Our analysis shows how portfolio construction, pacing, and governance created a resilient “Switzerland” profile – and what others can emulate.

Our analysis shows how portfolio construction, pacing, and governance created a resilient “Switzerland” profile – and what others can emulate.

The article highlights the growing role of private equity in public pension portfolios. Star Tribune reporter Emma Nelson interviews Jill Schurtz, CIO of the $96 billion Minnesota pension system, State Senator Nick Frentz, MPI CEO Michael Markov and cites MPI’s analysis of Minnesota’s investment portfolio from the MPI Transparency Lab “that uses publicly available pension returns data to assess risk.”

“Minnesota’s pension funds are among the riskiest in the country because of how much they have invested in both public shares and private equity — the bulk of their investments — according to analysis from Markov Processes International.”

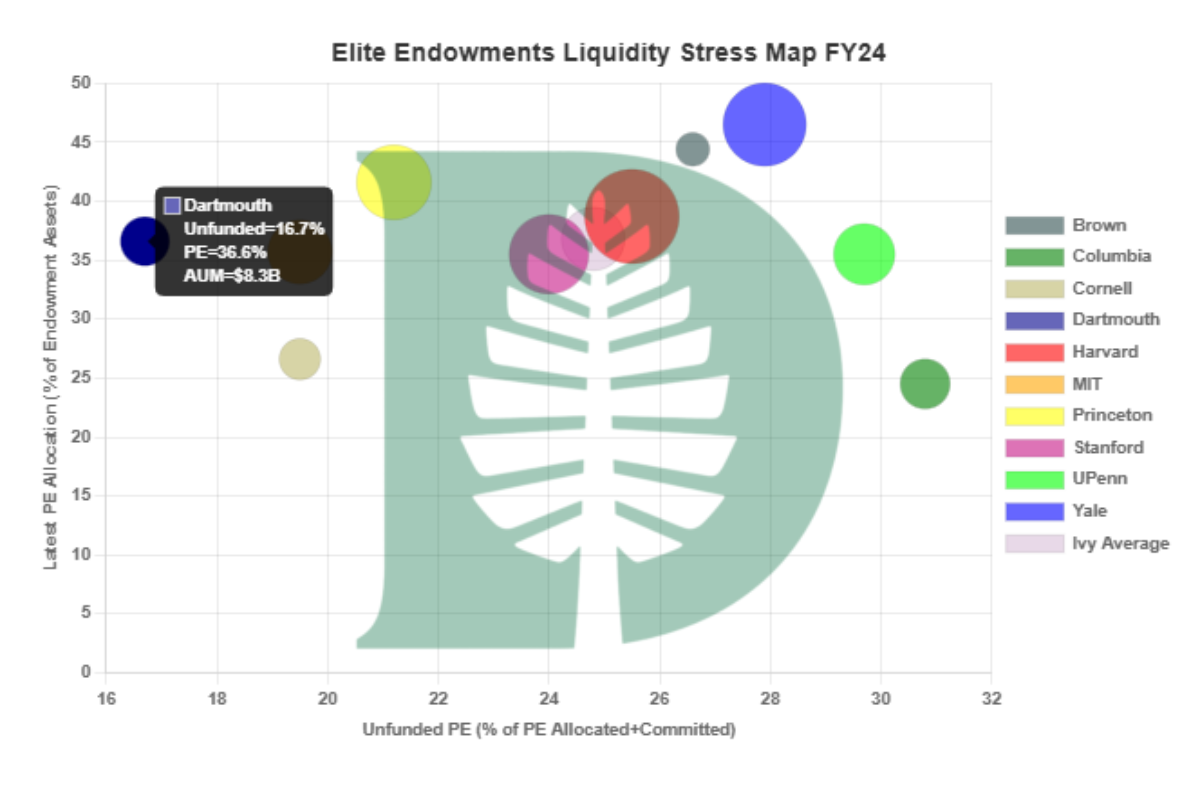

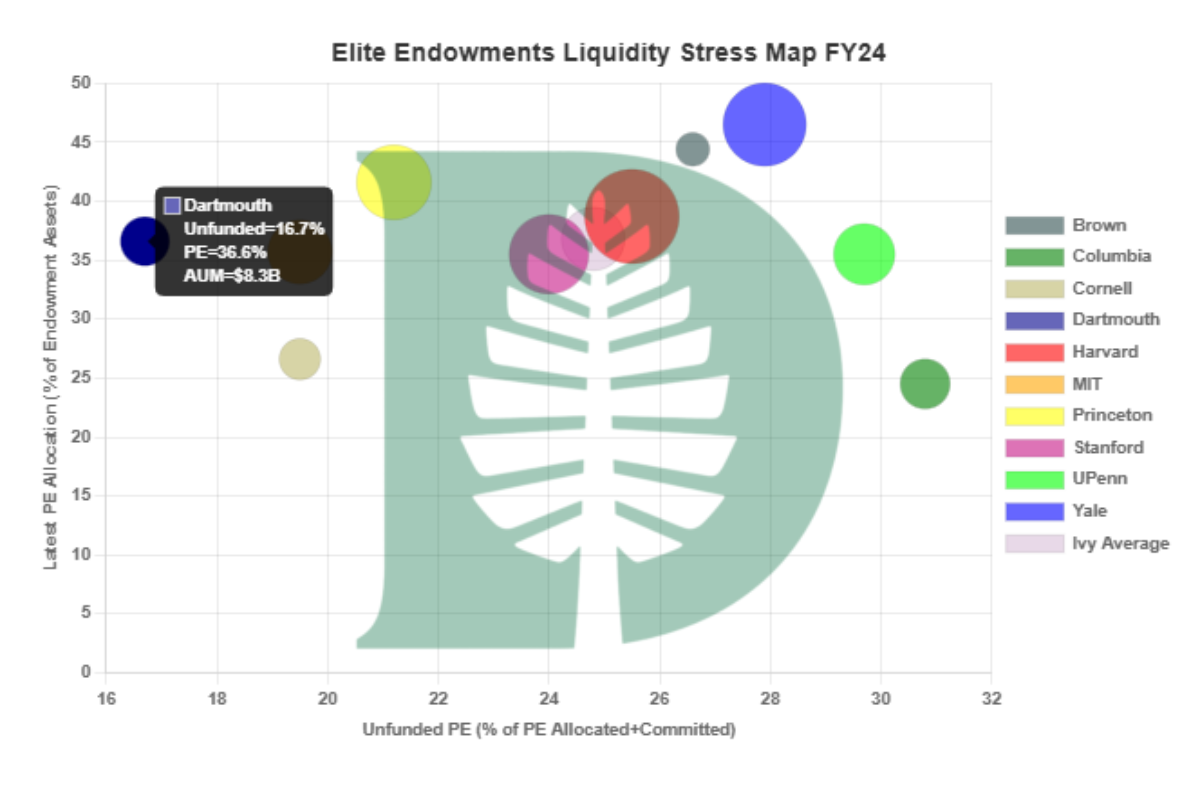

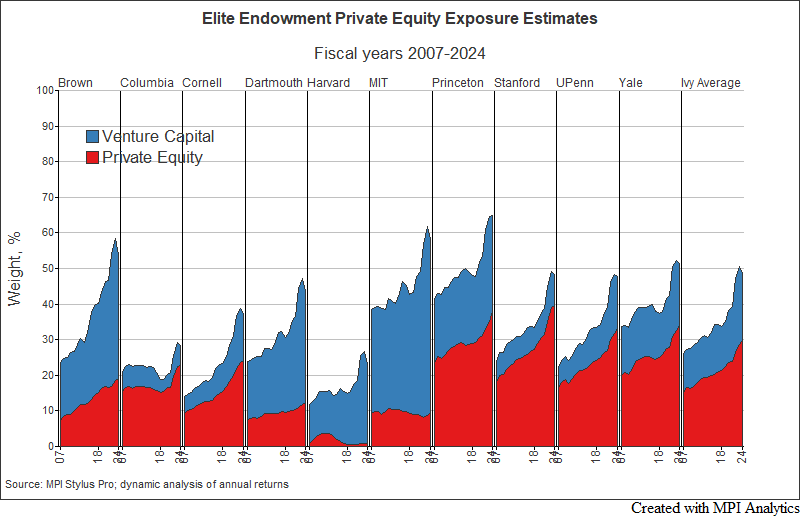

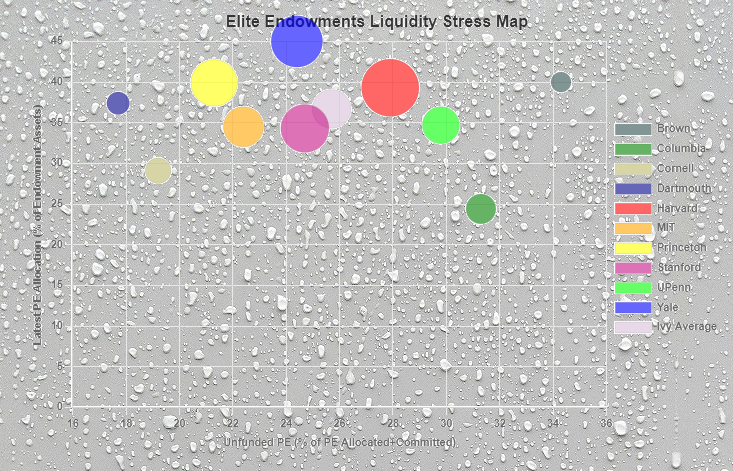

Ivy endowment Fiscal 2024 in review: risks; VC; long-term vs recent years; prospects of Yale Model.

