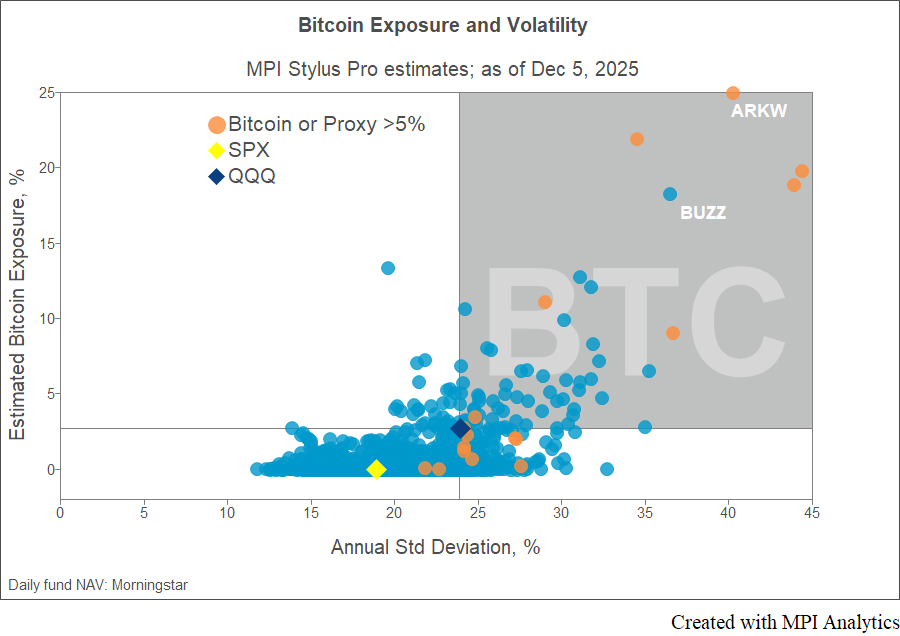

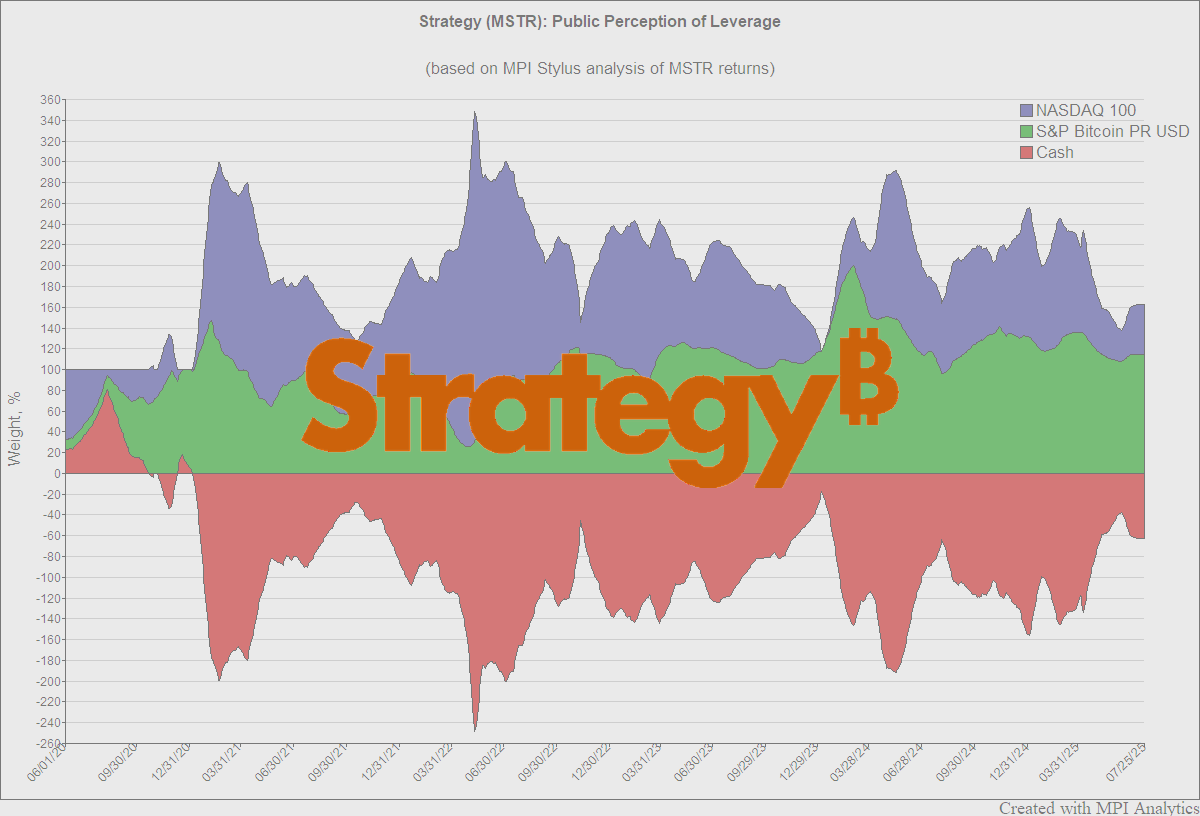

Mapping hidden Bitcoin exposure across 1,500+ mutual funds and ETFs using returns-based analysis.

