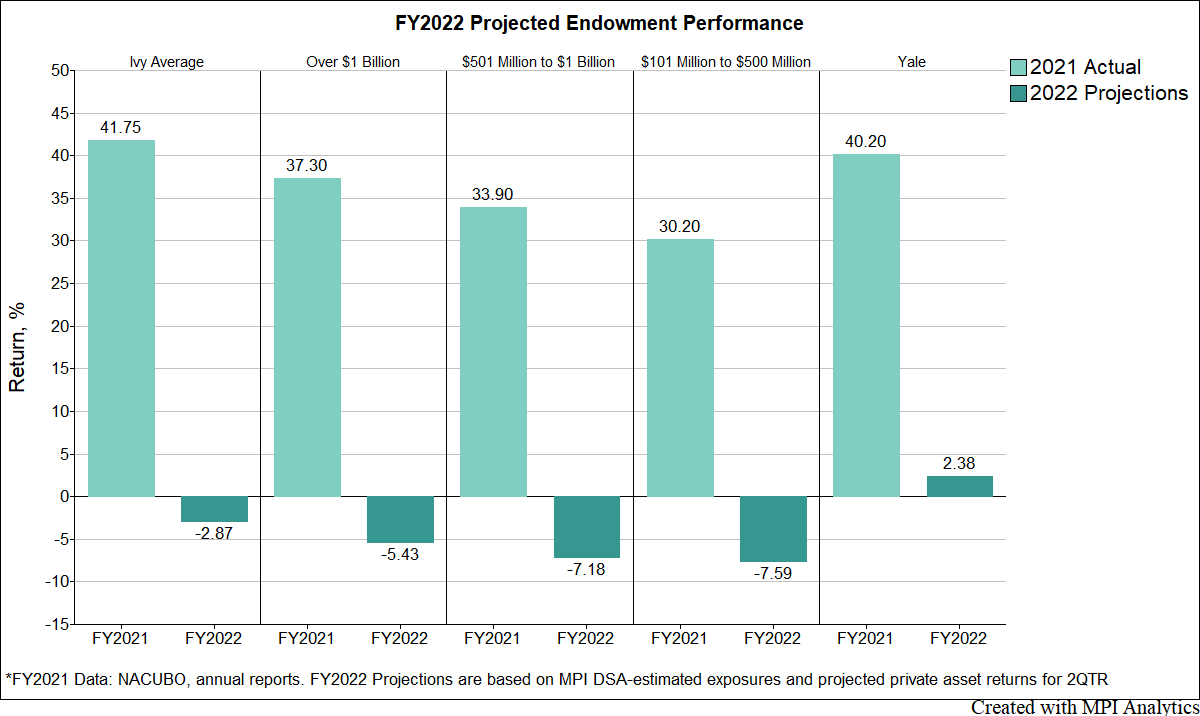

We embarked on a project to estimate 2022 FY performance for Ivies and major US university endowments… weeks before official reports become available.

We embarked on a project to estimate 2022 FY performance for Ivies and major US university endowments… weeks before official reports become available.