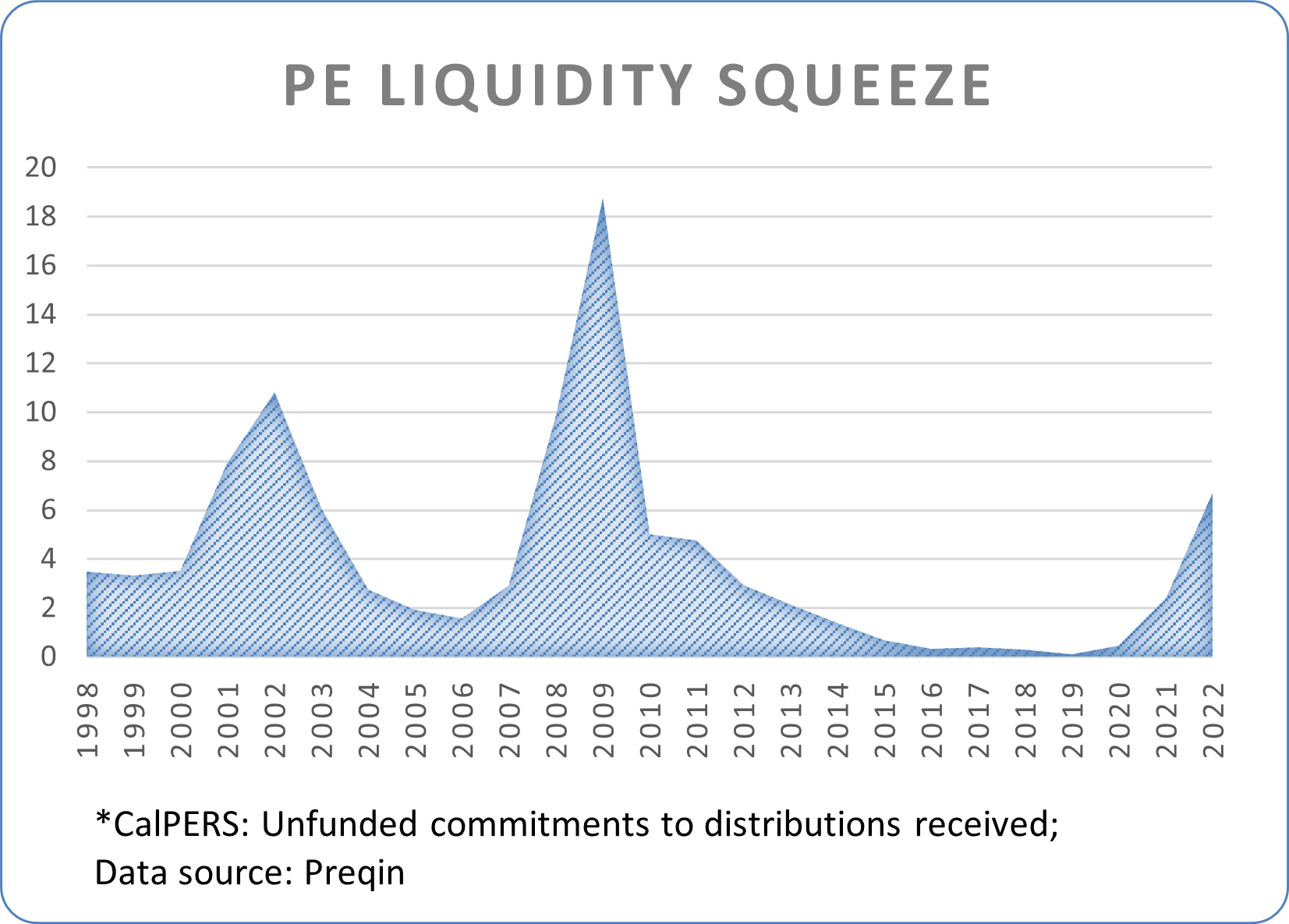

How the anemic deal climate, record low distributions and massive unfunded capital commitments are pushing endowments further into illiquid private equity & venture capital, increasing risk & leverage in portfolios (and markets broadly)

