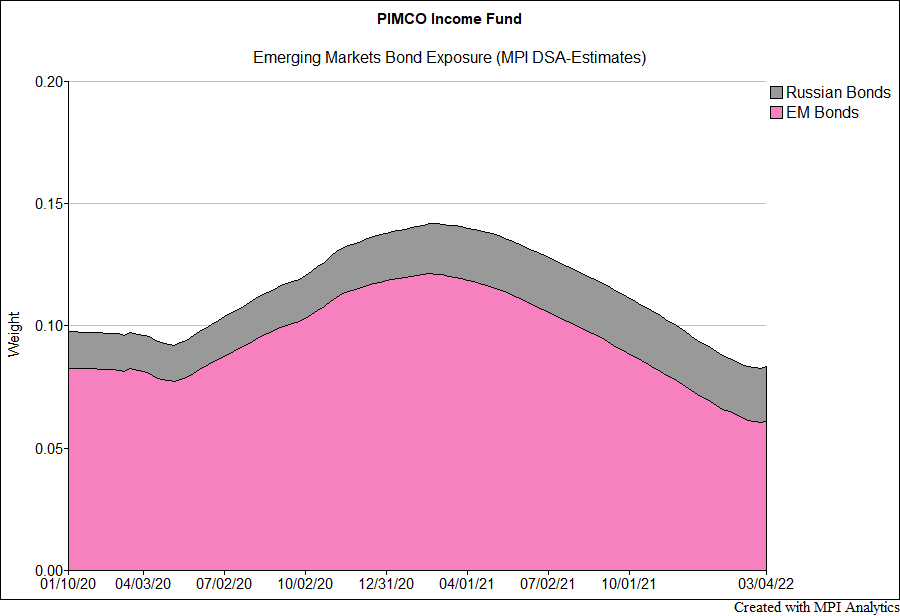

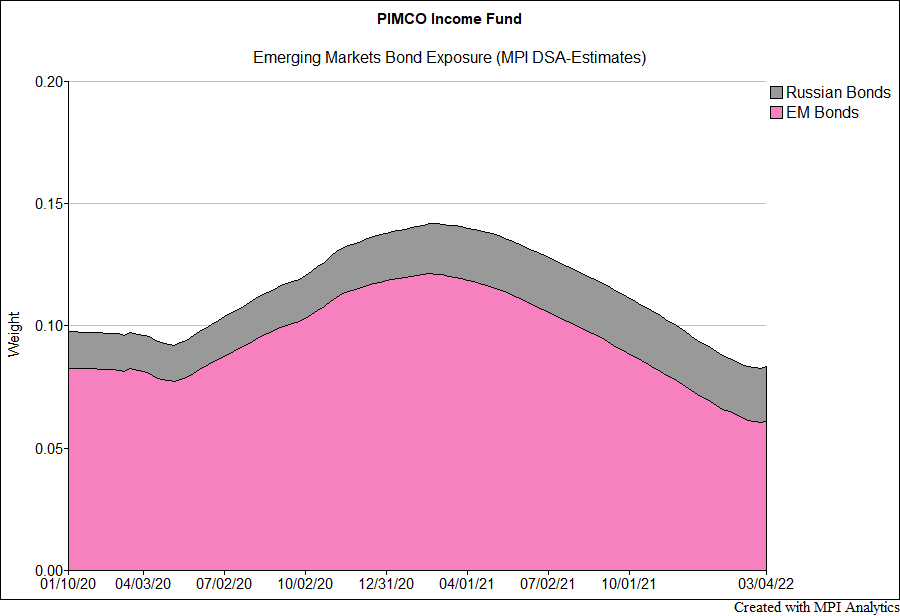

PIMCO Income fund had some of the largest by size exposure to Russian debt. We use quant tools to monitor daily the size and impact of this segment on the fund’s performance from the start of the Russian attack on Ukraine.

PIMCO Income fund had some of the largest by size exposure to Russian debt. We use quant tools to monitor daily the size and impact of this segment on the fund’s performance from the start of the Russian attack on Ukraine.

