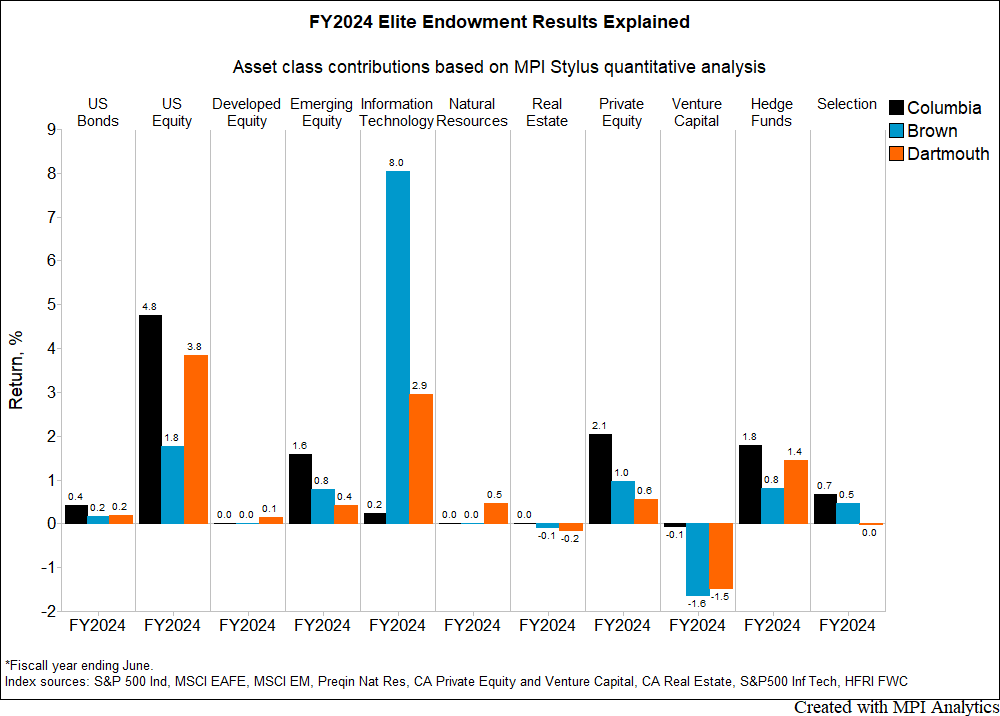

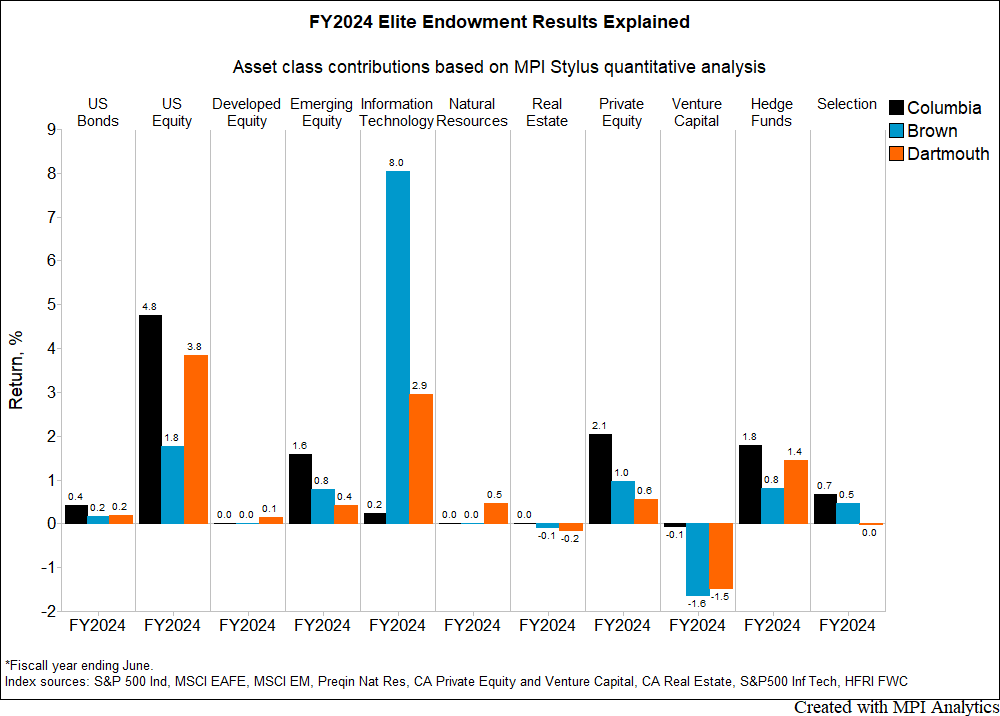

With Mag 7 stocks trouncing VC and Private Markets trailing in FY2024, Columbia and Brown lead Ivy endowments but with vastly different risk and exposures

With Mag 7 stocks trouncing VC and Private Markets trailing in FY2024, Columbia and Brown lead Ivy endowments but with vastly different risk and exposures

Ivy and elite endowments did poorly in fiscal year 2023, especially relative to a global 70/30 benchmark and smaller, less resourced endowments that invest in less private markets assets/funds than those employing the ‘Yale model’.

