Should Institutional Investors be Selling Market Crash Insurance? Do they Know They Are?

We use Allianz Structured Alpha hedge fund as an illustration to demonstrate how investors could apply quantitative techniques to assess potential risks of complex volatility strategies.

This article is a continuation of MPI Quantitative Research series focusing on hedge fund strategies during the COVID market crisis: Risk Parity, Renaissance RIEF, Infinity Q

Are You Buying or Selling a Tail Risk Insurance?

The concept of fire insurance is familiar to most as a contract where one pays a recurring premium in exchange for being able to file a claim with the insurance company to be reimbursed for damages in case of fire. The cash flows associated with this contract are characterized by the insurance company collecting small premium payments every month in exchange for infrequent large payouts in the case of a fire damage claim. A similar return pattern exists in the investment industry in so-called tail risk hedging strategies, designed to protect investors in case of a market sell-off in exchange for a stream of option premiums. One could call such a strategy Market Crash Insurance due to the large payouts that tend to coincide with large equity losses. But why would an institutional investor take the other side and actually sell tail risk insurance? Do they even know they are? It seems obvious that selling Market Crash Insurance would serve to exacerbate an equity portfolio’s losses in a tail risk event, not to hedge them.

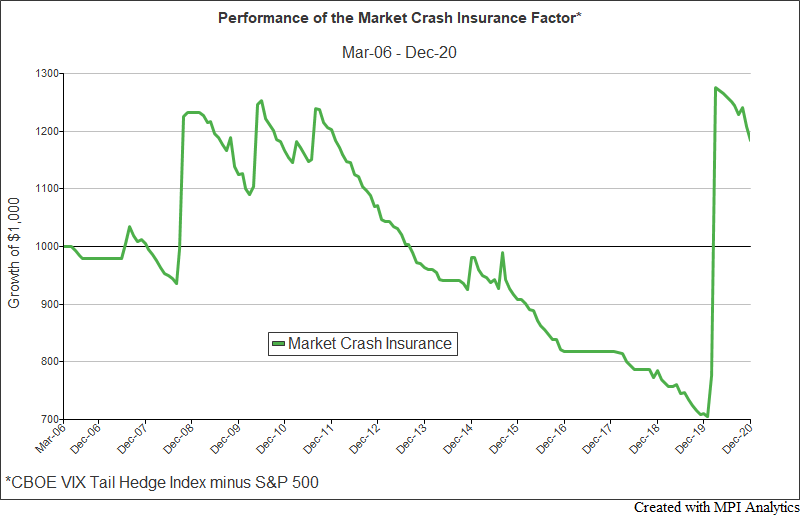

Building the Market Crash Insurance Factor

To demonstrate how this works, we construct a Market Crash Insurance factor by subtracting S&P 500 Index returns from the CBOE VIX Tail Hedge index (VXTH) to extract the tail hedge portion of the index, consisting of out-of-the money VIX options. It is evident from the chart below that a steady stream of option premium payments accumulated between the market downturns such as GFC (2008) and COVID (2020) to “collect the insurance” at the time of the crisis. So, it’s a reasonable strategy to invest in for an institution to protect their core assets.

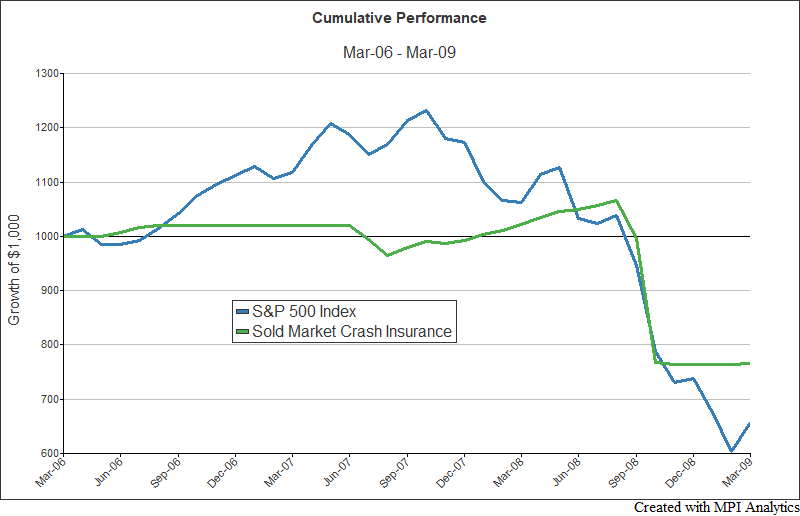

What happens if someone sells such a protection? For that we need to simply reverse the sign of the Market Crash Insurance index. Below we plot this factor (which we call “Sold Market Crash Insurance”) along with the S&P 500, it’s evident that from March 2006[1] to June 2008, the returns looked like they shared very little in common. In fact, when the S&P 500 experienced losses between September 2007 and June 2008, the two factors showed a distinctly negative correlation. Then, between August and October of 2008, both factors experienced dramatic losses. Therefore, a portfolio of these two factors served to exacerbate the losses experienced by stocks during the GFC – the exact opposite of the goal of portfolio construction – to reduce portfolio volatility by diversifying across assets whose returns do not move in lock step.