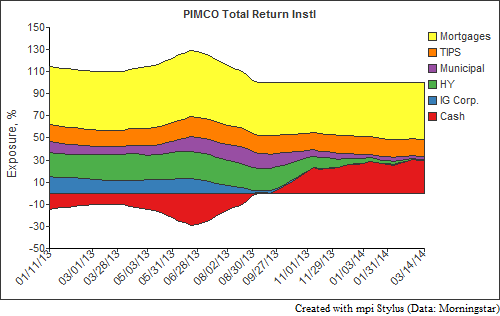

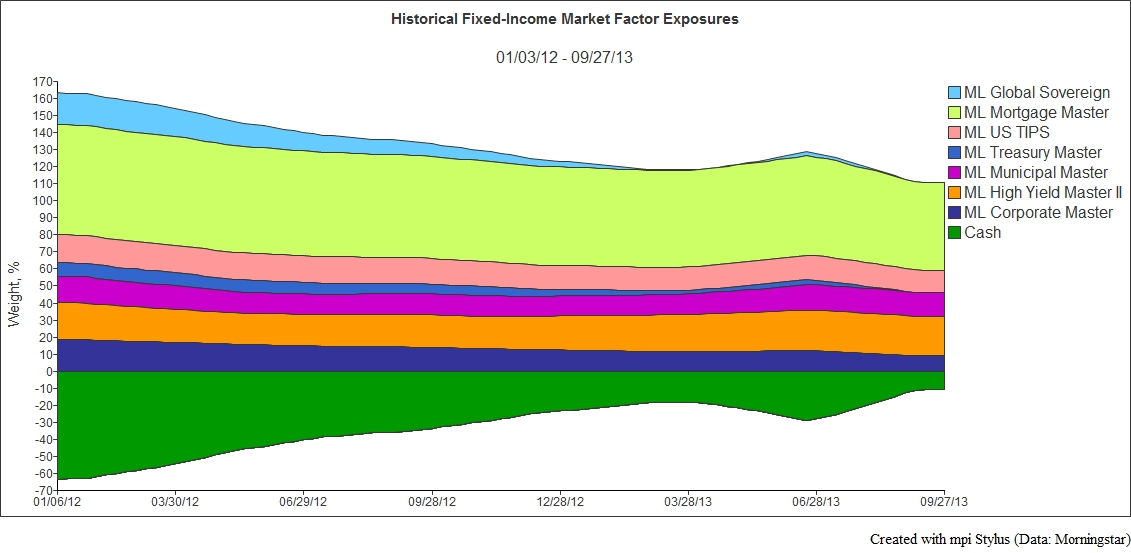

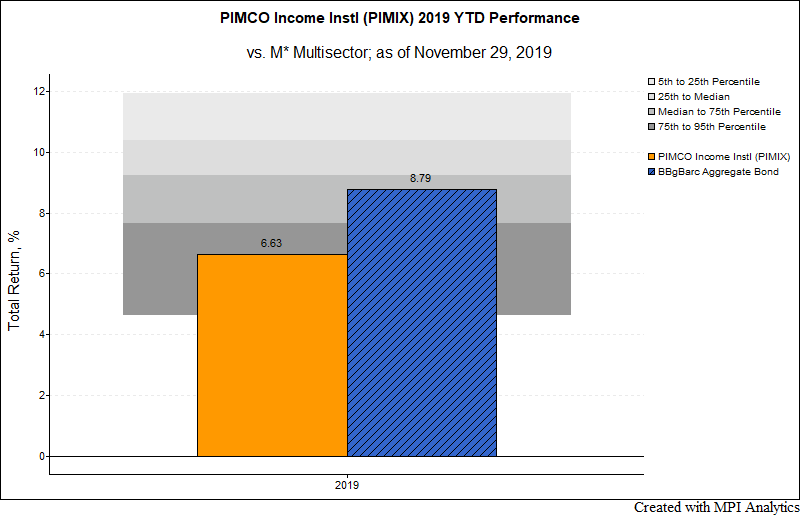

Since its launch in 2007, PIMCO Income Fund has become one of the top-performing US bond funds. However, in 2019 the fund has underperformed both the benchmark and most of its peers. Using this fund as an example, we will demonstrate how advanced returns-based analysis can be used to analyze complex fixed income products without delving into volumes of complex holdings.

Webcast: December 18, 2019

Over the past 10 years, PIMCO Income fund (PIMIX) has been the top performing fund in its category and the only one in the top quartile 10 years running. However, in 2019 the fund has fallen to the bottom quartile.

Using this fund as an example, we will demonstrate how returns-based analysis can be used to analyze complex fixed income products without delving into volumes of complex holdings reported with a lag.

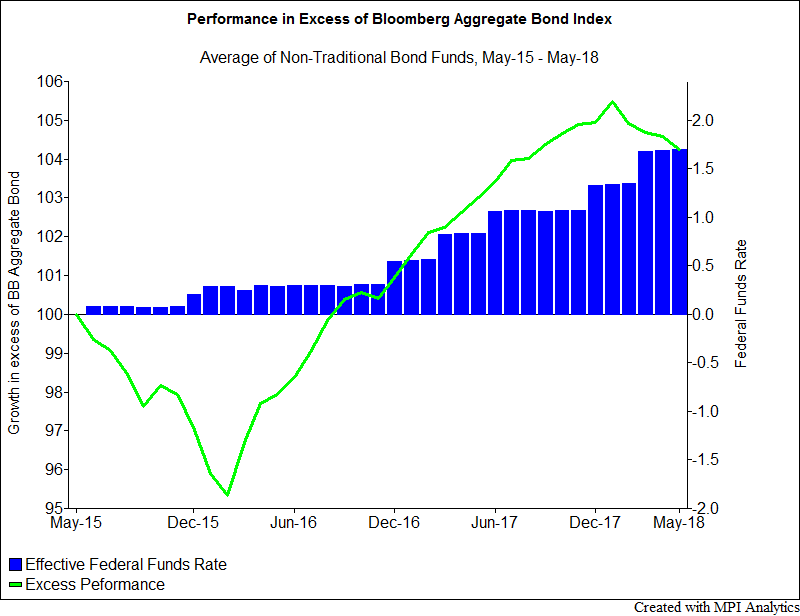

After years of underperformance following the financial crisis, the non-traditional bond fund segment is beginning to shine, outperforming the broader market index in the face of rising rates.