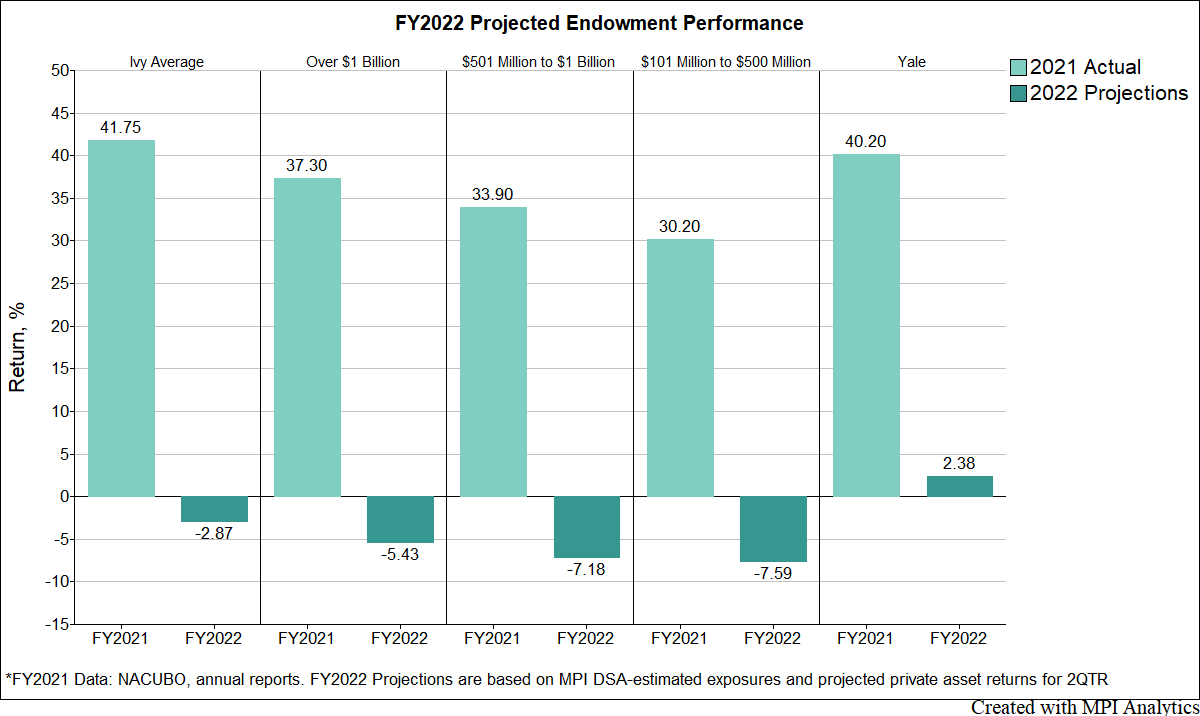

A WSJ article features a fund which outperformed all of the actively managed US stock mutual funds by a large margin. We found its twin ETF from WisdomTree that was spared the accolades. And we use advanced quant techniques to dissect the strategy and its winning bets.

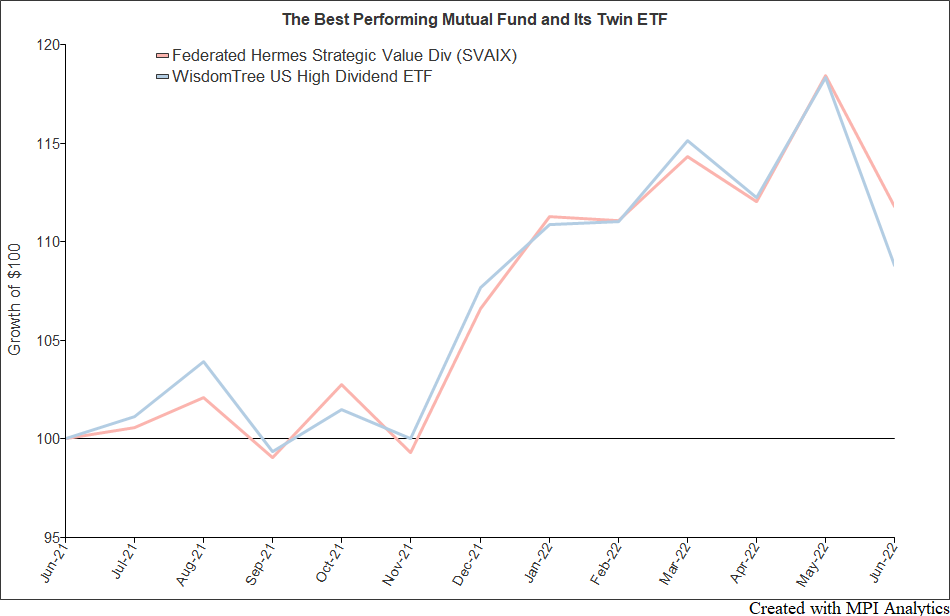

Berkshire Hathaway had exceptional performance so far this year. We use quantitative analysis of its stock returns to provide some clues.

