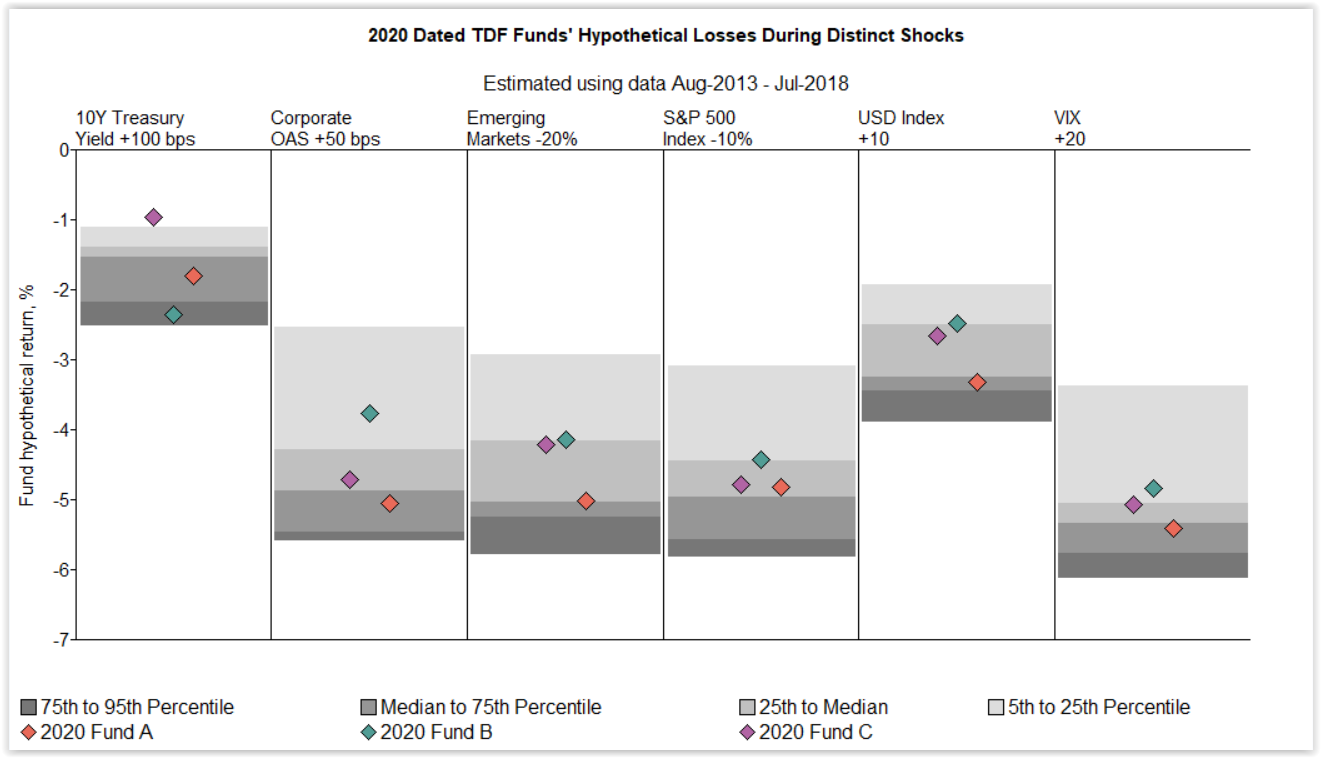

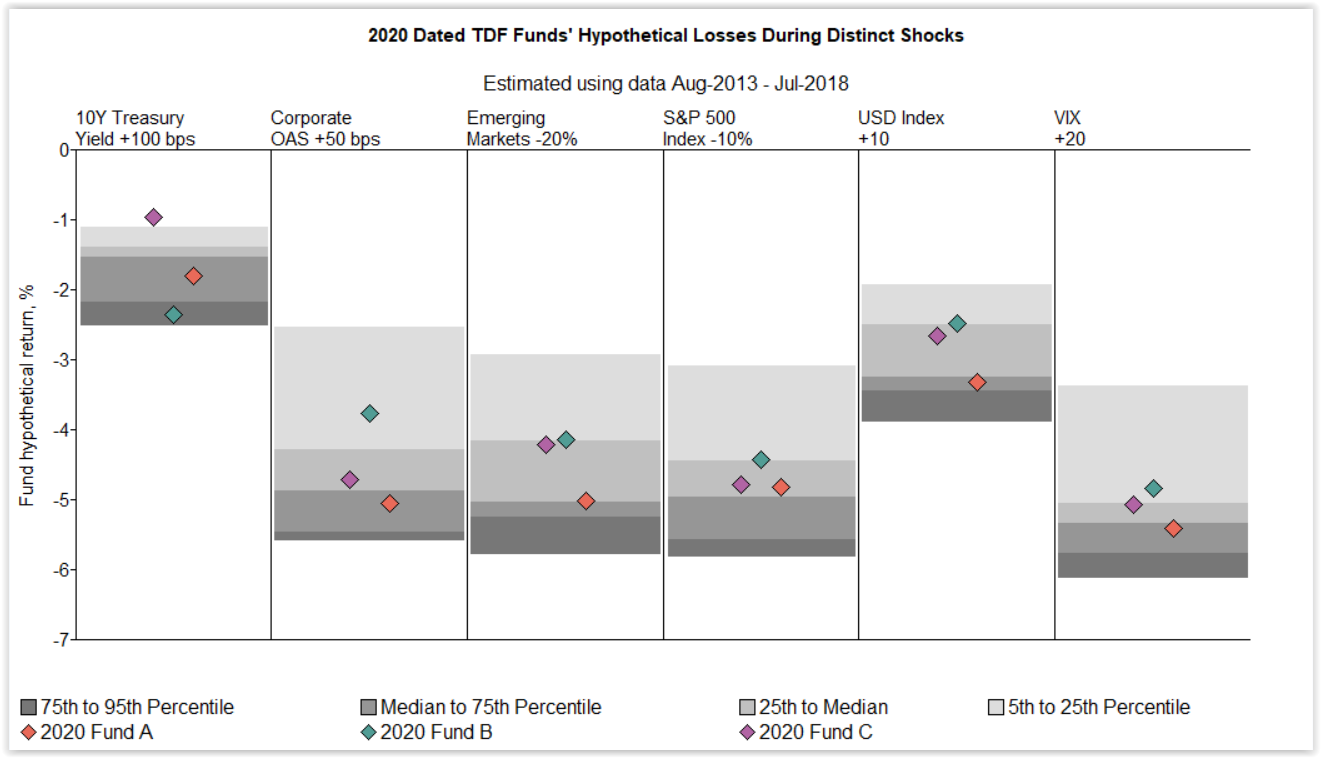

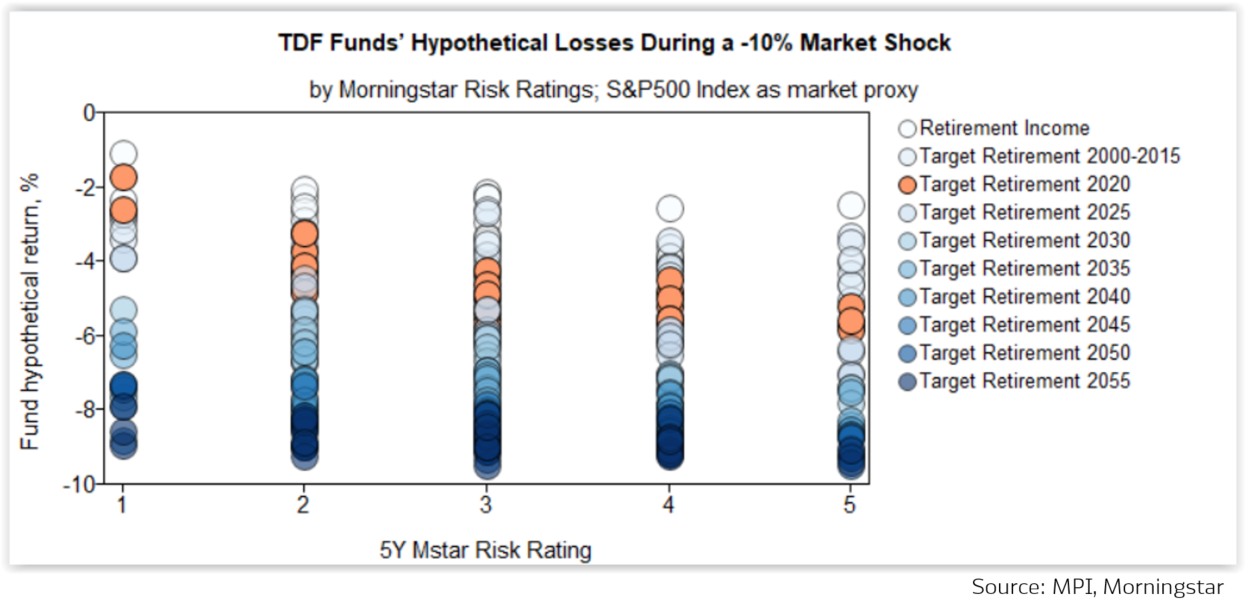

In this post, our research team demonstrates how scenario analysis can highlight different risk sensitivities among same-vintage TDFs that could go undetected by traditional risk measures.