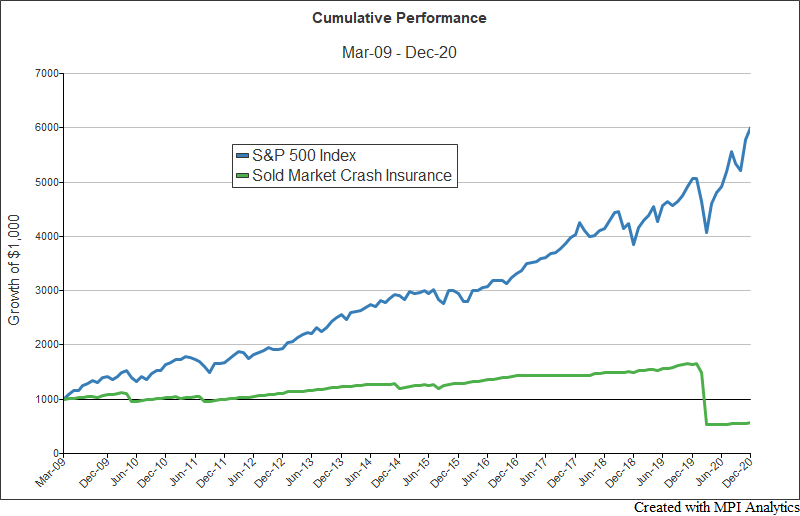

With this background, we can then plot these same factors from the GFC to the present. We see that someone selling tail risk insurance would have received an extremely consistent return premium through the beginning of 2020, approximately 11 years during which the factor returned 65%, or almost 6% annually. Overlaying such a steady stream of returns over the S&P 500 index would have appeared to many investors as the desirable “alpha” because the factor added little volatility to the portfolio and a significant return premium.

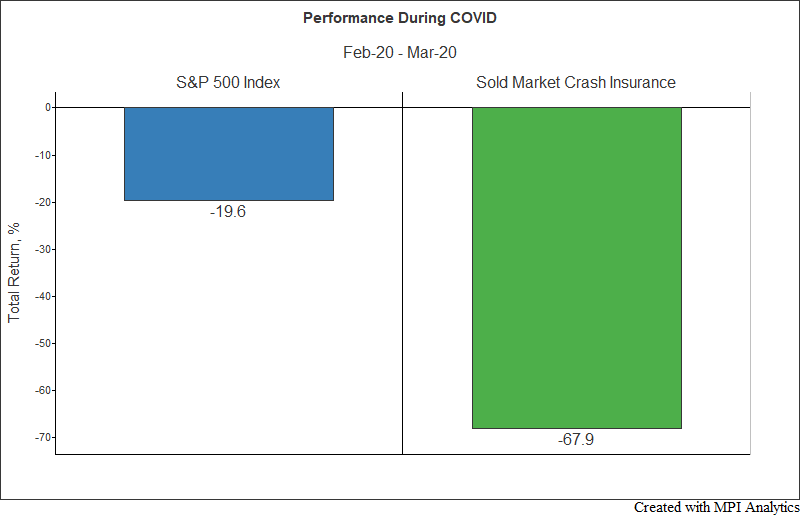

But this excess return would not represent your typical finance textbook alpha. Instead, it would represent a stream of option premiums from a portfolio of sold out-of-the money VIX options with a negatively skewed return distribution indicating that it is prone to infrequent yet dramatic losses. The risk associated with the 11 years of consistently positive returns was made evident in only two months, February and March of 2020. In these two months alone, this factor lost 67.9%, eclipsing the total return premium generated over the previous 11 years.

Allianz’s Structured Alpha – a Case Study

Market volatility during the COVID crisis resulted in some prominent volatility-trading hedge fund blow ups: Malachite, Parplus Partners, Ronin Capital and Allianz Structured Alpha. The latter is a subject of a recently disclosed DOJ investigation. In addition, Allianz is being sued by a number of pension fund investors. The family of Allianz Structured Alpha products 250, 500, 1000 and 1000 Plus were supposed to “always remain hedged against sharp market downturns” but instead they suffered significant losses ranging from 33% to 70% and upward of 90% depending on the strategy and lost combined $4B in client assets. Following market losses, Allianz liquidated its hedge funds and, in December 2020, the AllianzGI Structured Return Fund Institutional Class (AZIIX) mutual fund as well.