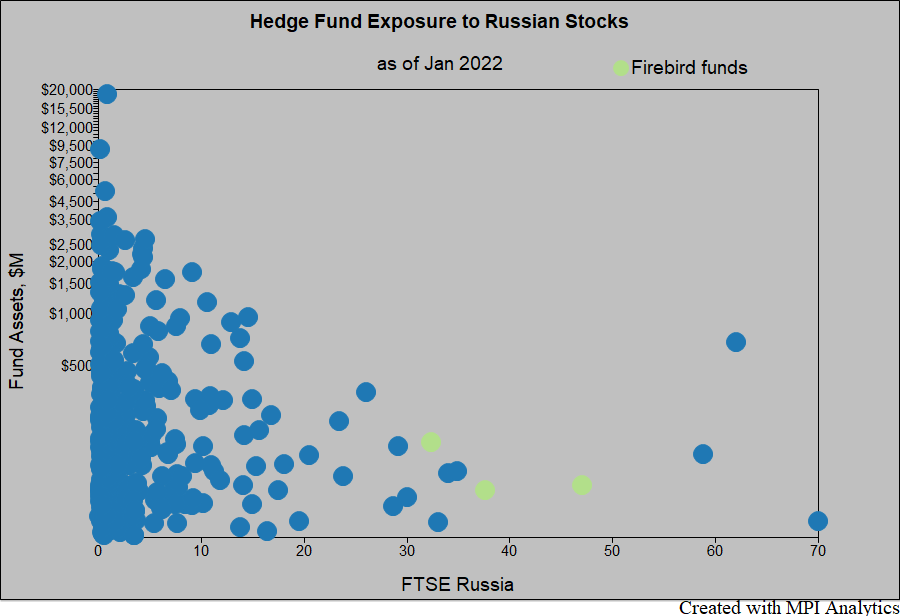

Using MPI’s Dynamic Style Analysis (DSA), we analyzed 600 equity hedge funds to assess their exposure to Russian equities

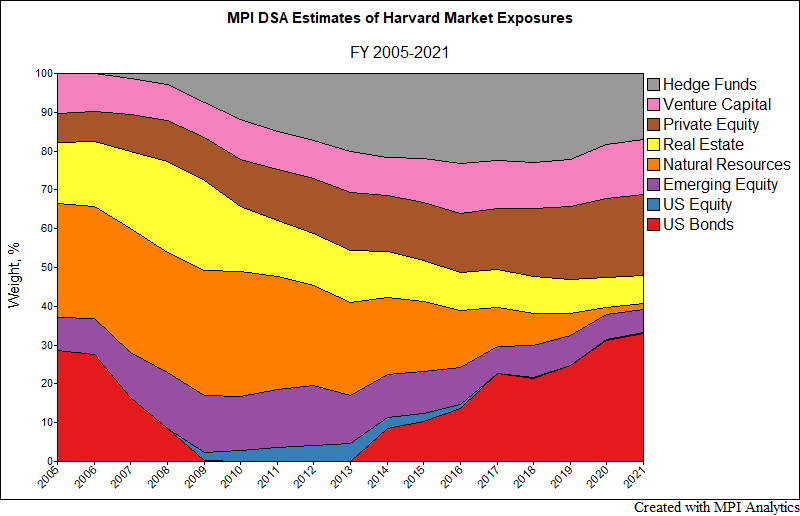

Haunted by the ghosts of 2009, Harvard endowment’s lower risk appetite still pays off with a 33.6% return.