MPI is continuing its long tradition of bringing you special insights into the true drivers of endowment performance and risk. Stay tuned for the launch of our new Endowments research hub, and exciting daily updates throughout the FY2022 reporting season.

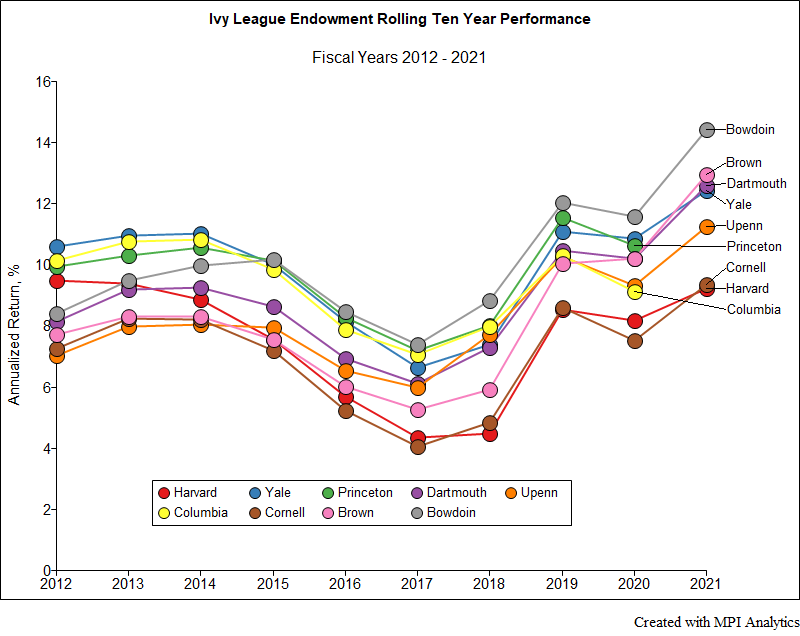

Bowdoin College Endowment has been outperforming all Ivies on a 10-year basis since 2015 with its latest FY2021 result bringing it to 14.4%, an almost impossible number to beat.