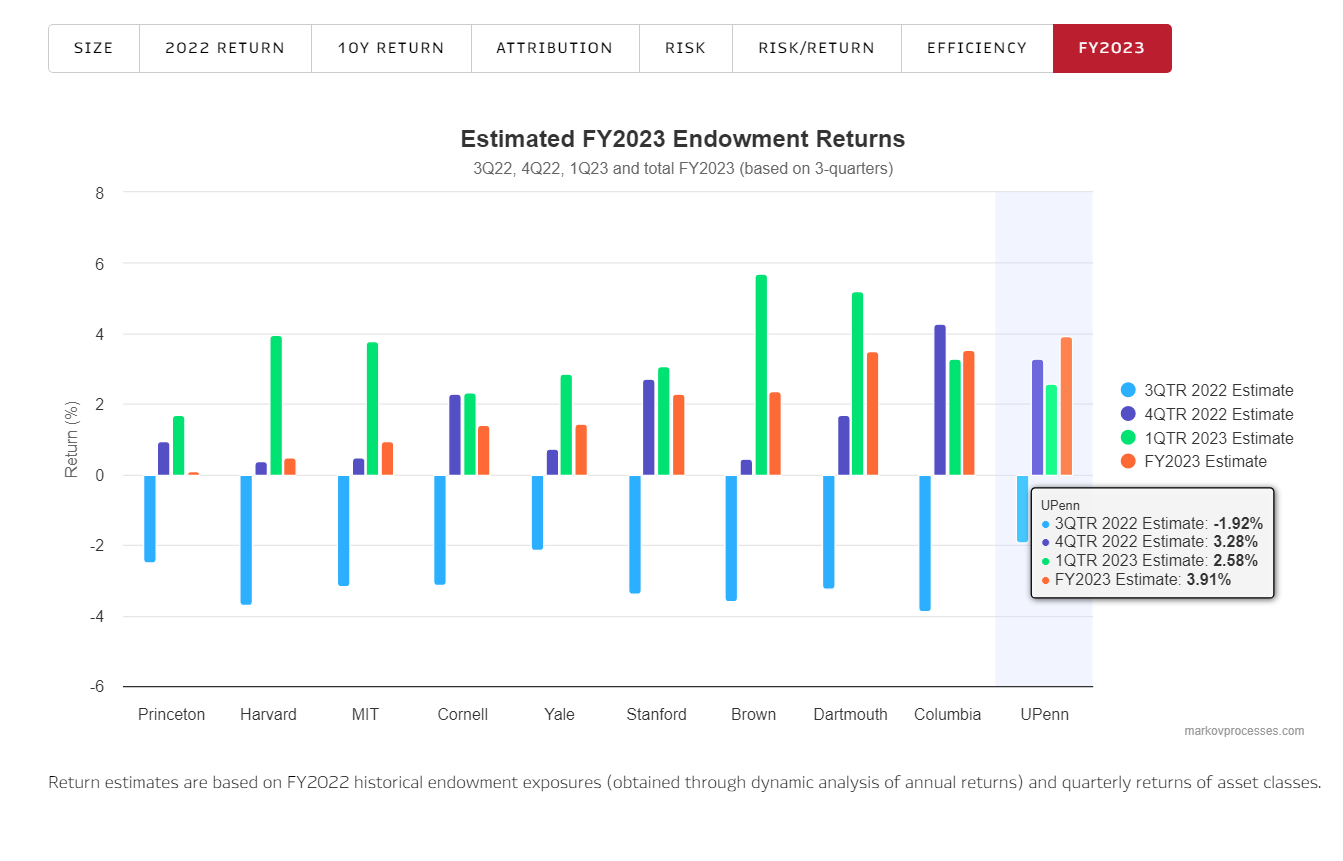

We provide some clues as to why some of the largest endowments have disappointing results in FY2023

Endowments and pensions continue to post gains, but exposure to private markets pushes many below benchmarks

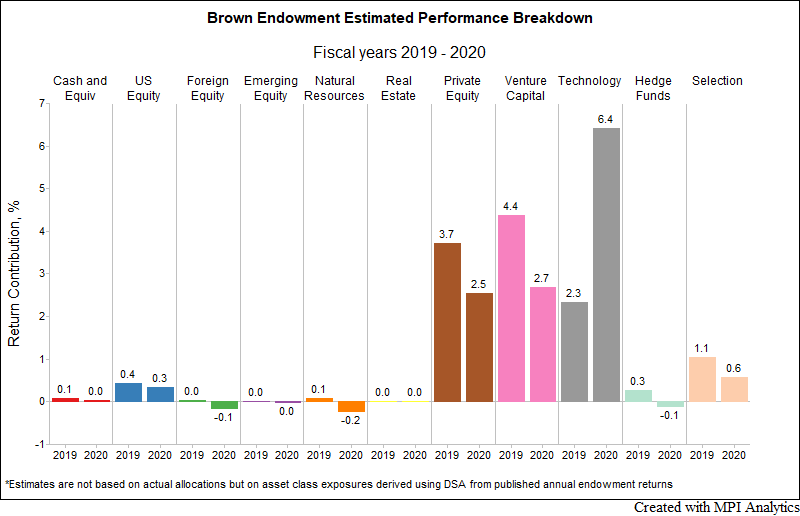

For the second straight year, Brown outperformed all other Ivy endowments by a large margin. Our research team, using MPI Stylus Pro to dissect the endowment annual returns, provides a plausible explanation of the endowment’s spectacular results.