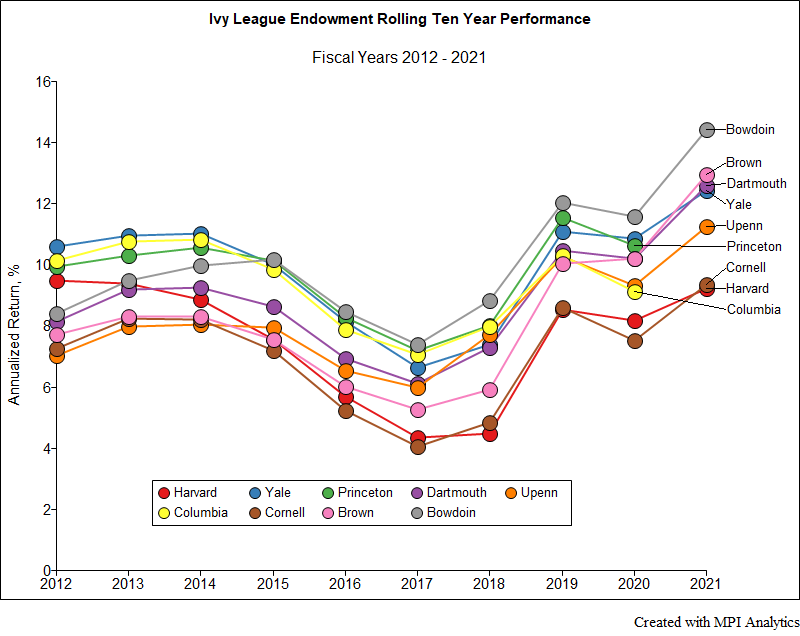

Bowdoin College Endowment has been outperforming all Ivies on a 10-year basis since 2015 with its latest FY2021 result bringing it to 14.4%, an almost impossible number to beat.