Mapping hidden Bitcoin exposure across 1,500+ mutual funds and ETFs using returns-based analysis.

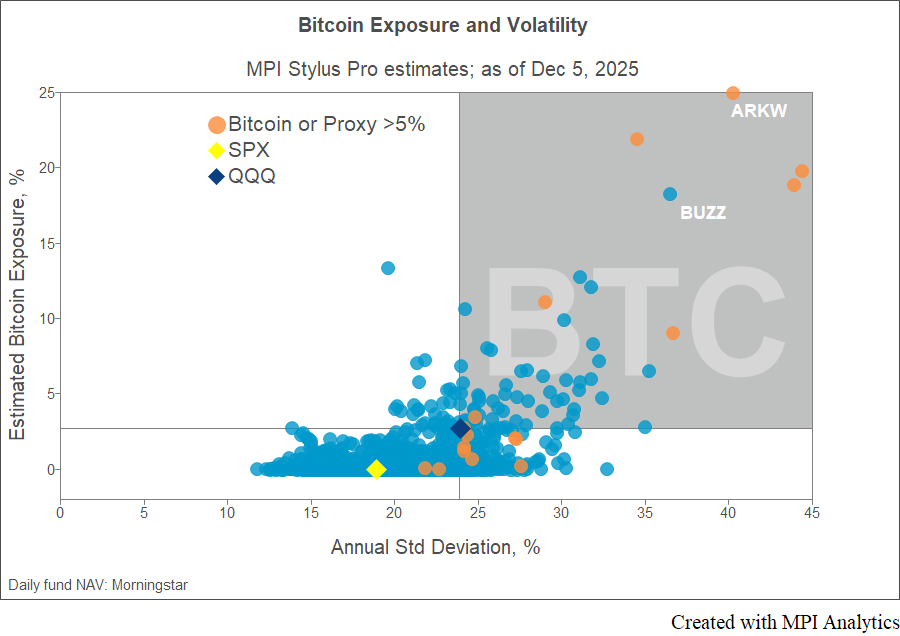

We analyze annual endowment returns to offer a plausible explanation for MIT, Stanford, and Michigan’s spectacular FY25 results. The evidence points to AI and digital-asset themes.

Using its proprietary Stylus Pro software, MPI shows that concentrated exposure to these areas is a plausible source of superior performance at Michigan, MIT and Stanford, among other schools.

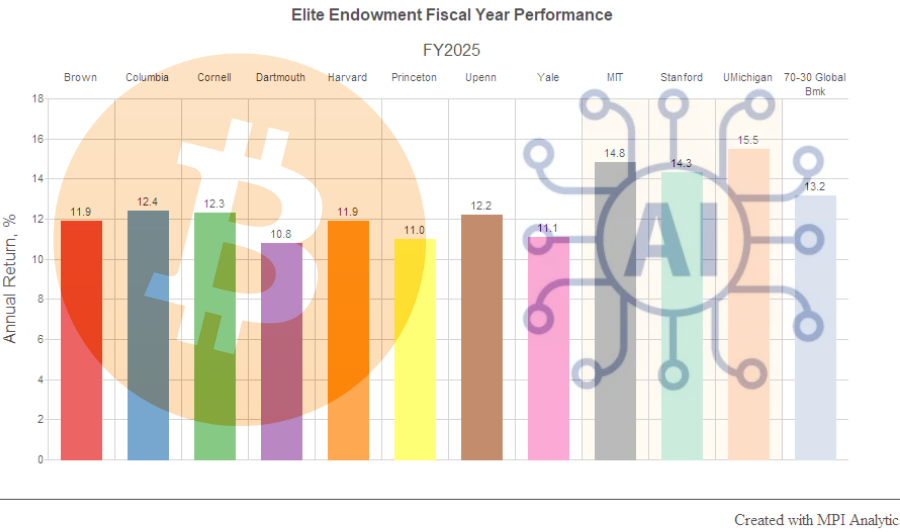

Our Stylus Pro system is normally used by large multi strat hedge funds to x-ray traders’ P&L. Here we decided to x-ray the daily stock price of the largest holder of Bitcoin.

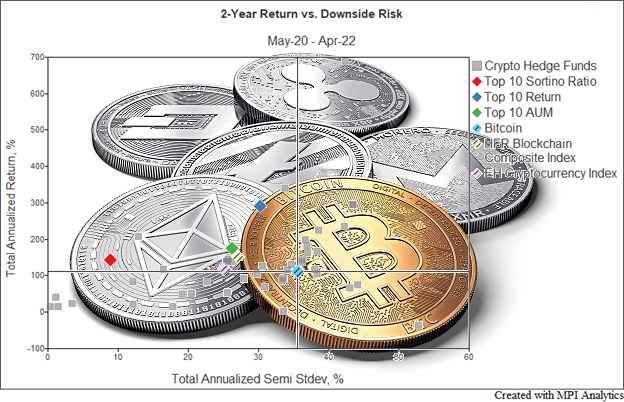

We look at the universe of active crypto hedge funds and observe that by and large they delivered on the promise… at least the ones that survived so far.

Investors – and the Feds – need to focus less on specific stories like MicroStrategy’s Bitcoin exposure, and more on how big the systemic risk picture may be for all of us.