In order to get some insight into the source of the Structured Alpha losses we utilize Dynamic Style Analysis (DSA) included in our MPI Stylus Pro system. Similar to other return-based quantitative techniques, DSA uses only the fund’s return against the returns of market factors to arrive at a factor portfolio that closely tracks the fund’s actual returns. Given that the fund was invested in non-linear instruments, we use “strategy factors” in addition to market factors in our analysis – such as our recent analysis of another volatility-focused strategy Infinity Q fund. The CBOE has a number of options and volatility-based strategy indices and our system identified the VIX Tail Hedge index as having the most predictive value when explaining the Structured Alpha’s returns.

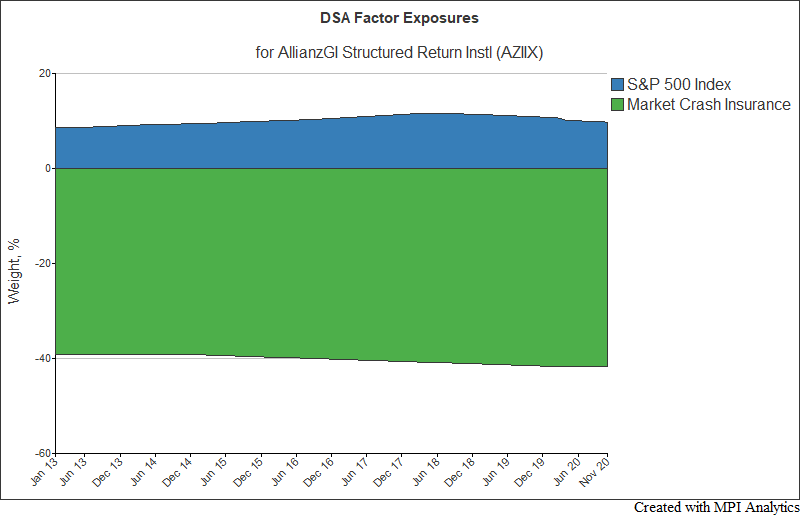

The chart below shows the DSA analysis results of the now liquidated mutual fund AZIIX using just two factors: S&P 500 Index and the Market Crash Insurance factor described earlier (CBOE VIX Tail Hege Index minus S&P 500). It shows that the fund behaved as if it had sold uncovered tail event insurance: consistently short 40% exposure to the Market Crash Insurance and 10% exposure to the market.

It is easy to see that any investor investing with this fund or other funds of the family technically sold market crash insurance in exchange for the steady stream of premiums or “alpha.” The performance of the two-factor portfolio above (blue line in chart below) tracks the fund’s returns (in red) very well including the dramatic loss in the first quarter of 2020.

![]() The fund’s returns were quite consistent prior to 2020 as the majority of the risk the fund appeared to be taking was through the negative exposure to the Market Crash Insurance factor which we have shown to produce consistently positive returns outside of periods of large stock losses.

The fund’s returns were quite consistent prior to 2020 as the majority of the risk the fund appeared to be taking was through the negative exposure to the Market Crash Insurance factor which we have shown to produce consistently positive returns outside of periods of large stock losses.

When markets began to realize the extent to which COVID-19 was going to affect the world’s economies, global stock markets sold off dramatically in February and March of 2020 with the CBOE VIX index reaching into 60s causing collapse of the option portfolio. Our additional analysis of the Allianz Structured Alpha hedge funds shows two to three times the exposure than that of the mutual fund version to the Market Crash Insurance factor, resulting in much higher premiums, albeit much higher losses during the crisis.

Conclusion

Harry Markowitz once said that “diversification is the only free lunch in finance” because it has the potential to lower a portfolio’s risk without sacrificing its expected return. Alpha seems to be another version of a hoped-for free lunch that gets investors salivating: expecting much higher return for seemingly the same amount of risk. However, before sitting down to such a lunch its prudent to make sure that the food is good and that the cashier is not waiting for you at the door with a bill. Alpha can take various forms and quant tools exist to decipher “alpha” as simple leverage (Like That 40% Return? Better Understand Risks First), clever beta (Bridgewater Pure Alpha), potential fraud (Madoff: A Tale of Two Funds) or “manual price adjustments” (Infinity Q: Too Much Alpha). In the case of Structured Alpha, its alpha could be plausibly explained by an attractive steady stream of premiums from the sold market crash insurance.

[1] Inception date of the CBOE VIX Tail Hedge Index

Tail risk is hard to insure. My 7 years with AEGON/Transamerica trying to make institutional investment products arguing with actuaries educated me on this.