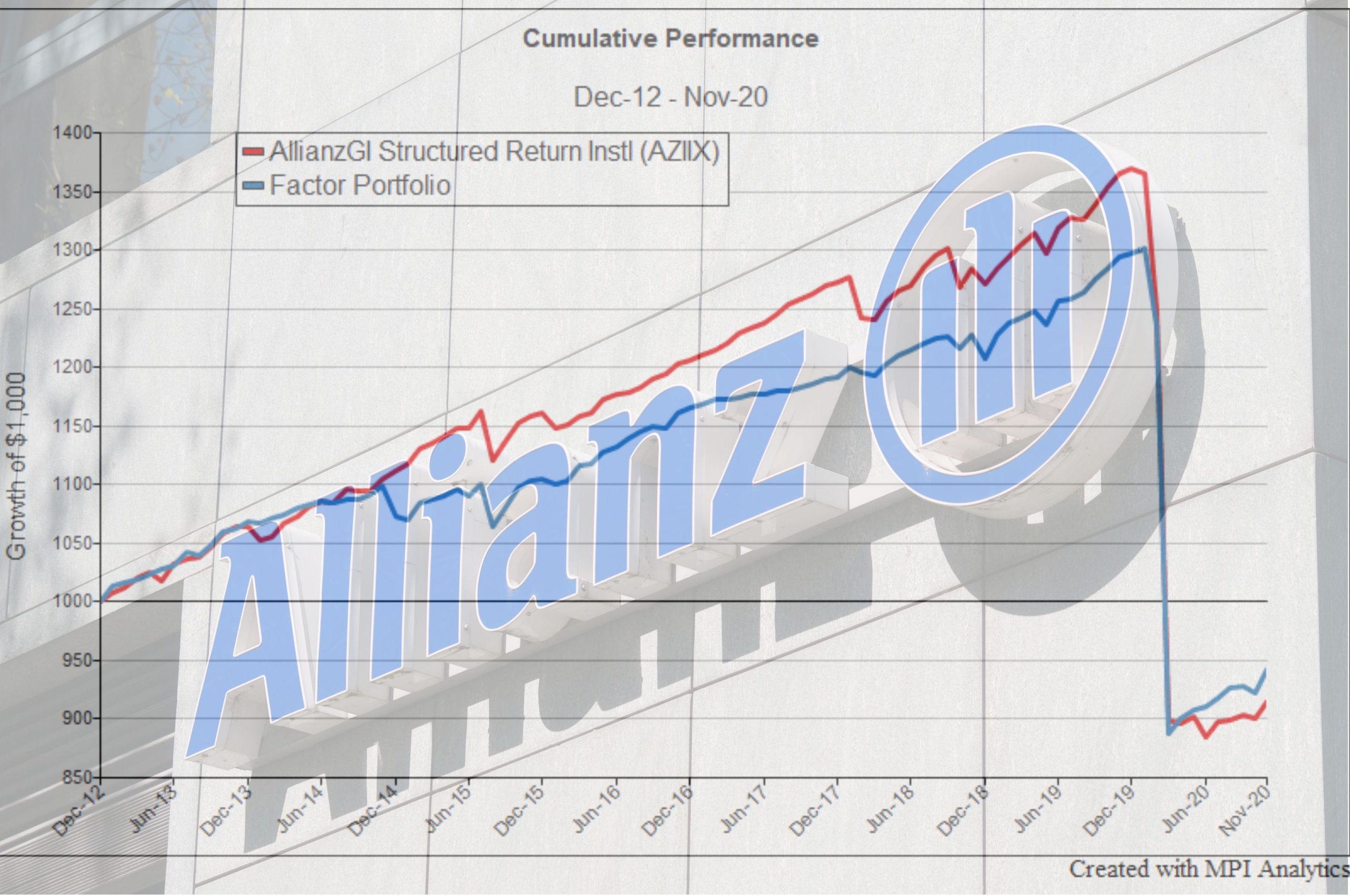

We use Allianz Structured Alpha hedge fund as an illustration to demonstrate how investors could apply quantitative techniques to assess potential risks of complex volatility strategies.

