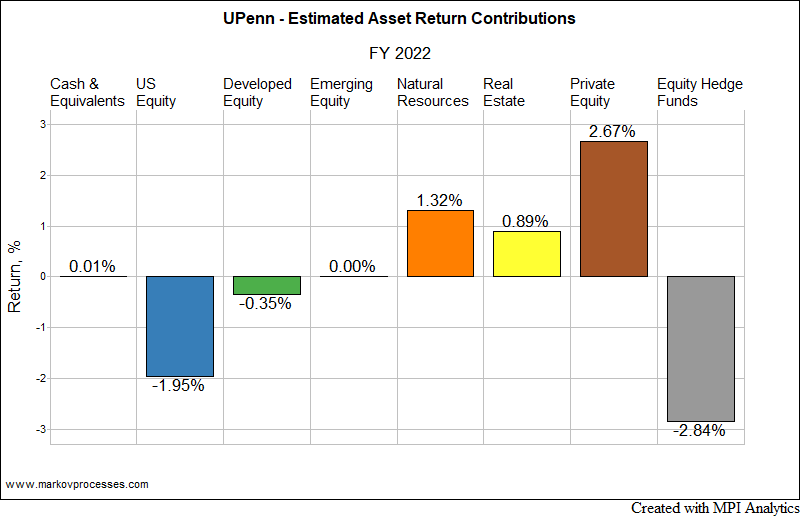

MPI is continuing its long tradition of bringing you special insights into the true drivers of endowment performance and risk. Stay tuned for the launch of our new Endowments research hub, and exciting daily updates throughout the FY2022 reporting season.