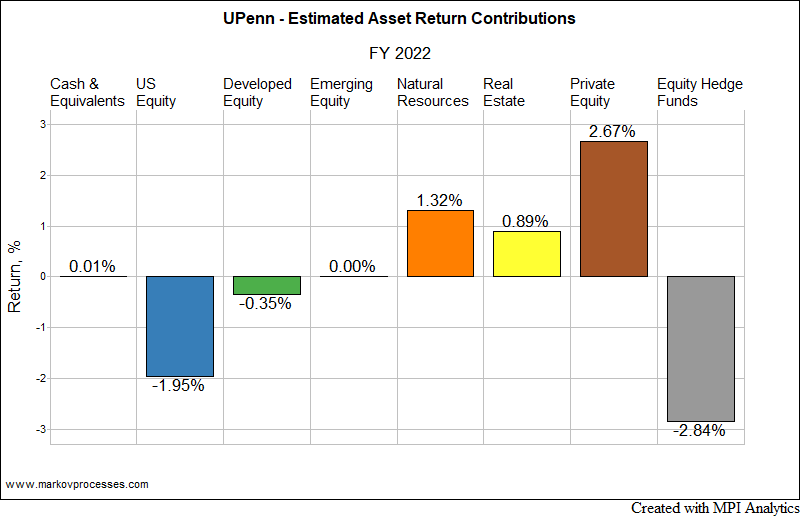

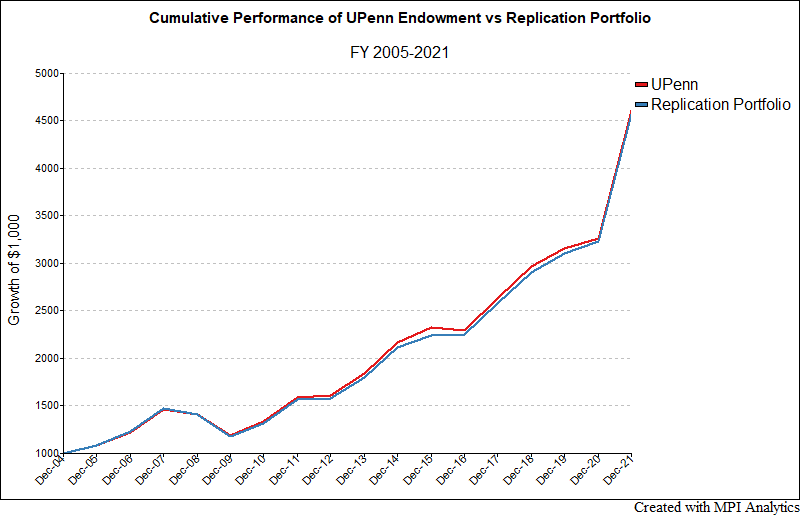

UPenn’s $20.5 Billion endowment posted a return of 41.1% for FY 2021, driven by strong returns in private equity and venture capital.

