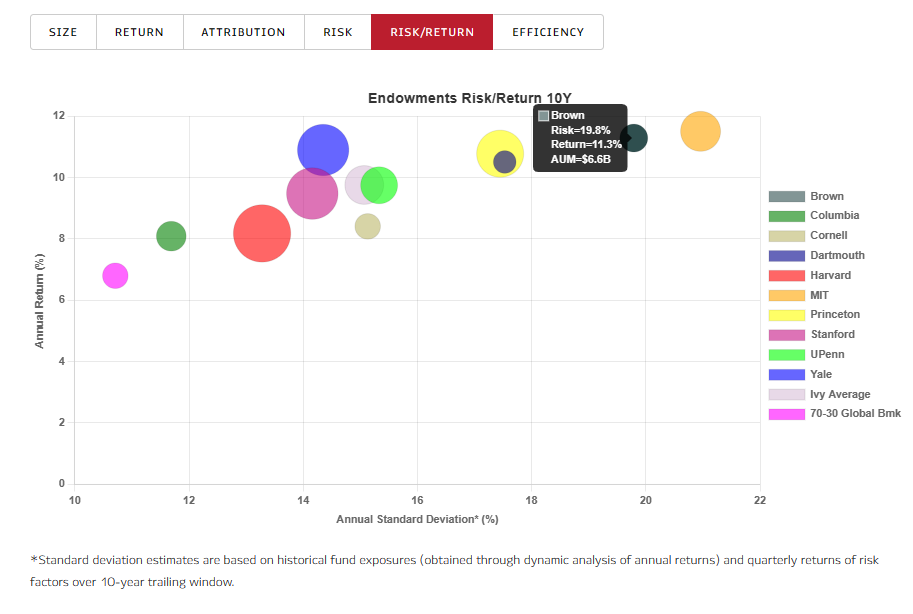

Ivy and elite endowments did poorly in fiscal year 2023, especially relative to a global 70/30 benchmark and smaller, less resourced endowments that invest in less private markets assets/funds than those employing the ‘Yale model’.

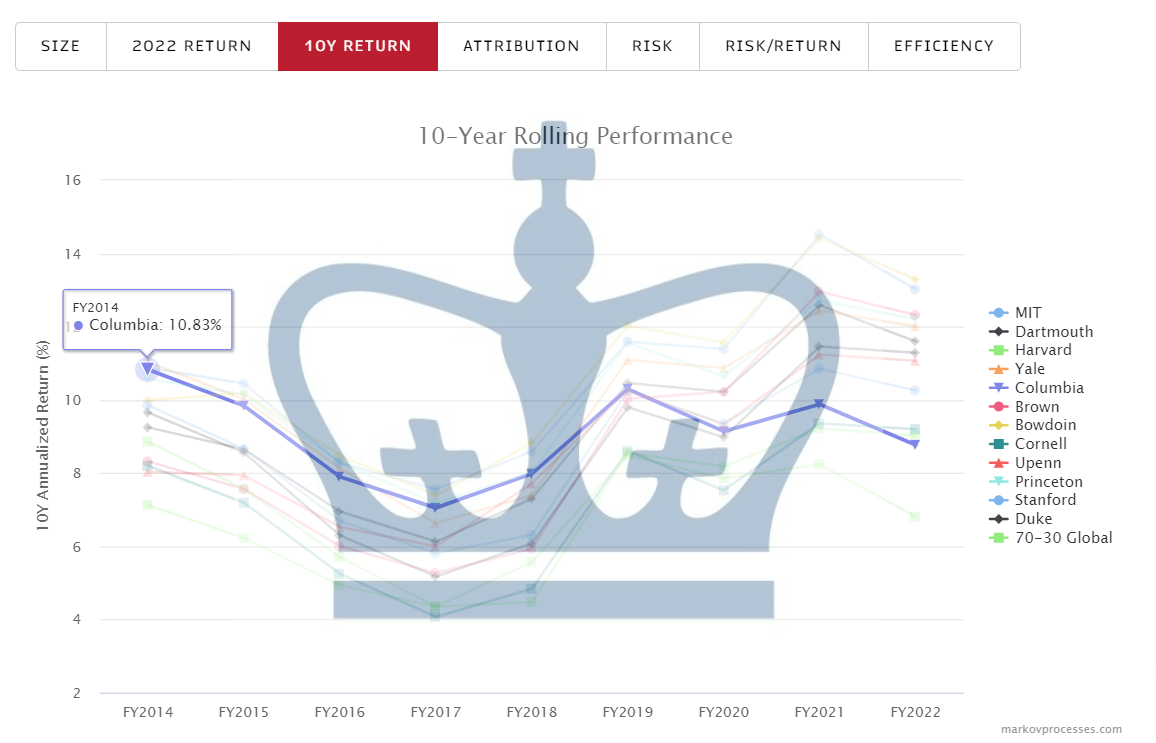

About eight years ago, Columbia University’s endowment had a 10-year return that was one of the best in class, together with MIT and Yale.

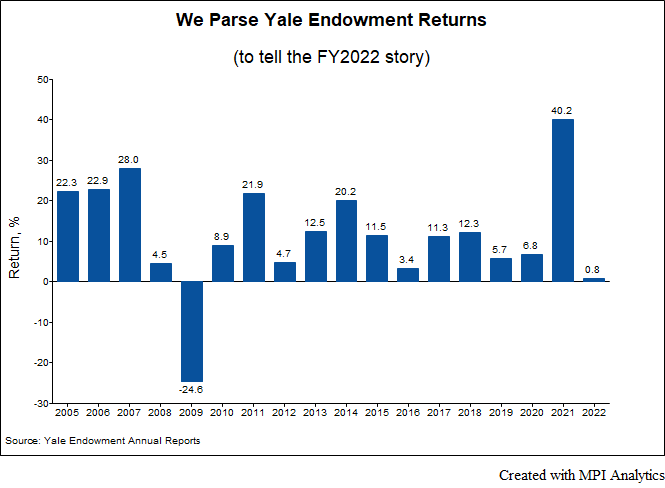

Yale’s been cutting private equity and real estate for years to stay liquid. Did they cut too much, or did they find the right balance for FY2022?