In this post, our research team demonstrates how scenario analysis can highlight different risk sensitivities among same-vintage TDFs that could go undetected by traditional risk measures.

In this post, our research team shows how returns-based scenario analysis can be used to enhance traditional portfolio risk analysis by helping to assess potential fund performance through extreme market events.

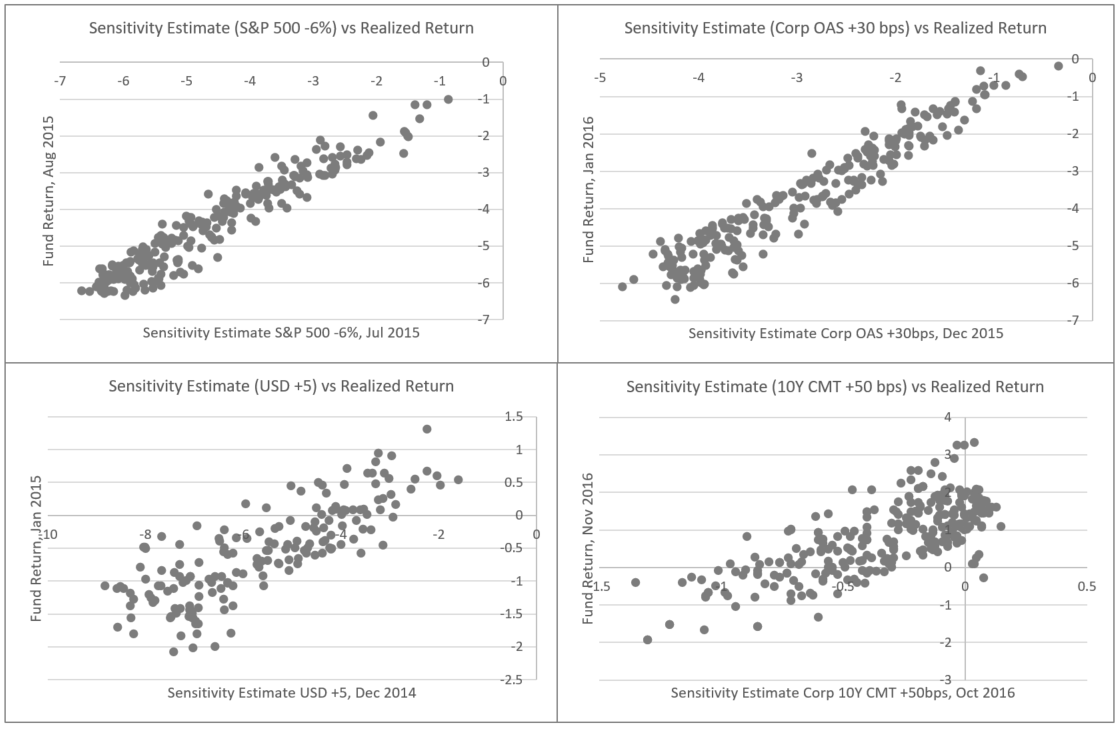

In this post, our research team demonstrates a clever way to backtest forward-looking scenarios commonly used in portfolio risk analysis.

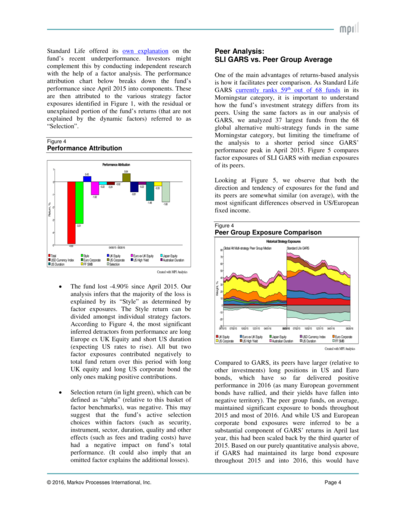

Using Standard Life Global Absolute Return Fund (SLI GARS) weekly performance data, we show how sophisticated factor analysis can provide valuable insights into this fund’s complex global “go anywhere” investment strategy.