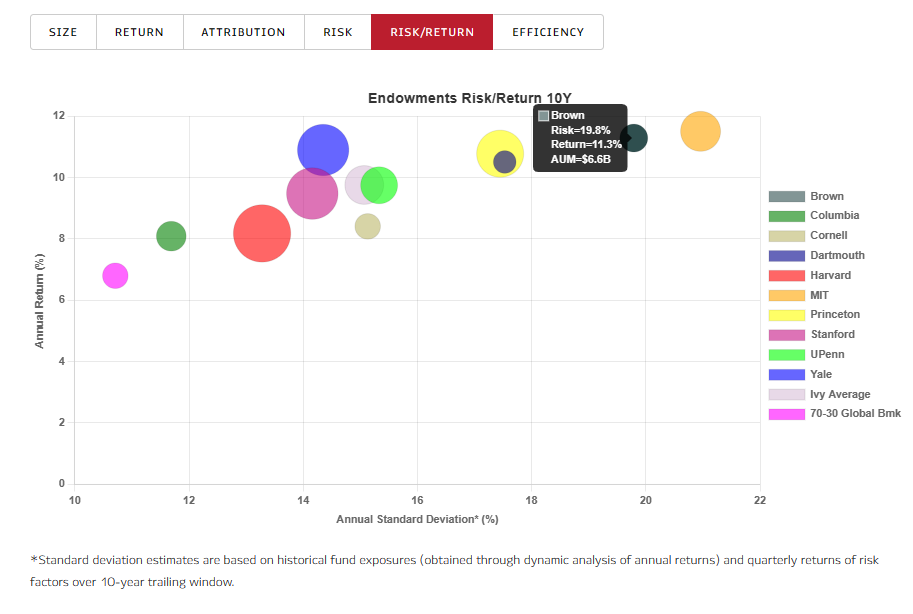

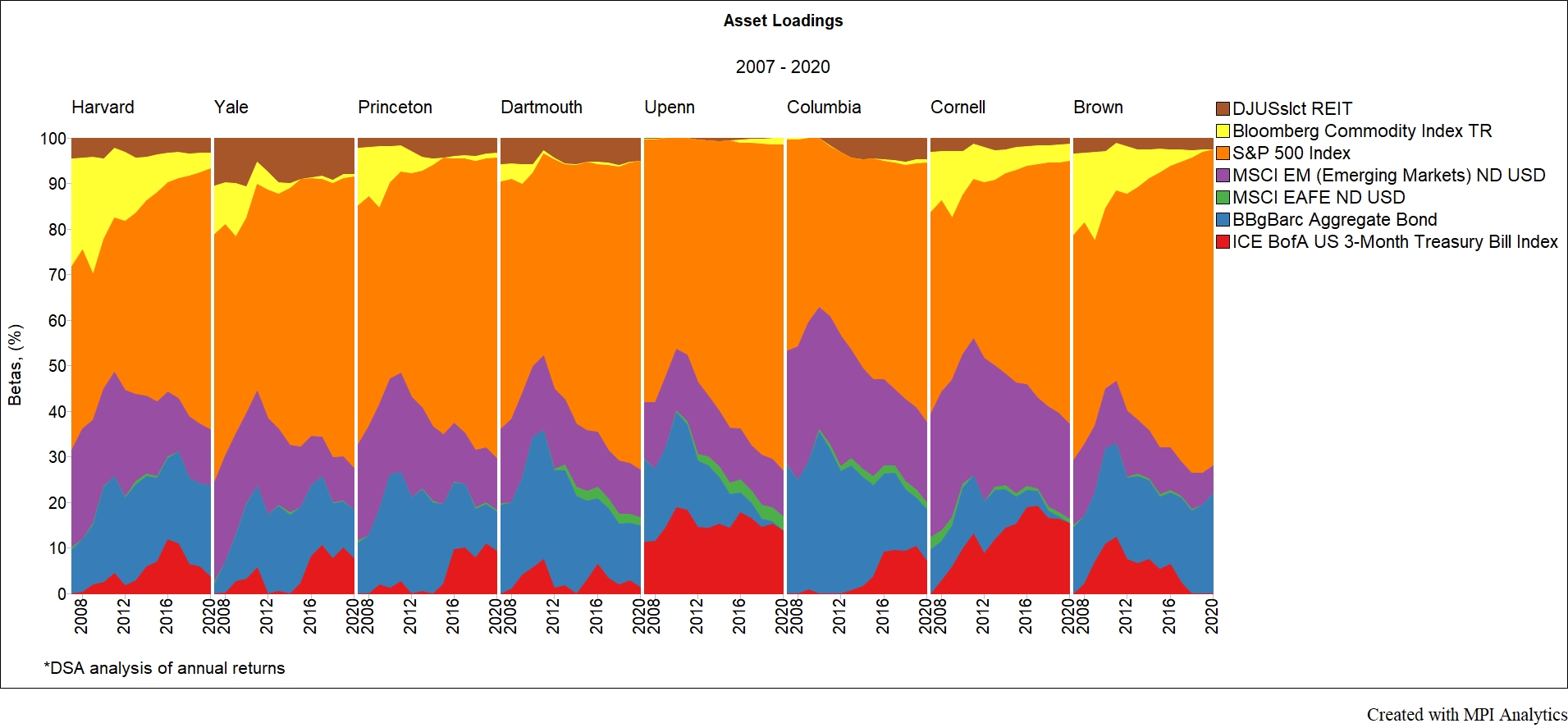

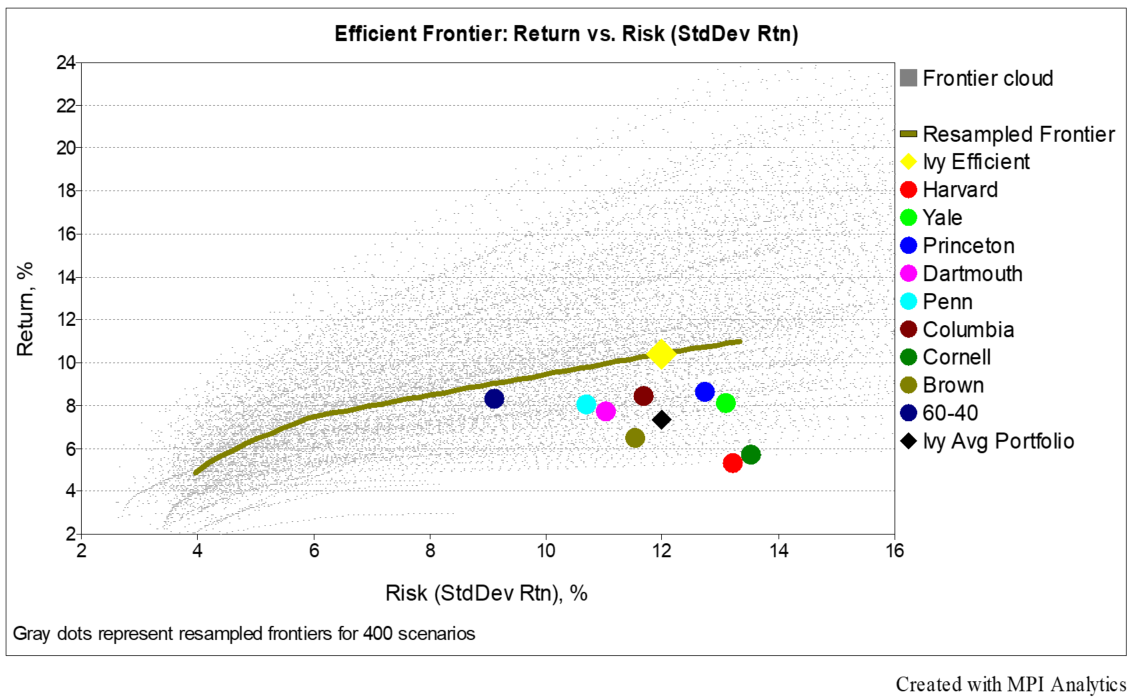

Lessons (not) learned: our analysis shows Ivies are at pre-GFC levels of risk

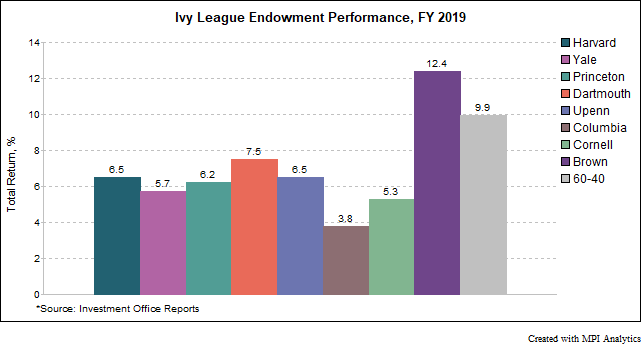

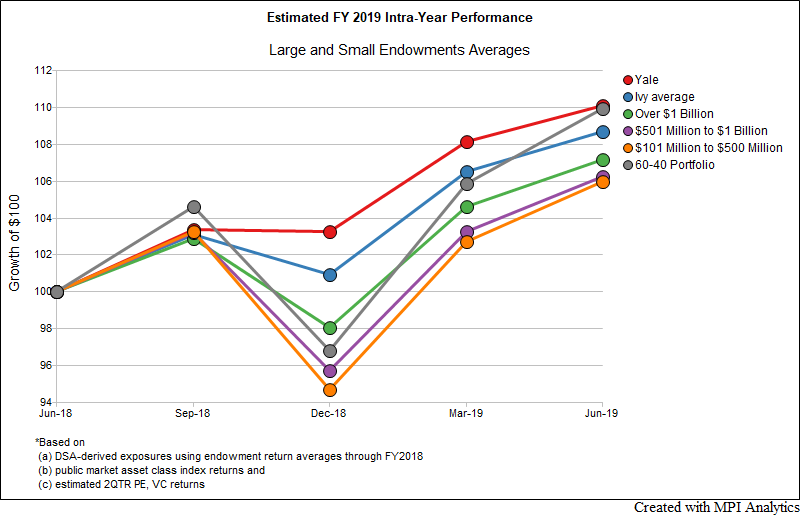

Fiscal year 2019 was a curious year for the Ivy League endowments. In a year with strong returns in key private market investment classes, the average Ivy underperformed a traditional domestic balanced 60-40 portfolio in FY 2019. Ivies also experienced a wider dispersion of returns and saw a shift in the historical positioning of performance leaders and laggards.