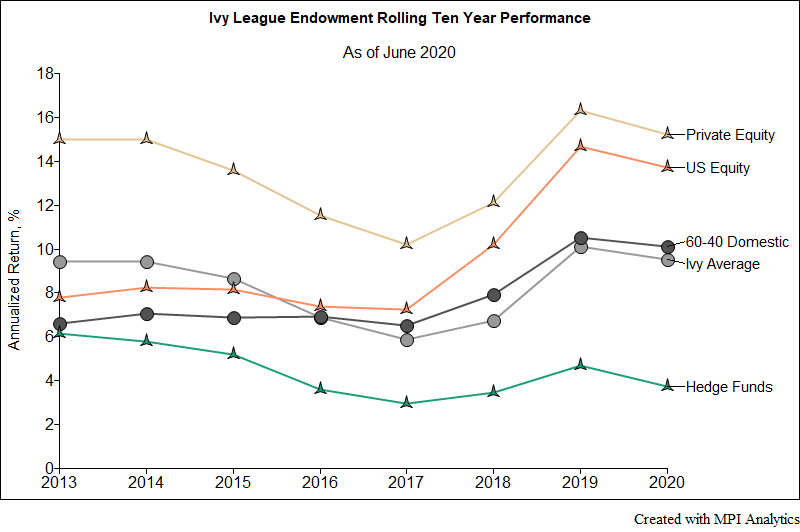

We take a quick look at Ivy schools’ endowments’ performance results both for the 2020 fiscal year and also long-term for 10-year periods.

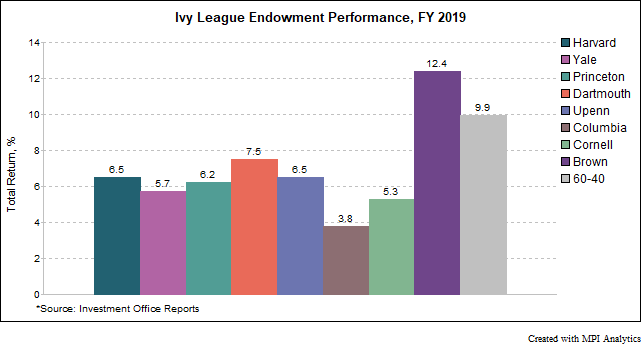

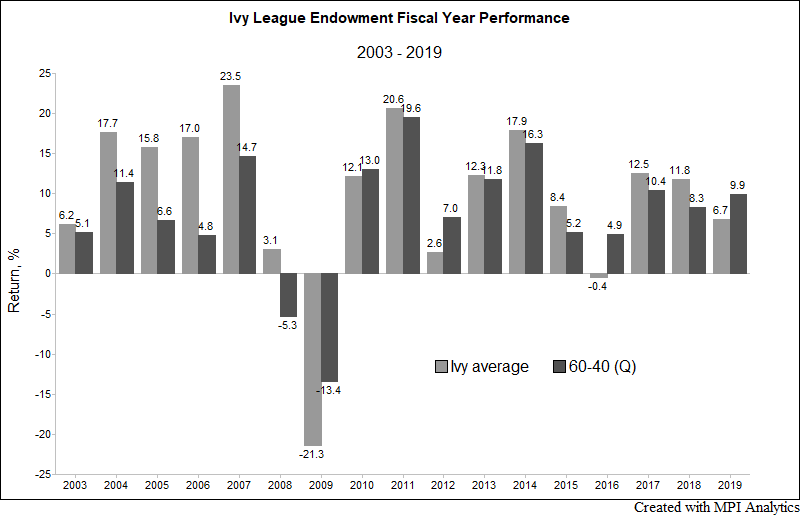

Fiscal year 2019 was a curious year for the Ivy League endowments. In a year with strong returns in key private market investment classes, the average Ivy underperformed a traditional domestic balanced 60-40 portfolio in FY 2019. Ivies also experienced a wider dispersion of returns and saw a shift in the historical positioning of performance leaders and laggards.

The grades for all the Ivy League endowments are in – and they are rather disappointing. Save for Brown, all Ivies underperformed the 9.9% return of a domestic 60-40 portfolio in fiscal year 2019. The Ivy average in FY 2019 was 6.7%, significantly underperforming the 60-40 and reversing two years in which they outperformed the traditional domestic benchmark.