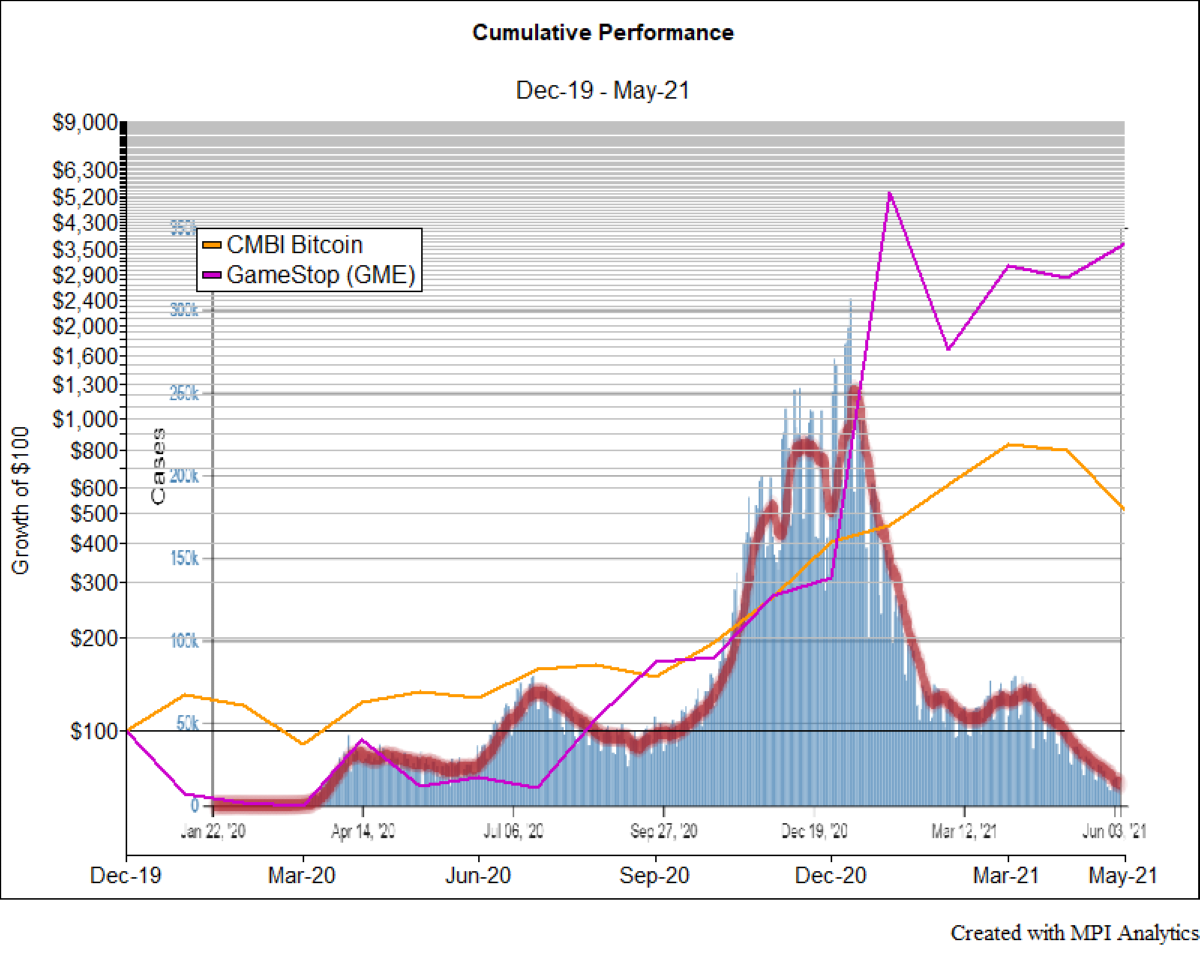

It’s been a wild rollercoaster ride these days for Bitcoin investors. The cryptocurrency hit an all-time high of $64k in April only to plummet nearly 50% a month later. Last year, as the entire world shut down access to mountain peaks and surfing spots, people started to look for stay-at-home ways to supply their adrenaline fix – and speculative trading fit the bill.

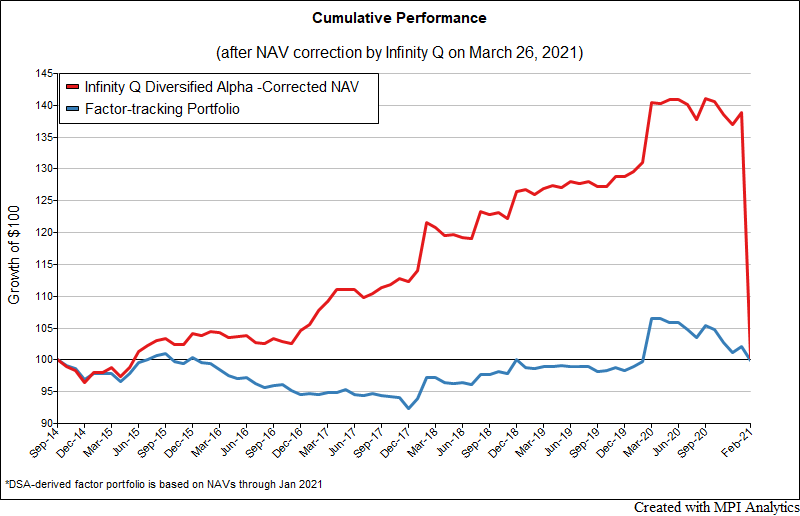

The suspension of redemptions and planned liquidation of the Infinity Q Diversified Alpha fund (IQDNX, IQDAX) – a $1.8 billion hedge fund-like multi-strategy liquid alternatives mutual fund that was started by investment staff from the family office of a private equity titan – has sent shockwaves through the fund management industry. Using MPI’s quantitative surveillance framework we discover a slew of red flags that could have alerted the fund’s investors.

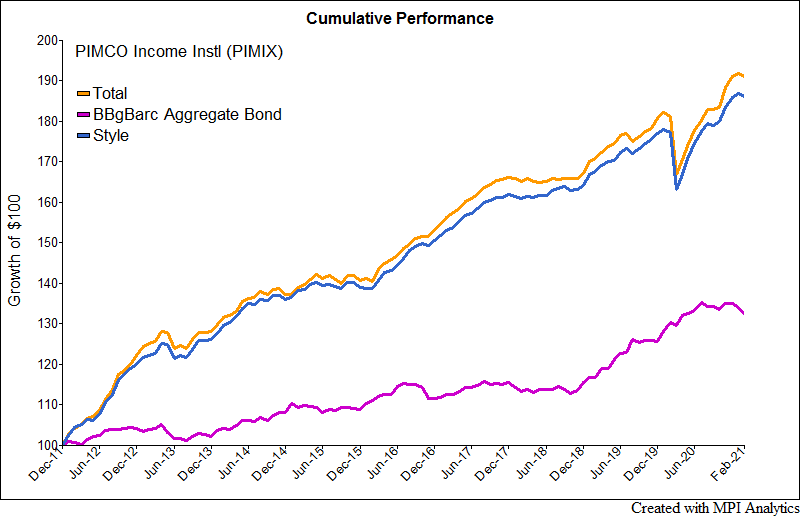

In 2019, we presented a return-based analysis framework that can be used to analyze complex fixed income funds such as PIMCO Income fund. In this updated blog, we apply a similar methodology to the fund as we did previously to evaluate the performance of the fund during the COVID market distress.