Using our analytical tools and publicly available endowment annual performance data, we project FY2019 performance of large and small endowments, as well as the Ivy League average and Yale

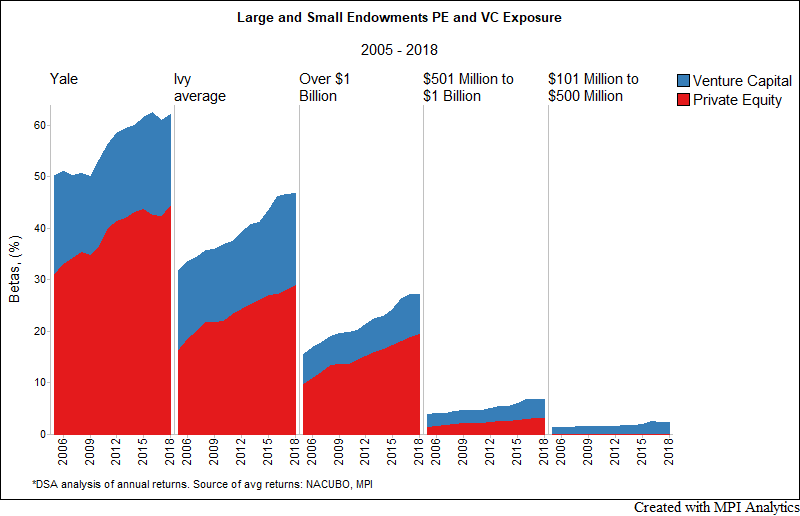

We sought to examine the relationships between endowment size, pedigree and exposure to private assets and what impact that may have on portfolio risk using advanced quantitative methods and a cutting edge methodology to better model the true behavior and risk profile of private market assets.

The endowment model, and active management in general, has come under increased scrutiny, while indexed, or passive, products have grown in popularity and number. Regardless of where you stand on that debate, it’s hard to deny that the Ivies approach to asset allocation has been very good.